Loading Insight...

Insights

Insights

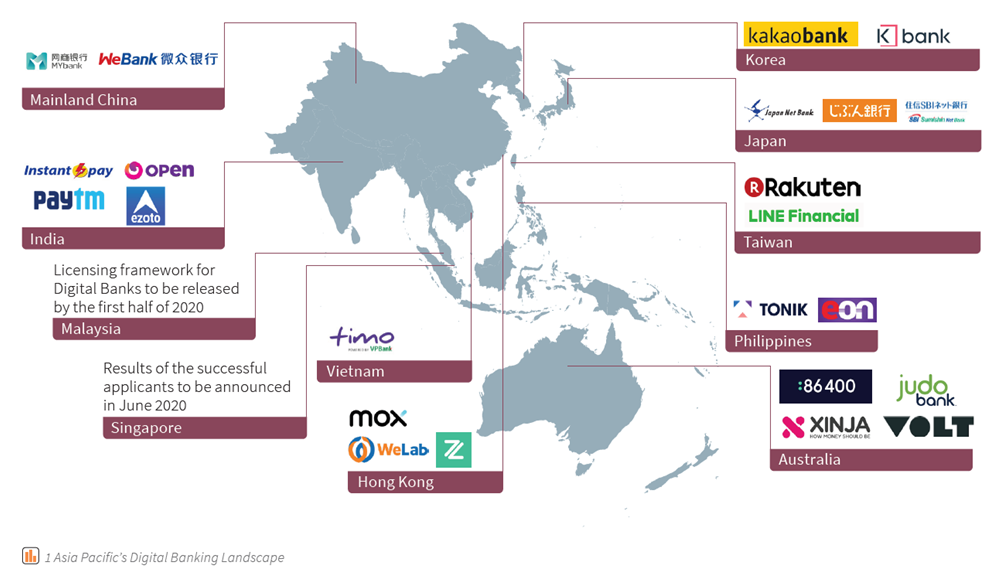

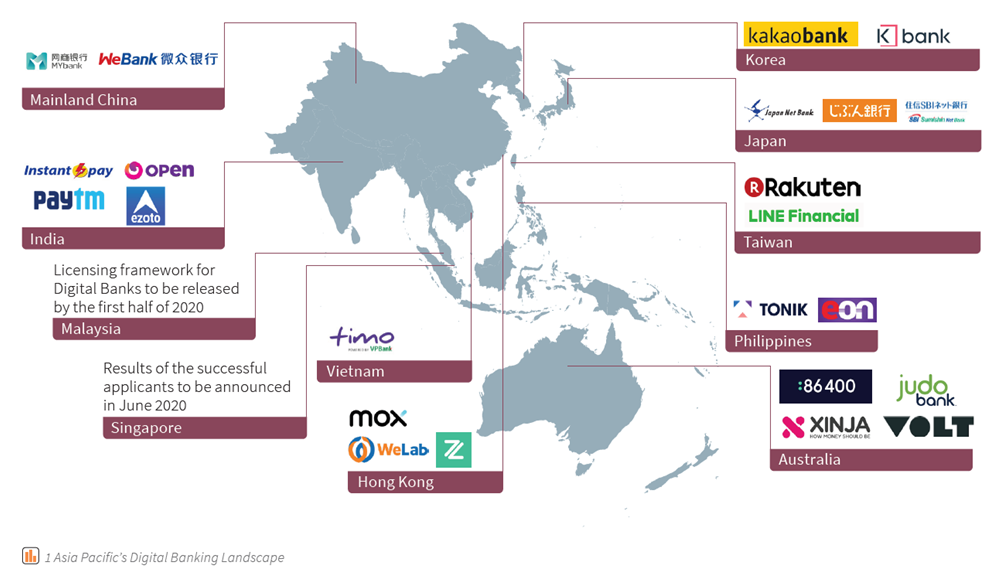

The digital banking scene has found its foothold in Asia over the past few years and it will continue to grow in the months to come. As seen below, the landscape is filled with players from various markets with a variety of offerings. But how did this first begin?

Though some may refer to digital banks as neobanks, challenger banks or virtual banks, what these banks have in common are they often started with no physical branches and leveraged technology to differentiate their offerings in the banking sphere.

"Asia Pacific's Digital Banking Landscape” is the first part of our 4-part series on Digital Banking.

How Asia Pacific's digital banking landscape began

The concept of digital banks was first developed in Europe where it radically challenged and transformed the banking landscape. At present, digital banks have garnered a strong foothold in the United States and Europe, but there’s still a long way to go in the Asia Pacific Region.

Japan Net Bank was the first digital bank to launch in Asia. Sakura Bank, presently known as Sumitomo Mitsui Banking Corporation, saw the opportunity for a standard payment method for Japan’s growing internet users, created a joint venture in 2000 to form a digital bank, and offered small B2C and C2C transaction settlements. Though the digital bank began to offer a larger variety of products, the trend of digital banking only began to take off when China came into the picture.

In 2015, the China Banking Regulatory Commission issued its first virtual banking licenses to Tencent’s WeBank and Alibaba’s MyBank. Tencent was known for its popular messaging app WeChat and Alibaba was famous for its global e-commerce platform. When news broke out that a social media app and an e-commerce site were challenging the traditional banking players by creating digital banks, it was met with excitement from many consumers and corporations. Shortly after, the Hong Kong Monetary Authority handed out 8 virtual bank licenses with the intention to catch up with Mainland China and Japan in disrupting bricks-and-mortar banking. This led to a wave of digital banks being set up across the Asia Pacific. Examples of these newly formed digital banks would be K-bank in South Korea and ZA Bank in Hong Kong.

Digital banking industry in Singapore

Singapore isn’t one to be left behind by the digital banking wave. As a nation, Singapore has been radicalised and transformed by technology and recently the Singapore government has taken the initiative to reposition itself as a technological hub through direct investment into technology and subsidies to incentivise innovators. Out of all the initiatives that the Singapore government has put forth, the most recent one would be the Monetary Authority Of Singapore’s Digital Banking License.

Applications for digital banking licenses have been submitted. The results will be released later this year. As we look at the list of local and international consortiums who applied for the license, a key observation is that many are outside the traditional banking space. It will be very exciting to see how these companies leverage their expertise in technology and consumer knowledge and apply it to the banking industry.

Elsewhere in the region, the digital banking trend is also picking up. Countries such as Malaysia and Thailand would begin to release their own digital banking licenses as well. Hence, it would be evident to state that the digital banking landscape in Asia would become a competitive one and the question stands as to how would a digital bank be able to differentiate itself.

Key elements for digital banks

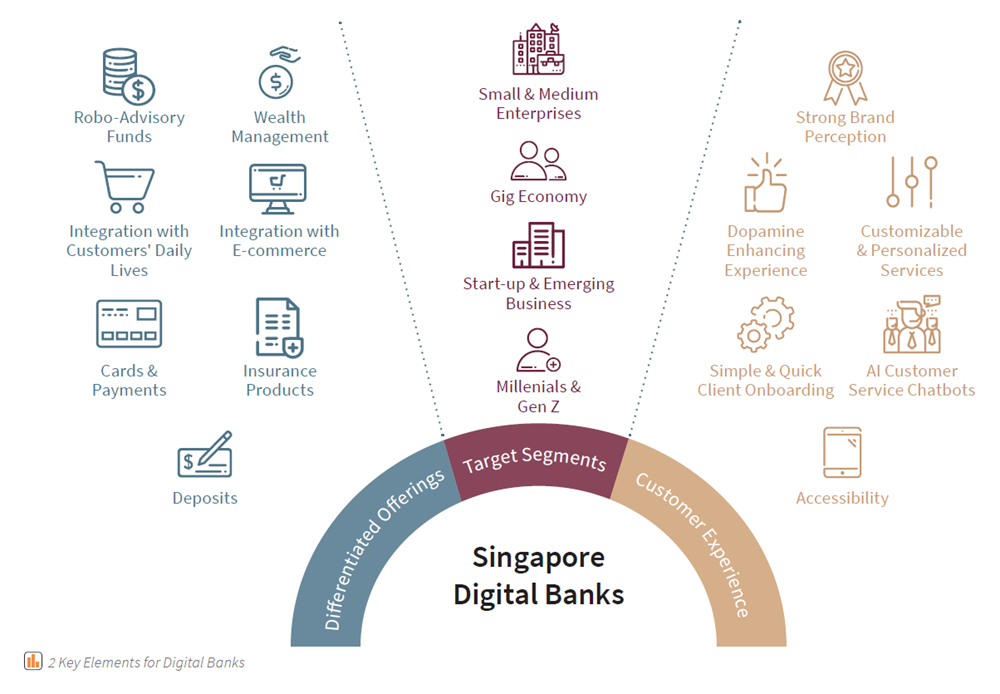

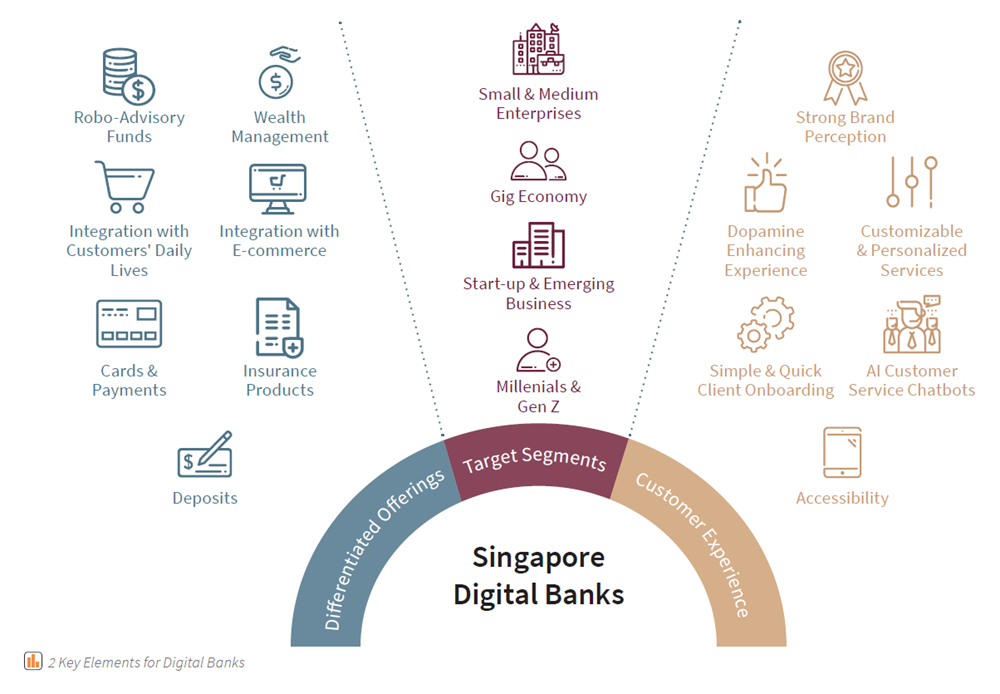

In order not to fall behind in this digital banking race, there are several essential factors that banks should focus on to differentiate themselves from other digital banks and traditional banks.

Differentiated Offerings

Differentiated offerings will be a key factor for digital banks to draw customers from the existing market. Digital banks are expected to distinguish themselves from traditional banks by offering better rates and removing minimum deposit requirements given their lower operational costs. Additionally, digital banks can differentiate themselves by offering technologically advanced products such as robo-advisory funds to investors to increase the attractiveness of their offerings.

Target Segments

When it comes to the target segments, digital banks are likely focusing on unique segments that traditional banks haven't been able to address well. Through the use of technological tools such as AI-based credit scoring models, digital banks can easily underwrite small and medium enterprises or individuals that have insufficient information or assets. As traditional banks haven’t been as successful and focused on these sectors, it would be a strategic opportunity for digital banks to create a niche for themselves.

For the third point on customer experience, the satisfaction and experience that customers would receive from using their service and app would be key in retaining and attracting customers. With many options to choose from and limited funds, digital banks must create a significant contrast between them and their competitors.

How Synpulse can help

Synpulse has profound knowledge and experience in designing and integrating digital banking solutions. Our team takes a holistic and integrative approach, providing support all the way from designing the go-to-market strategy and assessing the technology or solution to implementation. We have extensive implementation experience and an intimate understanding of working with industry-leading software.

The digital banking scene has found its foothold in Asia over the past few years and it will continue to grow in the months to come. As seen below, the landscape is filled with players from various markets with a variety of offerings. But how did this first begin?

Though some may refer to digital banks as neobanks, challenger banks or virtual banks, what these banks have in common are they often started with no physical branches and leveraged technology to differentiate their offerings in the banking sphere.

"Asia Pacific's Digital Banking Landscape” is the first part of our 4-part series on Digital Banking.

How Asia Pacific's digital banking landscape began

The concept of digital banks was first developed in Europe where it radically challenged and transformed the banking landscape. At present, digital banks have garnered a strong foothold in the United States and Europe, but there’s still a long way to go in the Asia Pacific Region.

Japan Net Bank was the first digital bank to launch in Asia. Sakura Bank, presently known as Sumitomo Mitsui Banking Corporation, saw the opportunity for a standard payment method for Japan’s growing internet users, created a joint venture in 2000 to form a digital bank, and offered small B2C and C2C transaction settlements. Though the digital bank began to offer a larger variety of products, the trend of digital banking only began to take off when China came into the picture.

In 2015, the China Banking Regulatory Commission issued its first virtual banking licenses to Tencent’s WeBank and Alibaba’s MyBank. Tencent was known for its popular messaging app WeChat and Alibaba was famous for its global e-commerce platform. When news broke out that a social media app and an e-commerce site were challenging the traditional banking players by creating digital banks, it was met with excitement from many consumers and corporations. Shortly after, the Hong Kong Monetary Authority handed out 8 virtual bank licenses with the intention to catch up with Mainland China and Japan in disrupting bricks-and-mortar banking. This led to a wave of digital banks being set up across the Asia Pacific. Examples of these newly formed digital banks would be K-bank in South Korea and ZA Bank in Hong Kong.

Digital banking industry in Singapore

Singapore isn’t one to be left behind by the digital banking wave. As a nation, Singapore has been radicalised and transformed by technology and recently the Singapore government has taken the initiative to reposition itself as a technological hub through direct investment into technology and subsidies to incentivise innovators. Out of all the initiatives that the Singapore government has put forth, the most recent one would be the Monetary Authority Of Singapore’s Digital Banking License.

Applications for digital banking licenses have been submitted. The results will be released later this year. As we look at the list of local and international consortiums who applied for the license, a key observation is that many are outside the traditional banking space. It will be very exciting to see how these companies leverage their expertise in technology and consumer knowledge and apply it to the banking industry.

Elsewhere in the region, the digital banking trend is also picking up. Countries such as Malaysia and Thailand would begin to release their own digital banking licenses as well. Hence, it would be evident to state that the digital banking landscape in Asia would become a competitive one and the question stands as to how would a digital bank be able to differentiate itself.

Key elements for digital banks

In order not to fall behind in this digital banking race, there are several essential factors that banks should focus on to differentiate themselves from other digital banks and traditional banks.

Differentiated Offerings

Differentiated offerings will be a key factor for digital banks to draw customers from the existing market. Digital banks are expected to distinguish themselves from traditional banks by offering better rates and removing minimum deposit requirements given their lower operational costs. Additionally, digital banks can differentiate themselves by offering technologically advanced products such as robo-advisory funds to investors to increase the attractiveness of their offerings.

Target Segments

When it comes to the target segments, digital banks are likely focusing on unique segments that traditional banks haven't been able to address well. Through the use of technological tools such as AI-based credit scoring models, digital banks can easily underwrite small and medium enterprises or individuals that have insufficient information or assets. As traditional banks haven’t been as successful and focused on these sectors, it would be a strategic opportunity for digital banks to create a niche for themselves.

For the third point on customer experience, the satisfaction and experience that customers would receive from using their service and app would be key in retaining and attracting customers. With many options to choose from and limited funds, digital banks must create a significant contrast between them and their competitors.

How Synpulse can help

Synpulse has profound knowledge and experience in designing and integrating digital banking solutions. Our team takes a holistic and integrative approach, providing support all the way from designing the go-to-market strategy and assessing the technology or solution to implementation. We have extensive implementation experience and an intimate understanding of working with industry-leading software.