The 2010s saw the meteoric rise of instant messaging on social media platforms. The active user base on channels globally such as WhatsApp and WeChat are massive – data company Statista reported that WhatsApp has more than 2 billion monthly active users as of June 2021.

With the change in consumer behaviour and communication patterns, the case for financial institutions to leverage these platforms cannot be ignored, especially when reaching out to the younger, more tech-savvy customers.

However, the speed, convenience and ease of use that make these channels highly attractive to the modern user, ironically, are also the same reasons that are making financial institutions cautious.

In this article, we identify the fundamental questions that can shape your bank’s instant messaging strategy.

- Should you include instant messaging as an official communication channel?

In the early part of the last decade, most private banks kept social instant messaging out of their approved communication channels list due to security concerns. However, with a growing segment of customer base that use these channels for financial transactions, not using these platforms as a form of communication could be a lost opportunity. With the rise in usage of digital wallets, mobile-enabled trading and more, the boundaries between financial transactions and social instant messaging are blurred. It is thus imperative that banks are able to leverage these channels, where the majority of their clients are easily accessible, while ensuring the security and auditability of any interactions and engagements. - What social media platforms should you choose?

The penetration of the various social media platforms differs by geography. A quick look across Asia shows that WhatsApp is a popular platform in countries like India, Singapore, Malaysia, and Indonesia. WeChat is dominant in China and has a significant user base in Hong Kong, while LINE has the highest penetration in Thailand and Taiwan, and Facebook Messenger continues to be used widely in the Philippines.

More recently, we also see a rise in the popularity of other messaging platforms such as Signal and Telegram due to privacy concerns. It is therefore important for banks to consider their target geography and user base before choosing the platforms they want to invest in. - What use cases should be supported?

More often than not, clients can easily communicate with employees of the bank through the clients’ personal accounts. To change this behaviour, banks need to provide incentives such as making the services offered via official channels more attractive and compelling. We have observed that merely offering a communication channel will not result in a huge user adoption and, in many ways, can be counterproductive. As such, use cases have to be defined and designed while keeping client preferences and behaviours in focus at all times. - What are the operational enhancements needed?

Adopting a new channel requires multiple enhancements. The operational run books must be updated, policies revised, procedures enhanced, and support desks established. Training resources are required, monitoring controls need to be created, and many other considerations need to be taken into account. Banks need to adopt a holistic 360-degree approach to internal changes. - What are the legal and regulatory controls that must be put in place?

There is much to be gained from adopting social instant messaging channels for official communications, but Banks always have to balance convenience with compliance. One cannot be at the expense of the other. Changing procedures, and updating T&Cs are simply not enough. Banks need to do their due diligence and work with regulators in ensuring full compliance with the set guidelines. The design of the use cases and operational procedures heavily influence the kind of controls and guidelines Banks have to assess. Therefore, it is very important to make the regulatory work stream an integral part of the transformation journey. - What is the target segment?

Official social instant messaging platforms have their own sets of limitations and restrictions. Case in point, an offshore WeChat service account has many more restrictions compared to a personal WeChat account. Depending on the type of account (single, joint, corporate, etc.) and service (advice, order, inquiry, etc), the required participants, procedural steps and mandatory disclosures and checks will vary. Identifying the right target segment of users allows the banks to create usable offerings that is tailored to the platform. - So, what are the technology elements that must be in place?

There are multiple technology providers in the market offering similar services. In addition to the analysis of features supported for instant messaging channels, banks need to evaluate the solution’s support for a plug-and-play channel addition, flexible interfaces, and a continuation of the user journey across platforms and channels. Being able to design tailored experiences across any device any medium (or ADAM) is a fundamental requirement that needs to be solved by the technology platform. - After implementing the platforms, what are the key KPIs that we should look at?

Multi-year, multi-million-dollar roadmaps are being designed by numerous banks, but only a few are able to clearly answer the target KPIs and the ROI from them. Adoption and usage KPIs are important in the initial phases, but the focus needs to be on unlocking more business value.

Quantifying operational efficiencies gained and qualifying the enhanced security and customer experience are fundamental to long term gains.

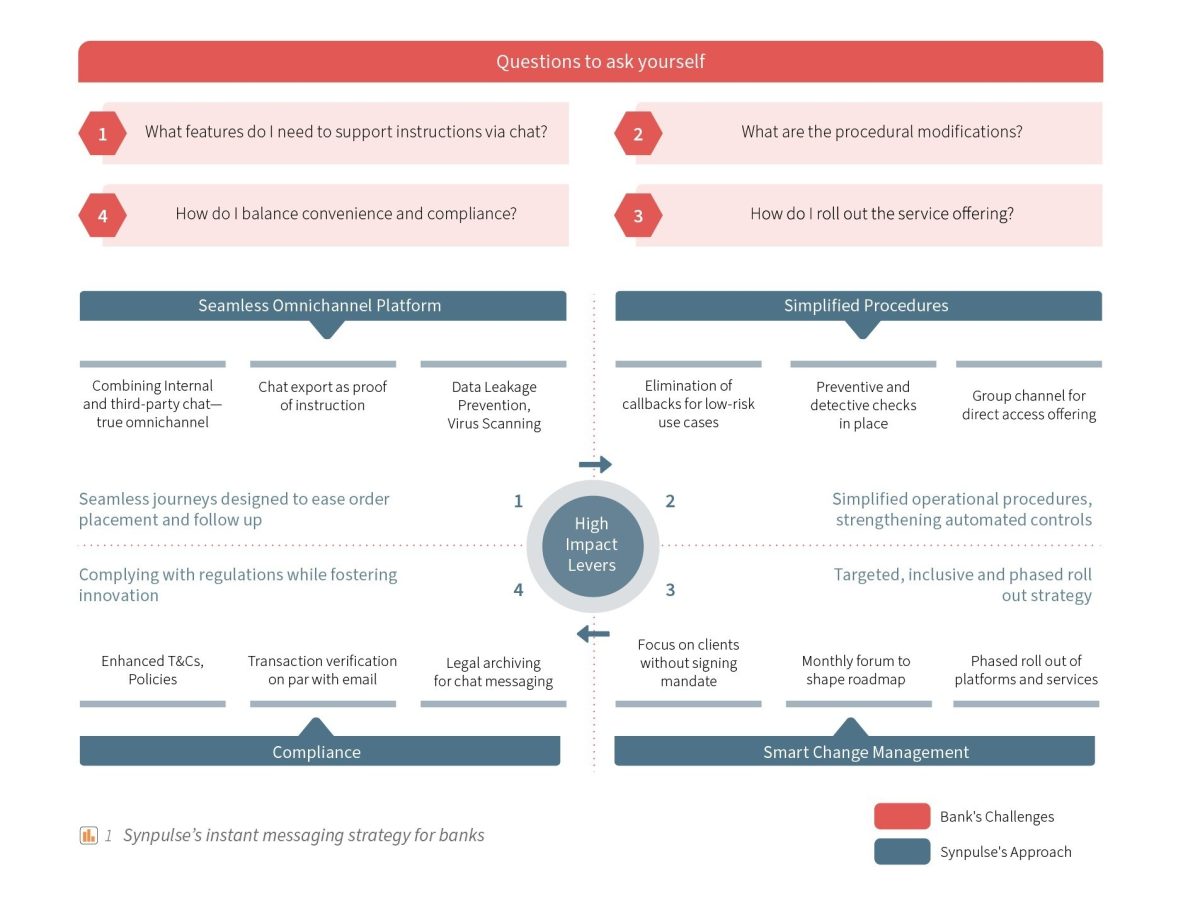

At Synpulse we have developed a four-pronged strategy that provides a holistic approach to operationalising instant messaging channels for banking purposes.

The charm of instant messaging on social media platforms is only growing and the advantages of connecting with your clients on their preferred channels will unlock opportunities, from more effective communication channels to higher client engagement and retention of customer trust. With this approach, we continue to help our clients unlock windfall gains. If you would like to know more, reach out to us!

Get a sneak peak of our Digital Client Onboarding solution and some sample use cases