In this article, we explore the key trends shaping China’s advisory market and highlight the solutions that banks should be aware of to stay competitive and meet the evolving needs of their clients.

With a better understanding of the existing market conditions for advisory in China, let’s ask the more important question – why do banks and brokerage firms need to redesign their advisory offerings?

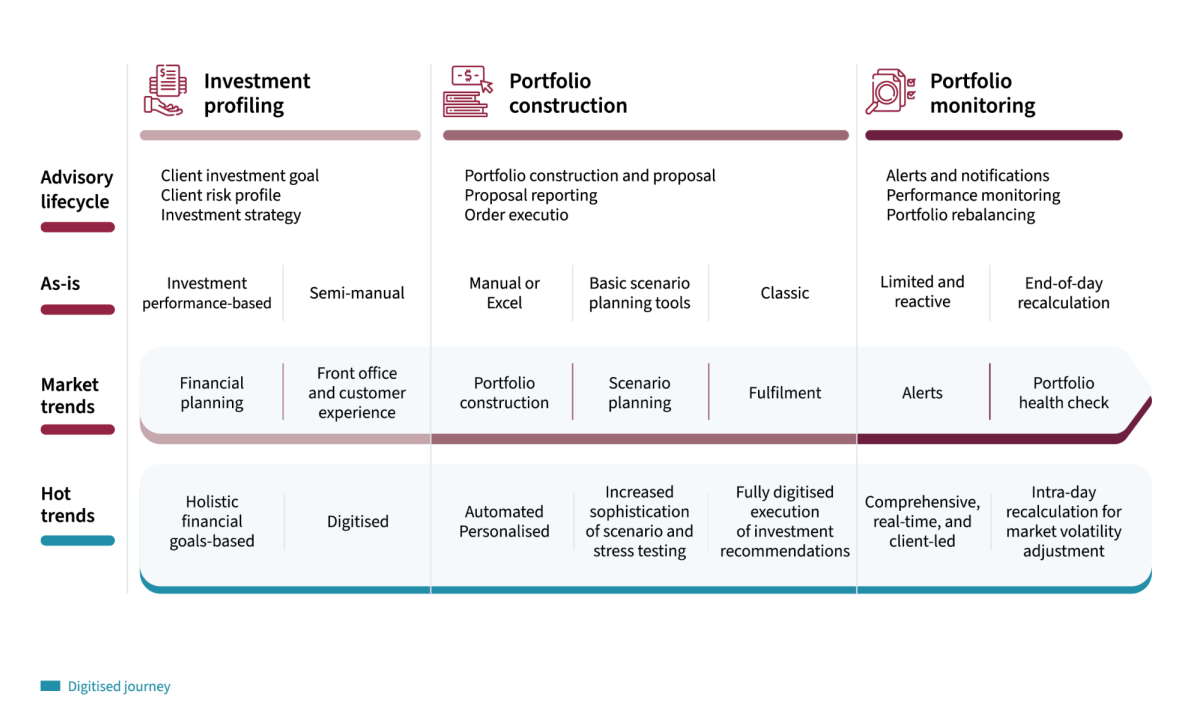

While digitalisation has been a topic, if not the focus topic, of the financial services sector, many private banks and securities firms are unfortunately still behind the curve in digitalising their businesses. Within the current advisory lifecycle, there are prevalent manual reactive processes that prove to be both time-consuming and cost-inefficient. Technology has the potential to enhance and streamline these processes.

Key trends shaping the advisory market in China

External forces in the form of current industry trends have also added more pressure for banks and brokerages to rethink their advisory offerings:

Solutions that banks should look out for

In Figure 1, we provide banks with a rundown of solutions and their distinctive features, emphasising how they align with the prevailing market trends. These distinctive features can serve as valuable guides for banks to help them make informed decisions about which solutions best suit their unique needs and business strategies.

Staying adaptive to emerging trends and solutions is crucial for thriving in China’s evolving digital advisory landscape. By closely aligning with the current market trends and considering the right solutions, financial institutions can address the changing expectations of their clients, enhance operation efficiency, improve customer engagement, and ultimately drive growth.

How we can support you

At Synpulse, we collaborate with leading financial institutions to deliver valuable advisory services and platform implementations to our clients. Backed by our technological powerhouse, Synpulse8, we offer holistic solutions that bridge any gaps, ensuring we meet your business needs.

Our extensive expertise in wealth management, digital advisory, and regulatory compliance is at your disposal. Reach out to us to learn more!