Loading Insight...

Insights

Insights

Summary

- Financial crime has surged since the pandemic, with losses estimated between USD 50 billion to USD 177 billion globally.

- Hong Kong and Singapore, as major financial hubs, are highly attractive targets for fraudsters due to their wealth and advanced digital infrastructure.

- Both regions face growing challenges, including phishing scams, investment fraud, and the rise of sophisticated cybercriminal tactics using AI and machine learning.

- Financial institutions in HK and SG are investing in advanced technologies and collaborating across sectors to strengthen fraud detection and prevention.

- Continued innovation, collaboration, and public awareness are crucial to countering evolving financial crimes over the next decade.

Financial crime has seen a significant increase since the pandemic, with developed regions becoming prime targets for fraudsters. Despite the ongoing efforts of financial institutions (FIs) and regulators, global losses are estimated to range from USD 50 billion to USD 177 billion, a figure that is likely to rise if these threats are not effectively countered. (Please refer to our previous article for more statistics.)

Hong Kong and Singapore, Asia’s foremost financial hubs, are at the forefront of this issue. Both jurisdictions have established strong regulatory frameworks that provide a solid defence against financial crime. However, their considerable wealth, advanced digital infrastructure, and booming e-commerce sectors also make them particularly attractive to fraudsters. The integration of AI and machine learning has transformed the financial landscape, offering new opportunities for growth and security. Yet, these same technologies have also armed criminals with sophisticated tools, enabling them to commit increasingly complex and damaging fraud.

Addressing this growing threat requires a proactive and coordinated response across industries involving regulators, FIs, and telecommunications authorities to safeguard these vital financial centres from further exploitation.

Regulatory responses in HK and SG

Both Hong Kong and Singapore face similar challenges when it comes to financial fraud, including phishing scams, investment fraud, and credit card fraud, with online scams involving fake investment opportunities being particularly prevalent. Regulatory bodies in Hong Kong and Singapore actively engage in public awareness campaigns to educate citizens about potential scams and fraudulent tactics, emphasising the importance of vigilance and informed decision-making in the fight against financial crime.

Hong Kong

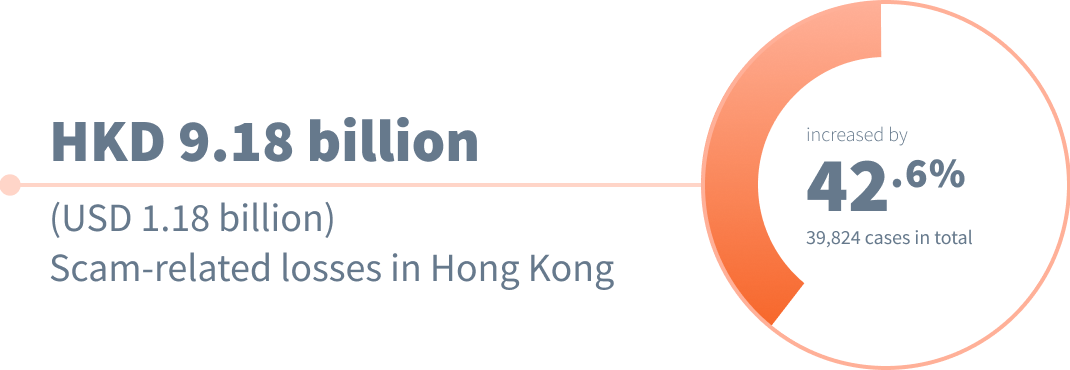

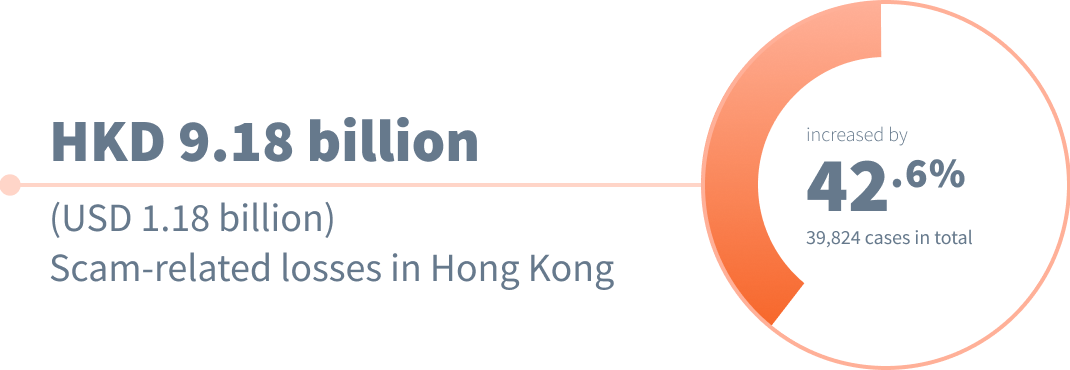

In 2023, scam-related losses in Hong Kong soared to HKD 9.18 billion (USD 1.18 billion), with reported cases increasing by 42.6% to 39,824. This worrying statistic is likely to trend upward if left unaddressed. In response, the Hong Kong Monetary Authority (HKMA) has enhanced its supervisory framework, emphasising stronger cybersecurity measures and fraud prevention strategies within financial institutions. The HKMA has also issued guidelines urging banks to adopt best practices in risk management and fraud detection to better defend against emerging threats.

To combat financial crime, the Hong Kong Police Force (HKPF) has released comprehensive crime reports for 2019-2023, providing valuable insights into the patterns and impacts of these crimes. The HKPF also established the Anti-Deception Coordination Centre (ADCC) under the Commercial Crime Bureau as a central hub for anti-fraud initiatives. The ADCC operates the "Anti-Scam Helpline 18222," offering 24/7 assistance to the public and support for HKPF units.

In 2022, the HKPF launched "Scameter," an anti-fraud search engine that allows users to check bank account numbers, stored value facility (SVF) user IDs, and phone numbers, providing a colour-coded risk rating. If the data is linked to scams, Scameter alerts users to potential risks before they proceed with payments or transactions, helping to prevent common frauds like online shopping scams, investment fraud, and romance scams.

Singapore

In 2023, the Singapore Police Force (SPF) reported 46,563 cases of financial fraud, a sharp 46.8% increase from the previous year, leading to estimated losses of SGD 651.8 million (USD 482 million). This trend indicates a growing concern for financial crimes affecting Singaporeans. While the total loss slightly decreased from last year's record high, the number of reported cases continues to rise, emphasising the need for increased vigilance and education on financial scams and frauds.

That same year, the MAS and the Infocomm Media Development Authority (IMDA) published the shared responsibility framework with the aim of defining the responsibilities of financial institutions, telecommunications operators, and consumers in preventing and responding to phishing incidents. The initiative seeks to enhance overall accountability and collaboration among stakeholders to better protect against the growing threat of phishing scams.

The Monetary Authority of Singapore (MAS) has been working closely with the Association of Banks in Singapore (ABS) and SPF to assess the situation and implement more safeguards against digital banking scams. This collaboration led to the creation of the Standing Committee on Fraud (SCF) in 2022, surpassing the ABS Anti-Scam Taskforce established in 2020. The committee is tasked with developing anti-scam strategies, which includes monitoring scams, information sharing among banks, providing industry-level guidance, and heightening public awareness.

In 2022, the SPF established the Anti-Scam Command (ASC), a centralised entity tasked with consolidating expertise and resources to combat scams effectively. This initiative brought together diverse capabilities under one umbrella, including scam investigation, incident response, intervention, enforcement, and sensemaking.

Additionally, the ASC expanded its scope by partnering with six major banks in Singapore: DBS Bank, OCBC, UOB, Standard Chartered, HSBC, and CIMB. In September 2022, these banks agreed to co-locate a select group of employees within the ASC to enhance the police's ability to respond promptly to scam incidents. These banking experts contribute their skills in tracing the flow of funds, freezing bank accounts linked to scam operations and facilitating swift action to combat scams effectively.

The role of financial institutions in mitigating scams

Leading FIs in HK and SG are taking a proactive approach to combatting fraud. Banks are leveraging advanced technologies, such as real-time transaction monitoring systems, data analytics, and machine learning algorithms, to stay one step ahead of potential threats. This enables them to identify suspicious activities quickly and respond swiftly.

Hong Kong

Banks and financial institutions in the Hong Kong Special Administrative Region (HKSAR) are working to build effective and sustainable anti-scam initiatives. By benchmarking these efforts against best practices, they can pinpoint and close critical gaps, particularly where risks are high, and controls need strengthening.

Amidst rising financial fraud, major banks are heavily investing in advanced anti-fraud technology. The Bank of China in HKSAR developed an AI system that quadrupled their fraud detection rates, while HSBC enhanced their analytics and prevention capabilities by 70%.[1]

With most scams occurring online, the Hong Kong Association of Banks (HKAB) is pushing for greater cross-sector collaboration, urging partnerships between the public and private sectors, including telecom networks and social media companies.

Singapore

Banks in Singapore are mandated to educate customers and implement multi-factor authentication for verifying customer identities and authorising online transactions, along with sending notification alerts for unauthorised transactions. However, online scammers have adapted, exploiting these safeguards by tricking customers into revealing personal information or installing malware.

A notable example is the OCBC incident in December 2021, where fraudsters stole SGD 13.7 million through phishing scams within days. In response, the MAS and ABS swiftly introduced enhanced security measures, including the removal of clickable links in emails and SMS, lowering fund transfer notification thresholds, and delaying the activation of new soft tokens.

To further combat financial crime, banks are deploying advanced AI systems. For instance, DBS Bank has improved its anti-money laundering capabilities by using machine learning algorithms to automate transaction monitoring and reduce false positives.

Safeguarding financial systems against financial crime

As financial crimes evolve over the next 5–10 years, driven by technological advances and shifting economic conditions, criminals are expected to increasingly use AI and deepfake technology, complicating detection efforts. The expanding use of cryptocurrencies and digital assets may lead to a rise in crimes like money laundering and ICO fraud, especially in periods of economic instability. Furthermore, the growth of remote work and online transactions is likely to heighten risks such as identity theft and phishing.

To combat these threats, financial institutions should invest in advanced fraud detection technologies, enhance cybersecurity measures, and educate customers. Collaboration with fintech companies and participation in information-sharing networks will be crucial to countering evolving fraud tactics. Over the coming decade, institutions will need to demonstrate agility and innovation to navigate the complex landscape of technology, regulation, and financial crime, ensuring the security of critical financial systems.

FIs must consider several key strategies to mitigate fraud. Below are some essential areas to focus on, which encompass internal controls, external collaboration, and training:

If you wish to further discuss this topic, please don't hesitate to contact our experts.

Summary

- Financial crime has surged since the pandemic, with losses estimated between USD 50 billion to USD 177 billion globally.

- Hong Kong and Singapore, as major financial hubs, are highly attractive targets for fraudsters due to their wealth and advanced digital infrastructure.

- Both regions face growing challenges, including phishing scams, investment fraud, and the rise of sophisticated cybercriminal tactics using AI and machine learning.

- Financial institutions in HK and SG are investing in advanced technologies and collaborating across sectors to strengthen fraud detection and prevention.

- Continued innovation, collaboration, and public awareness are crucial to countering evolving financial crimes over the next decade.

Financial crime has seen a significant increase since the pandemic, with developed regions becoming prime targets for fraudsters. Despite the ongoing efforts of financial institutions (FIs) and regulators, global losses are estimated to range from USD 50 billion to USD 177 billion, a figure that is likely to rise if these threats are not effectively countered. (Please refer to our previous article for more statistics.)

Hong Kong and Singapore, Asia’s foremost financial hubs, are at the forefront of this issue. Both jurisdictions have established strong regulatory frameworks that provide a solid defence against financial crime. However, their considerable wealth, advanced digital infrastructure, and booming e-commerce sectors also make them particularly attractive to fraudsters. The integration of AI and machine learning has transformed the financial landscape, offering new opportunities for growth and security. Yet, these same technologies have also armed criminals with sophisticated tools, enabling them to commit increasingly complex and damaging fraud.

Addressing this growing threat requires a proactive and coordinated response across industries involving regulators, FIs, and telecommunications authorities to safeguard these vital financial centres from further exploitation.

Regulatory responses in HK and SG

Both Hong Kong and Singapore face similar challenges when it comes to financial fraud, including phishing scams, investment fraud, and credit card fraud, with online scams involving fake investment opportunities being particularly prevalent. Regulatory bodies in Hong Kong and Singapore actively engage in public awareness campaigns to educate citizens about potential scams and fraudulent tactics, emphasising the importance of vigilance and informed decision-making in the fight against financial crime.

Hong Kong

In 2023, scam-related losses in Hong Kong soared to HKD 9.18 billion (USD 1.18 billion), with reported cases increasing by 42.6% to 39,824. This worrying statistic is likely to trend upward if left unaddressed. In response, the Hong Kong Monetary Authority (HKMA) has enhanced its supervisory framework, emphasising stronger cybersecurity measures and fraud prevention strategies within financial institutions. The HKMA has also issued guidelines urging banks to adopt best practices in risk management and fraud detection to better defend against emerging threats.

To combat financial crime, the Hong Kong Police Force (HKPF) has released comprehensive crime reports for 2019-2023, providing valuable insights into the patterns and impacts of these crimes. The HKPF also established the Anti-Deception Coordination Centre (ADCC) under the Commercial Crime Bureau as a central hub for anti-fraud initiatives. The ADCC operates the "Anti-Scam Helpline 18222," offering 24/7 assistance to the public and support for HKPF units.

In 2022, the HKPF launched "Scameter," an anti-fraud search engine that allows users to check bank account numbers, stored value facility (SVF) user IDs, and phone numbers, providing a colour-coded risk rating. If the data is linked to scams, Scameter alerts users to potential risks before they proceed with payments or transactions, helping to prevent common frauds like online shopping scams, investment fraud, and romance scams.

Singapore

In 2023, the Singapore Police Force (SPF) reported 46,563 cases of financial fraud, a sharp 46.8% increase from the previous year, leading to estimated losses of SGD 651.8 million (USD 482 million). This trend indicates a growing concern for financial crimes affecting Singaporeans. While the total loss slightly decreased from last year's record high, the number of reported cases continues to rise, emphasising the need for increased vigilance and education on financial scams and frauds.

That same year, the MAS and the Infocomm Media Development Authority (IMDA) published the shared responsibility framework with the aim of defining the responsibilities of financial institutions, telecommunications operators, and consumers in preventing and responding to phishing incidents. The initiative seeks to enhance overall accountability and collaboration among stakeholders to better protect against the growing threat of phishing scams.

The Monetary Authority of Singapore (MAS) has been working closely with the Association of Banks in Singapore (ABS) and SPF to assess the situation and implement more safeguards against digital banking scams. This collaboration led to the creation of the Standing Committee on Fraud (SCF) in 2022, surpassing the ABS Anti-Scam Taskforce established in 2020. The committee is tasked with developing anti-scam strategies, which includes monitoring scams, information sharing among banks, providing industry-level guidance, and heightening public awareness.

In 2022, the SPF established the Anti-Scam Command (ASC), a centralised entity tasked with consolidating expertise and resources to combat scams effectively. This initiative brought together diverse capabilities under one umbrella, including scam investigation, incident response, intervention, enforcement, and sensemaking.

Additionally, the ASC expanded its scope by partnering with six major banks in Singapore: DBS Bank, OCBC, UOB, Standard Chartered, HSBC, and CIMB. In September 2022, these banks agreed to co-locate a select group of employees within the ASC to enhance the police's ability to respond promptly to scam incidents. These banking experts contribute their skills in tracing the flow of funds, freezing bank accounts linked to scam operations and facilitating swift action to combat scams effectively.

The role of financial institutions in mitigating scams

Leading FIs in HK and SG are taking a proactive approach to combatting fraud. Banks are leveraging advanced technologies, such as real-time transaction monitoring systems, data analytics, and machine learning algorithms, to stay one step ahead of potential threats. This enables them to identify suspicious activities quickly and respond swiftly.

Hong Kong

Banks and financial institutions in the Hong Kong Special Administrative Region (HKSAR) are working to build effective and sustainable anti-scam initiatives. By benchmarking these efforts against best practices, they can pinpoint and close critical gaps, particularly where risks are high, and controls need strengthening.

Amidst rising financial fraud, major banks are heavily investing in advanced anti-fraud technology. The Bank of China in HKSAR developed an AI system that quadrupled their fraud detection rates, while HSBC enhanced their analytics and prevention capabilities by 70%.[1]

With most scams occurring online, the Hong Kong Association of Banks (HKAB) is pushing for greater cross-sector collaboration, urging partnerships between the public and private sectors, including telecom networks and social media companies.

Singapore

Banks in Singapore are mandated to educate customers and implement multi-factor authentication for verifying customer identities and authorising online transactions, along with sending notification alerts for unauthorised transactions. However, online scammers have adapted, exploiting these safeguards by tricking customers into revealing personal information or installing malware.

A notable example is the OCBC incident in December 2021, where fraudsters stole SGD 13.7 million through phishing scams within days. In response, the MAS and ABS swiftly introduced enhanced security measures, including the removal of clickable links in emails and SMS, lowering fund transfer notification thresholds, and delaying the activation of new soft tokens.

To further combat financial crime, banks are deploying advanced AI systems. For instance, DBS Bank has improved its anti-money laundering capabilities by using machine learning algorithms to automate transaction monitoring and reduce false positives.

Safeguarding financial systems against financial crime

As financial crimes evolve over the next 5–10 years, driven by technological advances and shifting economic conditions, criminals are expected to increasingly use AI and deepfake technology, complicating detection efforts. The expanding use of cryptocurrencies and digital assets may lead to a rise in crimes like money laundering and ICO fraud, especially in periods of economic instability. Furthermore, the growth of remote work and online transactions is likely to heighten risks such as identity theft and phishing.

To combat these threats, financial institutions should invest in advanced fraud detection technologies, enhance cybersecurity measures, and educate customers. Collaboration with fintech companies and participation in information-sharing networks will be crucial to countering evolving fraud tactics. Over the coming decade, institutions will need to demonstrate agility and innovation to navigate the complex landscape of technology, regulation, and financial crime, ensuring the security of critical financial systems.

FIs must consider several key strategies to mitigate fraud. Below are some essential areas to focus on, which encompass internal controls, external collaboration, and training:

If you wish to further discuss this topic, please don't hesitate to contact our experts.