Loading Insight...

Insights

Insights

Client lifecycle management (CLM) stands as a cornerstone for private banks, shaping the trajectory of client interactions and operational efficacy. With evolving regulations and shifting client expectations, the CLM journey has become increasingly complex and difficult to navigate. This article series delves into the challenges, opportunities, and key enablers that private banks need to know.

Common CLM challenges in private banking

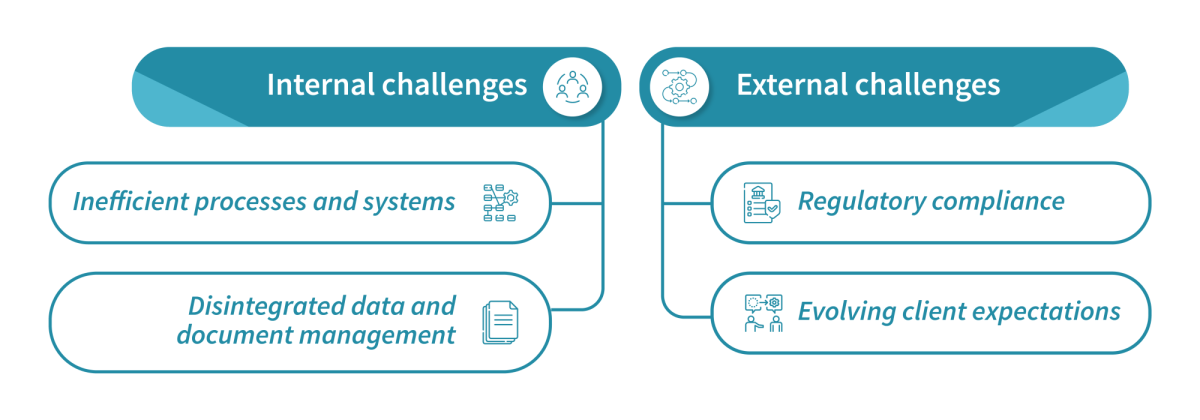

Private banks face both external and internal challenges that put their operating models to the test. On one hand, there is constant regulatory pressure to comply with more demanding requirements, which inadvertently exposes policy, process and system inefficiencies within the bank. On the other hand, internal client management processes and ever-increasing documentation requirements can be financially burdensome if not streamlined or supported by scalable systems. Let us have an extensive view in each category.

External challenges

Regulatory compliance

- Constant need to assess business impact from rapidly evolving regulations and to ensure timely uplifting or remediation of clients, which could be a tedious process exacerbated by siloed business organisations and data structures

- Heightened scrutiny particularly for anti-money laundering (AML) due to the higher risk nature of the business that involves large transactional amounts or assets under management, and client profiles that are likely to include risks arising from political exposure, cross-border tax obligations, and difficulties in source of wealth corroboration

- Regulatory complexity arising from cross-jurisdictional booking models often create confusion and duplication which not only compounds the challenge in meeting compliance requirements effectively but also dampens client experience

Evolving client expectations

- Establishing a digital-first client experience as the extended norm for engagement without losing the human touch has now become the necessity for a private banking relationship

- Striking an optimal balance in client servicing by being readily available and without excessive client outreach is now the bare minimal of client expectation

- Leveraging technological tools such as machine learning to integrate intelligent data analytics for generating valuable real-time insights to provide bespoke service that is highly sought-after by private banking clients

Internal Challenges

Inefficient processes and systems

- Long-drawn onboarding processes lead to high costs of acquisition and low conversion, creating extra overhead costs that put pressure on the business in an increasingly competitive landscape

- Lack of structured process that hinders the detection of risk factors early on, resulting in unproductive time to prospect and onboard clients failing to meet bank’s compliance standards

- Continued use of paper-based and manual processes with outdated and siloed legacy systems which are costly to maintain, puts banks at high risk of human errors and lack of agility to identify compliance risks effectively

Disintegrated data and document management

- Lack of single client view resulting in an inability to provide quality and timely portfolio advisory and sub-par client servicing standards, also leading to opportunity costs to expand the relationship through cross-selling or up-selling

- Failure to reconcile or leverage existing data especially during scheduled reviews results in client frustration and missed insights on client profile, preference and behaviours

- Data quality issues due to insufficient or ineffective governance and controls which would not only present operational risks but also regulatory implications

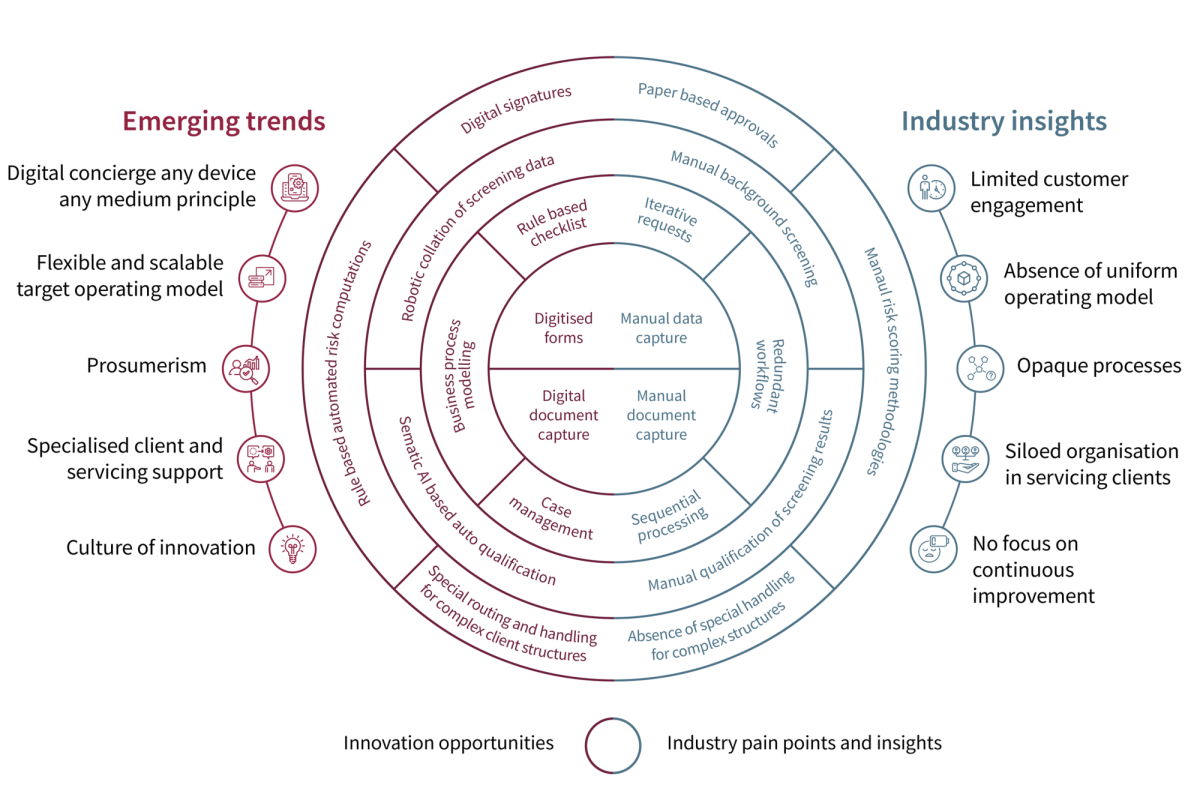

Industry insights and emerging trends

In the face of numerous challenges, private banks must be constantly on the lookout for emerging opportunities to tackle challenges and explore ways to overcome competition. This goes beyond mere technological and digital transformations, but also includes organisational re-alignment or a cultural mindset shift.

Any device, any media (ADAM) - Private banks are increasingly providing clients with access to banking and advisory services through multiple modes, with a strong emphasis on digital channels. These include mobile apps and instant chat messaging, designed to cater to the convenience of private banking clients who are typically on-the-go. This digital-first approach ensures clients have seamless, real-time access to their banking needs.

Target operating model (TOM) - Agility is becoming a cornerstone for private banks as they pivot entire business models front-to-back to capture new opportunities. This includes expanding their scope beyond traditional private banking to also serve the highly affluent segment, thereby broadening their client base and revenue streams.

Prosumerism - In the digital world, prosumers are clients who customise or provide feedback on the products and services that they engage with. This requires banks to tailor offerings to meet specific client needs and adopt a business model that is client-centric by design and focuses on leveraging client data.

Specialised client servicing - Leveraging data analytics and advanced technology, private banks are now able to offer bespoke services tailored to individual client needs. This approach enhances client satisfaction and loyalty without requiring additional resources from relationship managers, making it a highly efficient model for delivering personalised service.

Culture of innovation - A corporate culture that prioritises and celebrates innovation is deeply embedded within the private banking sector. Efforts to improve service offerings or enhance productivity are continually encouraged, contributing to the bank's agility and long-term competitiveness. This culture ensures that private banks remain at the forefront of industry advancements and client expectations.

Navigating the complex landscape of CLM in private banking requires an in-depth understanding of the challenges and opportunities at hand. We have identified the common hurdles faced by private banks, from regulatory compliance to operational inefficiencies, while also recognising the broader market context of emerging trends and insights.

As we continue this journey, our next article will delve into the exciting opportunities for private banks. From technological advancements to organisational re-alignment, there is much to uncover.

Stay tuned for our exploration of opportunities in the evolving realm of CLM and where banks should play in to strategise on the transformation initiatives.

Other articles in the series:

Developing and Maturing the CLM Journey: Unlocking Opportunities for Client Acquisition

Client lifecycle management (CLM) stands as a cornerstone for private banks, shaping the trajectory of client interactions and operational efficacy. With evolving regulations and shifting client expectations, the CLM journey has become increasingly complex and difficult to navigate. This article series delves into the challenges, opportunities, and key enablers that private banks need to know.

Common CLM challenges in private banking

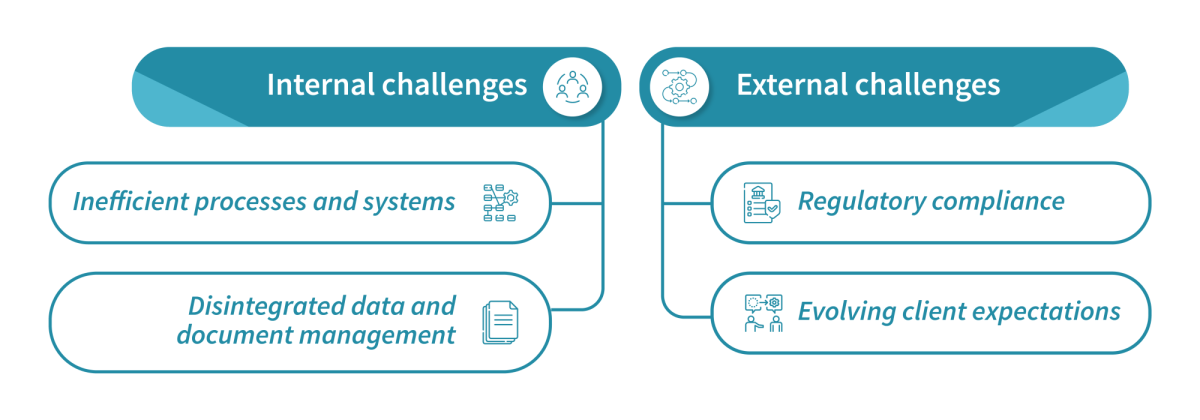

Private banks face both external and internal challenges that put their operating models to the test. On one hand, there is constant regulatory pressure to comply with more demanding requirements, which inadvertently exposes policy, process and system inefficiencies within the bank. On the other hand, internal client management processes and ever-increasing documentation requirements can be financially burdensome if not streamlined or supported by scalable systems. Let us have an extensive view in each category.

External challenges

Regulatory compliance

- Constant need to assess business impact from rapidly evolving regulations and to ensure timely uplifting or remediation of clients, which could be a tedious process exacerbated by siloed business organisations and data structures

- Heightened scrutiny particularly for anti-money laundering (AML) due to the higher risk nature of the business that involves large transactional amounts or assets under management, and client profiles that are likely to include risks arising from political exposure, cross-border tax obligations, and difficulties in source of wealth corroboration

- Regulatory complexity arising from cross-jurisdictional booking models often create confusion and duplication which not only compounds the challenge in meeting compliance requirements effectively but also dampens client experience

Evolving client expectations

- Establishing a digital-first client experience as the extended norm for engagement without losing the human touch has now become the necessity for a private banking relationship

- Striking an optimal balance in client servicing by being readily available and without excessive client outreach is now the bare minimal of client expectation

- Leveraging technological tools such as machine learning to integrate intelligent data analytics for generating valuable real-time insights to provide bespoke service that is highly sought-after by private banking clients

Internal Challenges

Inefficient processes and systems

- Long-drawn onboarding processes lead to high costs of acquisition and low conversion, creating extra overhead costs that put pressure on the business in an increasingly competitive landscape

- Lack of structured process that hinders the detection of risk factors early on, resulting in unproductive time to prospect and onboard clients failing to meet bank’s compliance standards

- Continued use of paper-based and manual processes with outdated and siloed legacy systems which are costly to maintain, puts banks at high risk of human errors and lack of agility to identify compliance risks effectively

Disintegrated data and document management

- Lack of single client view resulting in an inability to provide quality and timely portfolio advisory and sub-par client servicing standards, also leading to opportunity costs to expand the relationship through cross-selling or up-selling

- Failure to reconcile or leverage existing data especially during scheduled reviews results in client frustration and missed insights on client profile, preference and behaviours

- Data quality issues due to insufficient or ineffective governance and controls which would not only present operational risks but also regulatory implications

Industry insights and emerging trends

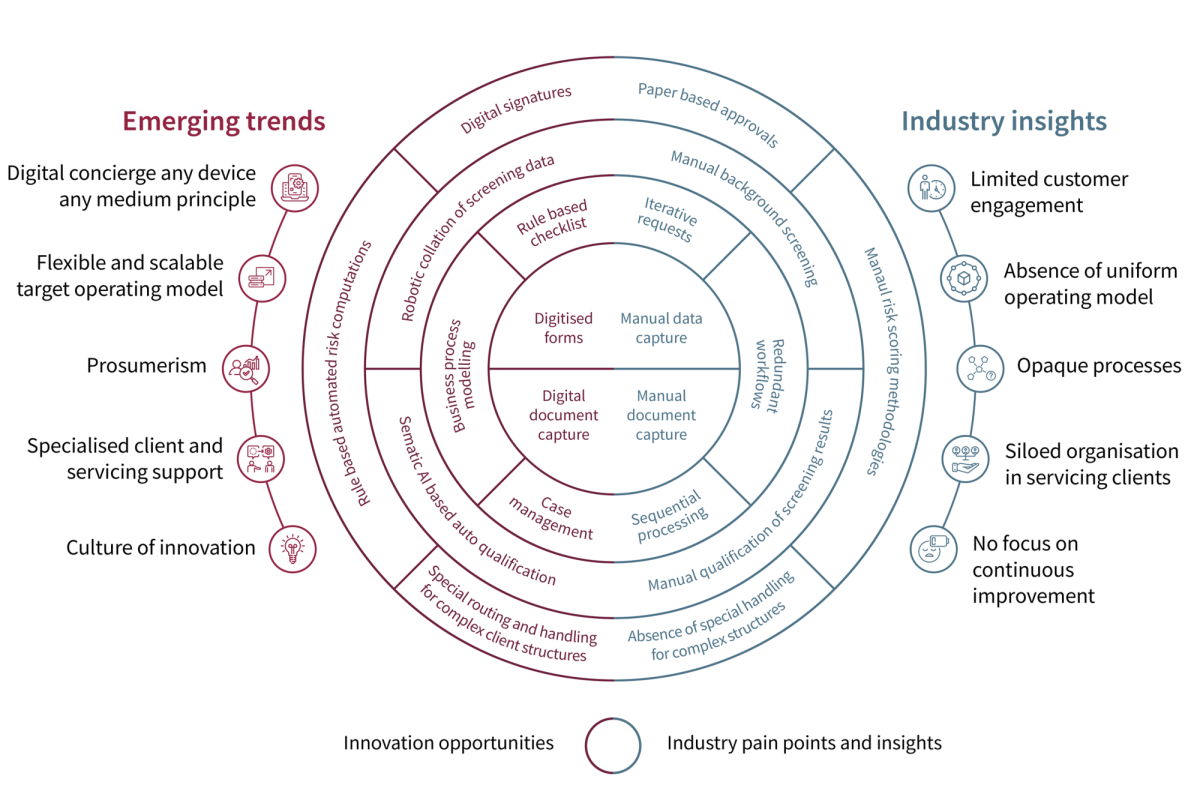

In the face of numerous challenges, private banks must be constantly on the lookout for emerging opportunities to tackle challenges and explore ways to overcome competition. This goes beyond mere technological and digital transformations, but also includes organisational re-alignment or a cultural mindset shift.

Any device, any media (ADAM) - Private banks are increasingly providing clients with access to banking and advisory services through multiple modes, with a strong emphasis on digital channels. These include mobile apps and instant chat messaging, designed to cater to the convenience of private banking clients who are typically on-the-go. This digital-first approach ensures clients have seamless, real-time access to their banking needs.

Target operating model (TOM) - Agility is becoming a cornerstone for private banks as they pivot entire business models front-to-back to capture new opportunities. This includes expanding their scope beyond traditional private banking to also serve the highly affluent segment, thereby broadening their client base and revenue streams.

Prosumerism - In the digital world, prosumers are clients who customise or provide feedback on the products and services that they engage with. This requires banks to tailor offerings to meet specific client needs and adopt a business model that is client-centric by design and focuses on leveraging client data.

Specialised client servicing - Leveraging data analytics and advanced technology, private banks are now able to offer bespoke services tailored to individual client needs. This approach enhances client satisfaction and loyalty without requiring additional resources from relationship managers, making it a highly efficient model for delivering personalised service.

Culture of innovation - A corporate culture that prioritises and celebrates innovation is deeply embedded within the private banking sector. Efforts to improve service offerings or enhance productivity are continually encouraged, contributing to the bank's agility and long-term competitiveness. This culture ensures that private banks remain at the forefront of industry advancements and client expectations.

Navigating the complex landscape of CLM in private banking requires an in-depth understanding of the challenges and opportunities at hand. We have identified the common hurdles faced by private banks, from regulatory compliance to operational inefficiencies, while also recognising the broader market context of emerging trends and insights.

As we continue this journey, our next article will delve into the exciting opportunities for private banks. From technological advancements to organisational re-alignment, there is much to uncover.

Stay tuned for our exploration of opportunities in the evolving realm of CLM and where banks should play in to strategise on the transformation initiatives.

Other articles in the series:

Developing and Maturing the CLM Journey: Unlocking Opportunities for Client Acquisition