Loading Insight...

Insights

Insights

Summary

- Embedded insurance disrupts the traditional insurance value chain by integrating insurance products directly into primary product and services, creating new revenue streams.

- Telecom providers (telcos), with their large customer bases and digital infrastructure, are uniquely positioned to lead in the embedded insurance market.

- Telcos benefit from embedded insurance through revenue diversification, customer retention, and leveraging IoT to offer personalised insurance solutions.

- Success in embedded insurance requires seamless integration, strategic partnerships, and a customer-centric approach to ensure frictionless experiences.

- Synpulse's Embedded Insurance as a Service (EaaS) framework offers end-to-end support, helping telcos design, implement, and optimise embedded insurance solutions.

When discussing embedded insurance, the focus often centres on insurance companies. It is commonly highlighted that the traditional insurance model is unsuitable for a successful embedded insurance proposition. The premise that the entire insurance value chain is managed monolithically by the risk carrier (i.e., the insurer) no longer applies. We believe that embedded insurance requires a disruption of the traditional value chain, resulting in a more partitioned approach. Synpulse, through its NEOINSURANCE® brand, develops future-proven business models such as embedded insurance.

While insurers are often seen as the focal point, embedded insurance also holds significant potential for primary product partners. In our article “Embedded Insurance Unveiled: Dispelling a Myth,” we discuss how these partners, such as telcos, can own the user interface and thrive in this ecosystem.

Telcos, with their large customer bases and digital infrastructure, are uniquely positioned to embed insurance into everyday services. Facing pressure from declining margins in their core business, they are turning to embedded insurance as a new revenue stream. This article explores why telcos are becoming key players in the embedded insurance landscape and how this partnership creates mutual benefits.

Why embedded insurance is attractive for telecom providers

Telecom providers are well-positioned to diversify their revenue streams through embedded insurance. By leveraging their large customer bases and digital platforms, telcos can offer insurance products that cater to specific customer needs. More specifically, engaging in embedded insurance has many benefits.

- Large customer base for scale: Telcos have millions of customers, allowing them to scale embedded insurance offerings rapidly. This helps achieve breakeven faster than many other industries which makes them attractive to risk carriers. Scalability is a key success factor when it comes to embedded insurance.

- Revenue diversification: As the traditional communication services market becomes more saturated and price competitive, telcos are looking for new revenue opportunities. Embedded insurance offers a chance to move beyond their core services and tap into the financial services space.

- Customer loyalty and retention: Offering insurance products can help telcos strengthen their relationship with customers. Insurance bundles, such as device protection plans, create ongoing interactions with customers and enhance customer loyalty and retention.

- Access to the Internet of Things (IoT) and telematics: With IoT-enabled devices like smartphones and wearables, telcos can offer innovative insurance solutions. These include usage-based insurance, behavioural monitoring, location-based tracking and parametric claims handling, all of which create personalised, customer-centric insurance products and enhances the user experience.

- End customer interface: Telcos hold a key advantage as they control the communication interface through mobile apps, SMS, and other channels. This makes embedding insurance a natural and low-disruption addition to their existing customer journey. Their platforms, which fulfil the essential need for communication, also allow insurance products to be embedded seamlessly in a "plug-and-play" fashion.

- Suitable products: Telcos produce lifestyle products that accompany the customer throughout his entire life and thus offer countless touchpoints.

Telecom providers are uniquely positioned to thrive in the embedded insurance space, one of the fastest-growing markets with significant untapped revenue potential. Embedded insurance not only generates new revenue streams for telcos but also delivers value to customers and risk carriers alike.

For customers, embedded insurance at the point of sale offers a seamless, one-stop-shop experience covering everything from purchase to claims management. Telcos can further enhance this by orchestrating claims and repairs, ensuring convenience and speed.

For risk carriers, partnering with telcos unlocks access to vast customer bases and complements telcos' subscription-based offerings with similarly structured insurance products.

Moreover, integrating claims prevention programmes using IoT and telematics, such as smart sensors for connected homes, adds value for all stakeholders. These solutions help prevent or mitigate incidents like leaks or fire hazards, combining connectivity with proactive protection, reducing claims ratios, and enriching the customer experience.

Understanding the embedded insurance value chain for telecom providers

To succeed in embedded insurance, telecom providers must choose the right insurance partners and prioritise seamless integration. Owning the customer interface allows telcos to manage customer engagement effectively, but their insurance partners must meet the technical demands of a fully-fledged embedded solution.

A frictionless customer experience is essential—insurance purchases, claims, and renewals should flow smoothly. This requires a modern IT landscape with an open, modular, and event-driven architecture that integrates seamlessly with ecosystem partners.

Unlike traditional insurance, where the value chain is managed under one roof, embedded insurance calls for outsourcing parts of the value chain to specialised partners. In this model, telcos typically handle customer engagement, leveraging their interface ownership.

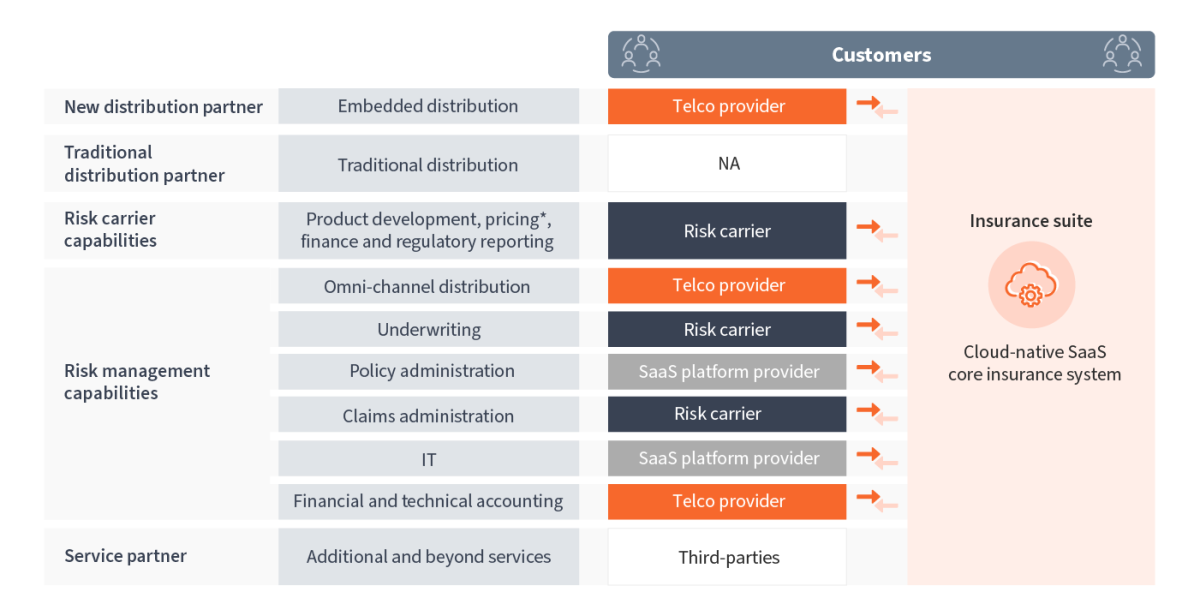

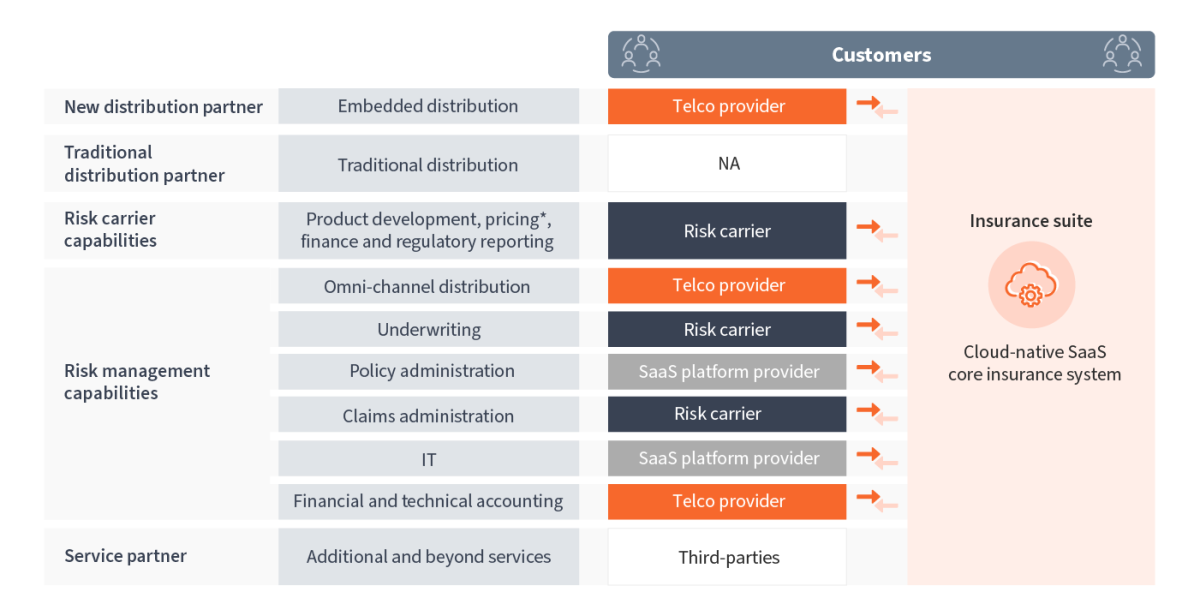

Figure 1: Set up of an embedded insurance proposition for telcos. The shown setup is only one option out of many possible value chain splits.

In Figure 1, we depict a possible setup of an embedded insurance proposition for a telco provider. Here the telco provider focuses on owning the customer interaction in the sales process. As a result, the insurance value chain is fragmented, with telco, risk carrier, platform provider, and third-party providers focusing on its core strengths to maximise value for the end customer.

Importantly for telco providers, their key focus is owning the customer interface and hence, the sales touchpoints as they have primary access to their large customer base which provides them with invaluable insights into customer behaviour and demand.

Spotlight: distribution and customer engagement

Distribution and customer engagement is one of the key parts where telcos can embed insurance products and engage customers effectively. It is critical to ensure that the end customer can easily access the insurance solution at the right time and place. telco providers have several strategies to offer insurance solutions with their primary core products.

- Bundling insurance with telecom services: Telcos can bundle insurance with existing services like data tariffs, roaming or TV subscriptions. This creates a more comprehensive offering that appeals to customers seeking convenience and added value.

- Bundling insurance with telecom devices: Customers purchasing smartphones, tablets, laptops, or other connected devices can be offered insurance coverage directly at checkout. This ensures that the experience of the end-customer with his new device is worry free.

- Micro insurances that can be purchased on the fly: Through existing touchpoints customers can purchase, activate, or manage their insurance policies directly through the telecom provider's app in a flexible on demand manner. For example, while activating a roaming travel plan, the end-customer can also activate a travel insurance plan that lasts while roaming abroad.

There are many further way’s how telecom providers can truly engage with customers to ensure their protection needs are embedded into their daily telecom consumer experience.

Synpulse offering EaaS

Synpulse offers an Embedded Insurance as a Service (EaaS) solution that provides out-of-the-box tools for telcos looking to enter this space. Our offering helps you to get traction in the insurance space and embed insurance into your telco services, unlocking new revenue streams and enhancing customer engagement. With our holistic Target Operating Model (TOM), we provide end-to-end support across strategy, implementation, and maintenance, enabling sustainable success in the embedded insurance market.

Building a strong strategic foundation

We ensure your embedded insurance initiatives align with your enterprise strategy, market trends, and customer expectations. This phase involves comprehensive research, planning, and design to ensure the foundation of your embedded insurance proposition is solid:

- Ensure strategic fit: Evaluate customer data to identify gaps where insurance can add value, such as smartphone insurance, digital identity protection, or family health packages.

- Insurance product selection: Develop insurance product structures that suit your target audience and strategy, ensuring relevance and high adoption rates.

- Risk carrier partnerships: Identify the most suitable insurers or reinsurers to manage underwriting and claims, leveraging their expertise to minimise risk exposure.

- Technology platform selection: Choose a platform that integrates seamlessly with your existing systems, ensuring smooth operations and a hassle-free customer experience.

- Customer journey design: Design intuitive customer touchpoints where insurance offerings are presented naturally during phone upgrades, SIM activations, or service subscriptions.

Turning vision into reality

Implementing an embedded insurance proposition successfully requires strategic alignment, collaboration, and seamless technical integration. Synpulse has developed a holistic embedded insurance implementation framework that ensures a smooth and comprehensive transition from concept to practice:

- Got-to-market strategy: Develop a compelling embedded insurance strategy that is well-anchored in your own organisation, complements your existing value proposition and is attractive to both your end-customers and ecosystem partners.

- Target Operating Model (TOM): Design a holistic target operating model for embedded insurance that defines how the value chain is split between your ecosystem partners and third-party providers and which actor owns the customer interface.

- Products and propositions: Define an innovative yet simple B2B2X insurance product portfolio that protects basic human needs of your end customers and can easily be embedded as native component into your primary telco products and services.

- Technology integration: Develop an open, modular IT architecture to embed digital embedded insurance offerings into your ecosystem partners' value chain and ensure scalability and compatibility with existing applications.

- Compliance and regulatory framework: Navigate insurance regulations across regions by setting up legal processes and acquiring necessary licenses upfront.

- Detailed roadmap: Develop a timeline with clear milestones, resource allocation, and risk mitigation strategies to guide the implementation of your embedded insurance proposition with targeted marketing campaigns and communication plans.

- Organisational Set-up and transition management: Reskill and upskill a cross-functional team trained in insurance operations, claims management, B2B2X partner management and customer support to operate your embedded insurance proposition.

- Ecosystem partner onboarding: Streamline lean B2B2X partner onboarding processes with insurers and third-party providers, defining service-level agreements (SLAs) and cross-company collaboration workflows to ensure operational readiness for embedded insurance.

Ensuring sustainable success

Embedded insurance is an ongoing journey that demands regular refinement and innovation to meet end-customer needs and market dynamics. Synpulse offers continuous support to keep your offerings competitive:

- Performance monitoring and analytics: Track critical KPIs like conversion rates, combined ratios, and customer satisfaction rate to assess the success of your insurance products.

- Scaling support: Expand your insurance offerings to new customer segments or markets, introducing innovative B2B2X products.

- Product updates and innovation: Refresh your insurance portfolio periodically to include trending risk protection areas, such as climate risk insurance, telemedicine benefits or cyber risk insurance.

- Customer experience optimisation: Enhance user experiences by incorporating feedback, improving digital interfaces, and offering more personalised insurance recommendations.

Let us guide you in reshaping the future of telecom through embedded insurance. Contact us today to begin your journey!

Summary

- Embedded insurance disrupts the traditional insurance value chain by integrating insurance products directly into primary product and services, creating new revenue streams.

- Telecom providers (telcos), with their large customer bases and digital infrastructure, are uniquely positioned to lead in the embedded insurance market.

- Telcos benefit from embedded insurance through revenue diversification, customer retention, and leveraging IoT to offer personalised insurance solutions.

- Success in embedded insurance requires seamless integration, strategic partnerships, and a customer-centric approach to ensure frictionless experiences.

- Synpulse's Embedded Insurance as a Service (EaaS) framework offers end-to-end support, helping telcos design, implement, and optimise embedded insurance solutions.

When discussing embedded insurance, the focus often centres on insurance companies. It is commonly highlighted that the traditional insurance model is unsuitable for a successful embedded insurance proposition. The premise that the entire insurance value chain is managed monolithically by the risk carrier (i.e., the insurer) no longer applies. We believe that embedded insurance requires a disruption of the traditional value chain, resulting in a more partitioned approach. Synpulse, through its NEOINSURANCE® brand, develops future-proven business models such as embedded insurance.

While insurers are often seen as the focal point, embedded insurance also holds significant potential for primary product partners. In our article “Embedded Insurance Unveiled: Dispelling a Myth,” we discuss how these partners, such as telcos, can own the user interface and thrive in this ecosystem.

Telcos, with their large customer bases and digital infrastructure, are uniquely positioned to embed insurance into everyday services. Facing pressure from declining margins in their core business, they are turning to embedded insurance as a new revenue stream. This article explores why telcos are becoming key players in the embedded insurance landscape and how this partnership creates mutual benefits.

Why embedded insurance is attractive for telecom providers

Telecom providers are well-positioned to diversify their revenue streams through embedded insurance. By leveraging their large customer bases and digital platforms, telcos can offer insurance products that cater to specific customer needs. More specifically, engaging in embedded insurance has many benefits.

- Large customer base for scale: Telcos have millions of customers, allowing them to scale embedded insurance offerings rapidly. This helps achieve breakeven faster than many other industries which makes them attractive to risk carriers. Scalability is a key success factor when it comes to embedded insurance.

- Revenue diversification: As the traditional communication services market becomes more saturated and price competitive, telcos are looking for new revenue opportunities. Embedded insurance offers a chance to move beyond their core services and tap into the financial services space.

- Customer loyalty and retention: Offering insurance products can help telcos strengthen their relationship with customers. Insurance bundles, such as device protection plans, create ongoing interactions with customers and enhance customer loyalty and retention.

- Access to the Internet of Things (IoT) and telematics: With IoT-enabled devices like smartphones and wearables, telcos can offer innovative insurance solutions. These include usage-based insurance, behavioural monitoring, location-based tracking and parametric claims handling, all of which create personalised, customer-centric insurance products and enhances the user experience.

- End customer interface: Telcos hold a key advantage as they control the communication interface through mobile apps, SMS, and other channels. This makes embedding insurance a natural and low-disruption addition to their existing customer journey. Their platforms, which fulfil the essential need for communication, also allow insurance products to be embedded seamlessly in a "plug-and-play" fashion.

- Suitable products: Telcos produce lifestyle products that accompany the customer throughout his entire life and thus offer countless touchpoints.

Telecom providers are uniquely positioned to thrive in the embedded insurance space, one of the fastest-growing markets with significant untapped revenue potential. Embedded insurance not only generates new revenue streams for telcos but also delivers value to customers and risk carriers alike.

For customers, embedded insurance at the point of sale offers a seamless, one-stop-shop experience covering everything from purchase to claims management. Telcos can further enhance this by orchestrating claims and repairs, ensuring convenience and speed.

For risk carriers, partnering with telcos unlocks access to vast customer bases and complements telcos' subscription-based offerings with similarly structured insurance products.

Moreover, integrating claims prevention programmes using IoT and telematics, such as smart sensors for connected homes, adds value for all stakeholders. These solutions help prevent or mitigate incidents like leaks or fire hazards, combining connectivity with proactive protection, reducing claims ratios, and enriching the customer experience.

Understanding the embedded insurance value chain for telecom providers

To succeed in embedded insurance, telecom providers must choose the right insurance partners and prioritise seamless integration. Owning the customer interface allows telcos to manage customer engagement effectively, but their insurance partners must meet the technical demands of a fully-fledged embedded solution.

A frictionless customer experience is essential—insurance purchases, claims, and renewals should flow smoothly. This requires a modern IT landscape with an open, modular, and event-driven architecture that integrates seamlessly with ecosystem partners.

Unlike traditional insurance, where the value chain is managed under one roof, embedded insurance calls for outsourcing parts of the value chain to specialised partners. In this model, telcos typically handle customer engagement, leveraging their interface ownership.

Figure 1: Set up of an embedded insurance proposition for telcos. The shown setup is only one option out of many possible value chain splits.

In Figure 1, we depict a possible setup of an embedded insurance proposition for a telco provider. Here the telco provider focuses on owning the customer interaction in the sales process. As a result, the insurance value chain is fragmented, with telco, risk carrier, platform provider, and third-party providers focusing on its core strengths to maximise value for the end customer.

Importantly for telco providers, their key focus is owning the customer interface and hence, the sales touchpoints as they have primary access to their large customer base which provides them with invaluable insights into customer behaviour and demand.

Spotlight: distribution and customer engagement

Distribution and customer engagement is one of the key parts where telcos can embed insurance products and engage customers effectively. It is critical to ensure that the end customer can easily access the insurance solution at the right time and place. telco providers have several strategies to offer insurance solutions with their primary core products.

- Bundling insurance with telecom services: Telcos can bundle insurance with existing services like data tariffs, roaming or TV subscriptions. This creates a more comprehensive offering that appeals to customers seeking convenience and added value.

- Bundling insurance with telecom devices: Customers purchasing smartphones, tablets, laptops, or other connected devices can be offered insurance coverage directly at checkout. This ensures that the experience of the end-customer with his new device is worry free.

- Micro insurances that can be purchased on the fly: Through existing touchpoints customers can purchase, activate, or manage their insurance policies directly through the telecom provider's app in a flexible on demand manner. For example, while activating a roaming travel plan, the end-customer can also activate a travel insurance plan that lasts while roaming abroad.

There are many further way’s how telecom providers can truly engage with customers to ensure their protection needs are embedded into their daily telecom consumer experience.

Synpulse offering EaaS

Synpulse offers an Embedded Insurance as a Service (EaaS) solution that provides out-of-the-box tools for telcos looking to enter this space. Our offering helps you to get traction in the insurance space and embed insurance into your telco services, unlocking new revenue streams and enhancing customer engagement. With our holistic Target Operating Model (TOM), we provide end-to-end support across strategy, implementation, and maintenance, enabling sustainable success in the embedded insurance market.

Building a strong strategic foundation

We ensure your embedded insurance initiatives align with your enterprise strategy, market trends, and customer expectations. This phase involves comprehensive research, planning, and design to ensure the foundation of your embedded insurance proposition is solid:

- Ensure strategic fit: Evaluate customer data to identify gaps where insurance can add value, such as smartphone insurance, digital identity protection, or family health packages.

- Insurance product selection: Develop insurance product structures that suit your target audience and strategy, ensuring relevance and high adoption rates.

- Risk carrier partnerships: Identify the most suitable insurers or reinsurers to manage underwriting and claims, leveraging their expertise to minimise risk exposure.

- Technology platform selection: Choose a platform that integrates seamlessly with your existing systems, ensuring smooth operations and a hassle-free customer experience.

- Customer journey design: Design intuitive customer touchpoints where insurance offerings are presented naturally during phone upgrades, SIM activations, or service subscriptions.

Turning vision into reality

Implementing an embedded insurance proposition successfully requires strategic alignment, collaboration, and seamless technical integration. Synpulse has developed a holistic embedded insurance implementation framework that ensures a smooth and comprehensive transition from concept to practice:

- Got-to-market strategy: Develop a compelling embedded insurance strategy that is well-anchored in your own organisation, complements your existing value proposition and is attractive to both your end-customers and ecosystem partners.

- Target Operating Model (TOM): Design a holistic target operating model for embedded insurance that defines how the value chain is split between your ecosystem partners and third-party providers and which actor owns the customer interface.

- Products and propositions: Define an innovative yet simple B2B2X insurance product portfolio that protects basic human needs of your end customers and can easily be embedded as native component into your primary telco products and services.

- Technology integration: Develop an open, modular IT architecture to embed digital embedded insurance offerings into your ecosystem partners' value chain and ensure scalability and compatibility with existing applications.

- Compliance and regulatory framework: Navigate insurance regulations across regions by setting up legal processes and acquiring necessary licenses upfront.

- Detailed roadmap: Develop a timeline with clear milestones, resource allocation, and risk mitigation strategies to guide the implementation of your embedded insurance proposition with targeted marketing campaigns and communication plans.

- Organisational Set-up and transition management: Reskill and upskill a cross-functional team trained in insurance operations, claims management, B2B2X partner management and customer support to operate your embedded insurance proposition.

- Ecosystem partner onboarding: Streamline lean B2B2X partner onboarding processes with insurers and third-party providers, defining service-level agreements (SLAs) and cross-company collaboration workflows to ensure operational readiness for embedded insurance.

Ensuring sustainable success

Embedded insurance is an ongoing journey that demands regular refinement and innovation to meet end-customer needs and market dynamics. Synpulse offers continuous support to keep your offerings competitive:

- Performance monitoring and analytics: Track critical KPIs like conversion rates, combined ratios, and customer satisfaction rate to assess the success of your insurance products.

- Scaling support: Expand your insurance offerings to new customer segments or markets, introducing innovative B2B2X products.

- Product updates and innovation: Refresh your insurance portfolio periodically to include trending risk protection areas, such as climate risk insurance, telemedicine benefits or cyber risk insurance.

- Customer experience optimisation: Enhance user experiences by incorporating feedback, improving digital interfaces, and offering more personalised insurance recommendations.

Let us guide you in reshaping the future of telecom through embedded insurance. Contact us today to begin your journey!