Loading Insight...

Insights

Insights

Embedded insurance seamlessly integrates insurance solutions into the customer journey of primary product partners, offering customer-centric coverages at the point of purchase through advanced technology. In this article, Synpulse, an early adopter of this model, aims to clearly distinguish it from other insurance distribution models.

The concept of embedded insurance has its roots in co-operations between insurers and product partners, such as retailers, OEMs, banks, digital marketplaces, or any other primary product partner that owns the customer interface. In recent years, the concept has evolved into a sophisticated, technology-driven business domain for insurers. Digitisation and interconnectivity technologies play a crucial role in transforming traditional insurance into an embedded part of the customer journey of a primary product partner, offering seamless and customer-centric insurance coverage at the point of purchase of the primary product. As the digital landscape continues to evolve, embedded insurance is likely to become even more pervasive and enter our everyday transactions. Alongside its growth in popularity, we observe that there is some uncertainty in the market about what an embedded insurance business model looks like and how it distinguishes itself from other insurance models, such as affinity, direct or integrated insurance.

Synpulse is an early mover in the field of embedded insurance as we saw this approach to deliver insurance services as a strategic lighthouse since its very beginnings and have a profound range of experience from many successfully delivered embedded insurance projects. By leveraging this ample experience, we would like to shed light in this article on what embedded insurance really means and describe its key characteristics and the differentiating factors compared to other insurance business models.

Definition of embedded insurance

The core of embedded insurance is the seamless embedding of insurance products and services into the purchasing journey of a non-insurance product or service, the primary product. Thus, embedded insurance is a B2B2X business model. Embedded insurance products enable third-party service providers (primary product partners) to embed relevant insurance solutions at the point of sale of the primary product or service, providing convenience and immediate coverage without requiring a separate transaction – a one-stop-shop experience for the end customer. Hence, from the perspective of the insurer, embedded insurance is more than an alternate distribution channel; it is a commitment to change how insurance products are produced and experienced. A more traditional insurance offering with an insurance-centric and line-of-business oriented paradigm gets transformed into an embedded solution with customer-centric and lifestyle-oriented focus.

The following key features define embedded insurance:

- Native component of the primary product: The insurance coverage is seamlessly embedded into the customer’s purchase journey of non-insurance products, goods and services as:

- An inherent feature of the primary product or

- An opt-in/opt out feature or

- An add-on feature or

- A feature of a membership model

- Proximity to the primary product’s core value proposition: Embedded insurance enhances the core offering of the primary product, good or service by providing added value through insurance coverage.

- White labelling: The insurance proposition is sold under the brand of the primary product.

- Customer interaction owned by primary product partner: The customer journey and the interaction with the end customer also for the insurance coverage is no longer owned by insurance but by the primary product partner.

- Distributed by non-insurance primary product partners: The insurance coverage is distributed by a primary product partner, such as OEMs, telcos, retailers, mobility providers, digital marketplaces. Thus, insurers can leverage the primary product partners’ large customer base and data.

- Leverage product partner’s customer data: The insurer utilises extensive customer data available through the primary product partner to design and tailor personalised insurance solutions.

- Use of appropriate technology solutions: The technology solution used to bridge the spatial and temporal gap between the insurer and the point of sale enables a one-stop-shop experience.

For embedded insurance, the end customer relationship is not owned by the insurer but by the primary product partner. The insurer, however, can take advantage of this customer relationship with an embedded proposition. The primary product partners are keen to retain full control of their customer relationship and therefore co-operative solutions need to be found to embed the insurance solution into that customer relationship at the right place and at the right time, without impacting the existing primary product customer journey.

Martin Frick, former CTO Companjon

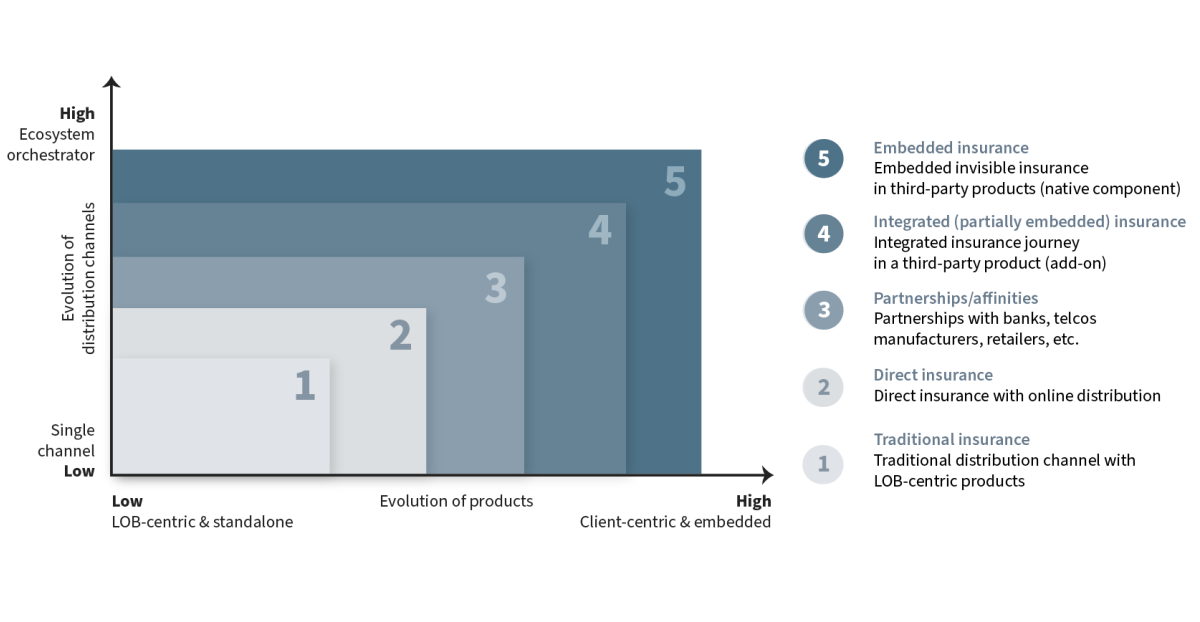

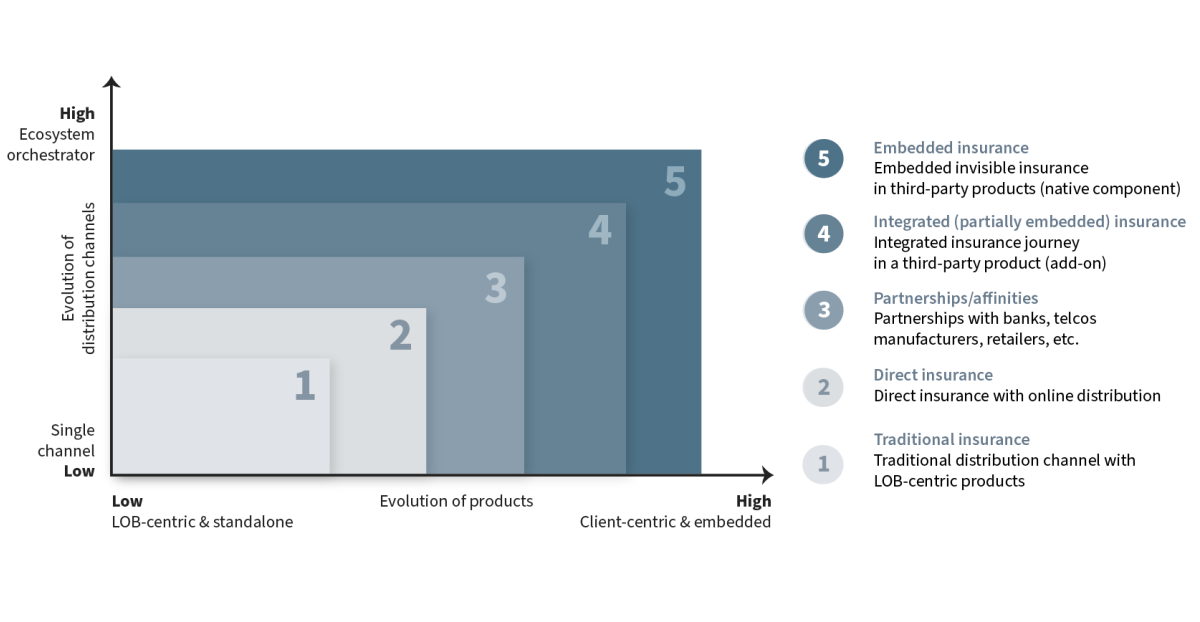

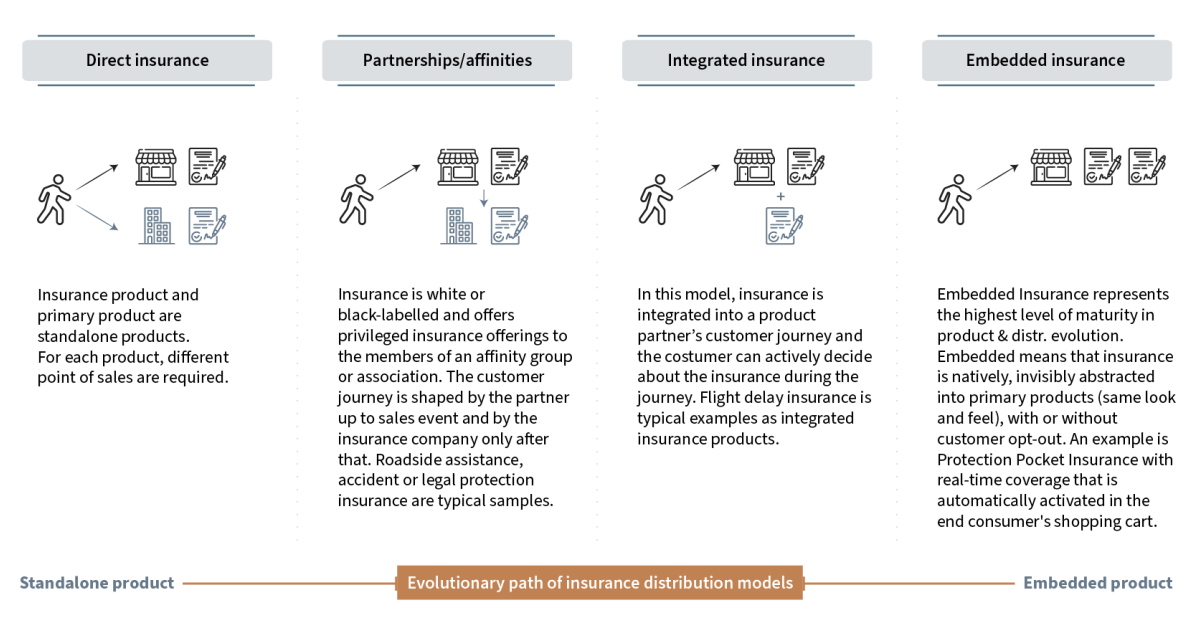

Figure 1: Insurance business models

Figure 1 depicts the evolution of embedded insurance along two dimensions: product evolution and distribution channel. From traditional insurance all the way to a seamlessly embedded insurance proposition enabled by the digital transformation of the industry, which facilitates embedding of insurance products into primary product customer journeys. This proposition requires a simplified insurance product structure, a close integration of the core insurance value chain into one of the primary products, and a suitable open, modular, and omni-speed technical architecture on the insurer’s side. The latter is necessary to integrate the insurance coverage part of the customer journey into the original look and feel of the end-customers’ experience at the point of sale. Only then is the insurance product a truly native component of the primary product.

At first sight the above categorisation of the different insurance models might be straightforward but let us go beyond the two dimensions product evolution and distribution channel. Table 1 maps the key features of embedded insurance to the different distribution models facilitating a clear definition of a true product offering.

Table 1: Insurance business models and key characteristics

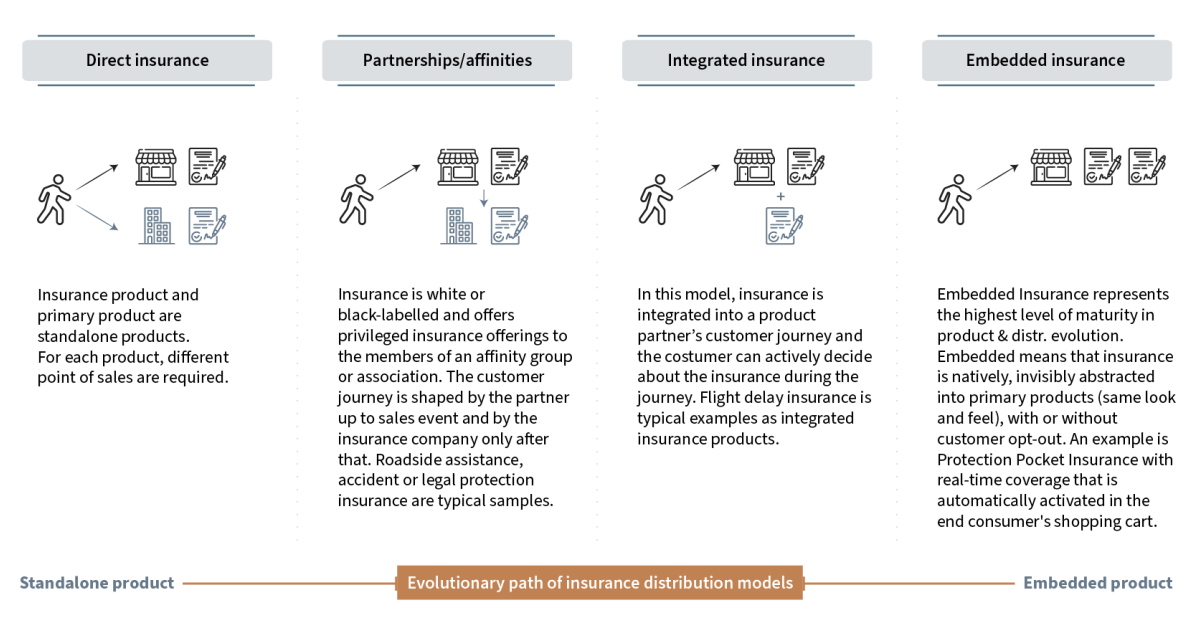

The characterisation of the insurance models from Table 1 is illustrated with examples in Figure 2 (except traditional insurance which is not the focus of this article).

Figure 2: Typical samples for each insurance model

Key success factors of an embedded insurance proposition

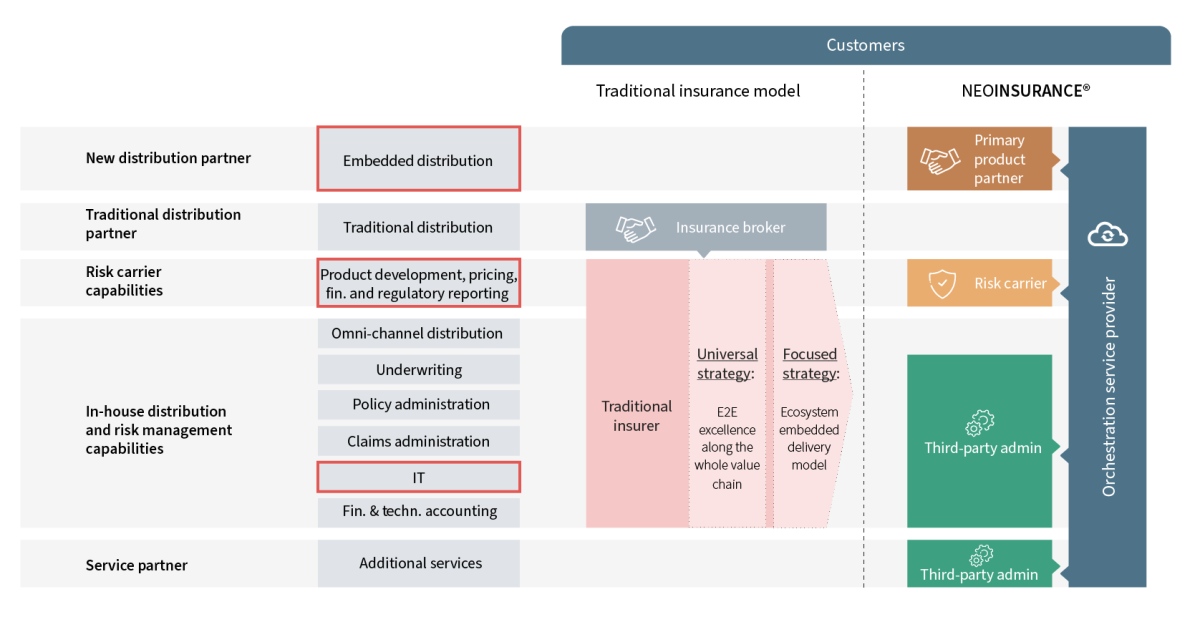

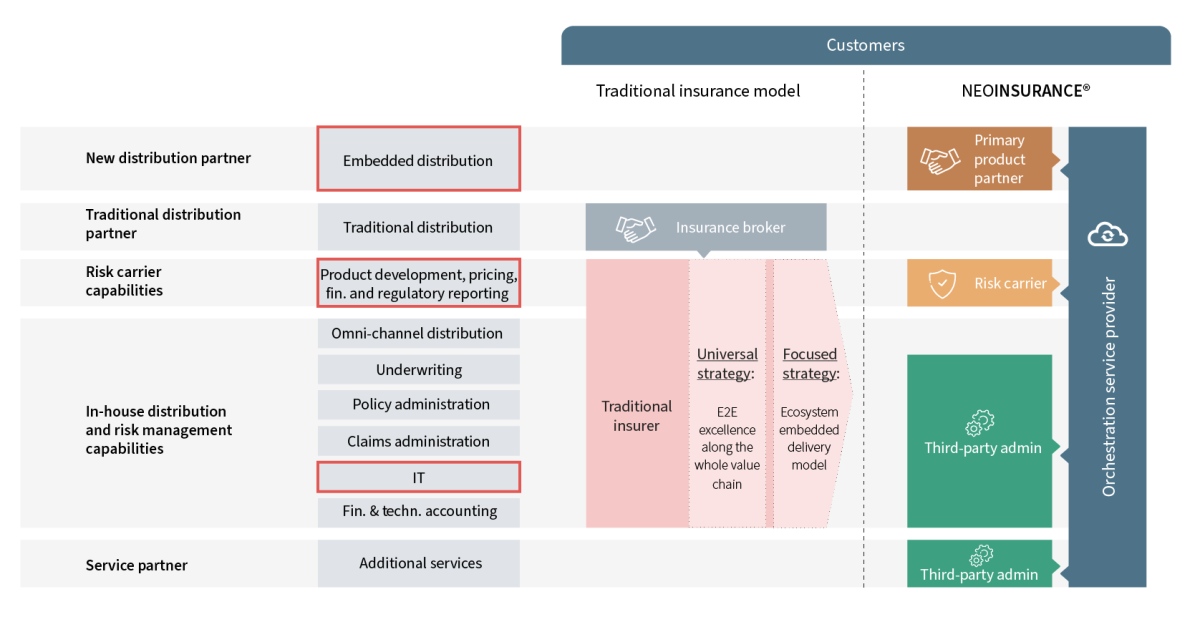

Having defined what a true embedded insurance offering looks like, you might ask yourself if there are actionable items to plan and execute such a proposition as an insurer or as new entrant in the insurance domain. We at Synpulse have developed a NEOINSURANCE® model that sheds light on how we believe the future state-of-the-art insurer will look like. It is built upon 7 core beliefs, each of which will help insurers to understand and navigate towards a future-proof proposition. In essence, the NEOINSURANCE® model states that the monolithic coverage of the value chain under one roof (traditional insurers) is no longer viable. Rather, segmenting the value chain across to specialised ecosystem players will provide end-customers with a higher value added and improve the customer experience.

The embedded insurance business model is one concrete application of the NEOINSURANCE® model:

Figure 3: The Synpulse NEOINSURANCE® model applied to an embedded insurance business model

The above outlines again that embedded insurance is significantly more than just a new distribution model. Importantly, an embedded insurance proposition needs to be developed holistically, starting with a clear vision and strategy of where and how to operate in the embedded insurance domain. Firstly, insurers must be fully aware which ecosystem role they want to play and hence which capabilities they want to keep in-house vs. source from external partners. The selection of strategic ecosystem partners – especially the primary product partner – is another important decision. One must also be aware that such an embedded insurance proposition bears specific operational and reputational risks, which must be managed properly.

Let’s deep dive into three parts of the partitioned value chain that outline key challenges insurers typically face when engaging on the embedded insurance playground:

Embedded distribution

In the embedded insurance model, the distribution of the insurance product is fully provided by the primary product partner. We have discussed this aspect in previous sections.

Product development

In embedded insurance, the insurance product needs to ultimately follow the primary product. Hence, the primary product will dictate the coverage required and the insurance purchase must have the same look and feel as the primary product. This requires the capability to co-create together with the primary product partner a common end customer proposition, perceived as one mold by the end customer. The insurer needs to upskill/reskill or source such capabilities and establish agile brand-servantship circles that are organised together with the primary product partner across company boundaries. This approach to product development is novel to traditional insurers that follow a predominantly self-contained approach.

IT

The insurance customer journey must seamlessly dock onto the customer journey of the primary product partner to “fuel” the insurance solution at the right time and in the right place at the point of sale as a one-stop shop experience for the end customer. This requires an advanced IT-technology stack based on an open, modular and microservices-driven architecture enabling full API-readiness.

Engaging in embedded insurance has significant consequences for the necessary IT capabilities of the insurer: the technical requirements for the customer interaction are driven by user experience of the product partner and its look and feel, which must be adopted by the insurance purchase experience. Modern cloud-native insurance core systems provide a significant advantage in this context.

Martin Frick, former CTO Companjon

How Synpulse can help to define, setup and operate a holistic TOM for a true embedded insurance proposition

Synpulse is your strategic embedded insurance partner. We offer consulting and technology services to insurance companies worldwide, including the Embedded Insurance Target Operating Model (TOM)®, Embedded Insurance Product, and Pricing Model®, Embedded Insurance Capability Model®, and Embedded Insurance Architecture Blueprints® among other.

Further we maintain non-commercial relationships with key embedded insurance enablers, such as leading insurtechs that provide the technology platform to successfully launch and operate a truly embedded insurance proposition. We maintain a comprehensive Embedded Insurance Market Radar® about suitable embedded insurance platform providers and MGAs that can help you to find the right enabling partners.

Please contact us if you would like to embark on your individual embedded insurance journey with us.

Meet our guest author Martin Frick, former CTO at Companjon! You can reach out to Martin Frick to schedule a conversation.

Embedded insurance seamlessly integrates insurance solutions into the customer journey of primary product partners, offering customer-centric coverages at the point of purchase through advanced technology. In this article, Synpulse, an early adopter of this model, aims to clearly distinguish it from other insurance distribution models.

The concept of embedded insurance has its roots in co-operations between insurers and product partners, such as retailers, OEMs, banks, digital marketplaces, or any other primary product partner that owns the customer interface. In recent years, the concept has evolved into a sophisticated, technology-driven business domain for insurers. Digitisation and interconnectivity technologies play a crucial role in transforming traditional insurance into an embedded part of the customer journey of a primary product partner, offering seamless and customer-centric insurance coverage at the point of purchase of the primary product. As the digital landscape continues to evolve, embedded insurance is likely to become even more pervasive and enter our everyday transactions. Alongside its growth in popularity, we observe that there is some uncertainty in the market about what an embedded insurance business model looks like and how it distinguishes itself from other insurance models, such as affinity, direct or integrated insurance.

Synpulse is an early mover in the field of embedded insurance as we saw this approach to deliver insurance services as a strategic lighthouse since its very beginnings and have a profound range of experience from many successfully delivered embedded insurance projects. By leveraging this ample experience, we would like to shed light in this article on what embedded insurance really means and describe its key characteristics and the differentiating factors compared to other insurance business models.

Definition of embedded insurance

The core of embedded insurance is the seamless embedding of insurance products and services into the purchasing journey of a non-insurance product or service, the primary product. Thus, embedded insurance is a B2B2X business model. Embedded insurance products enable third-party service providers (primary product partners) to embed relevant insurance solutions at the point of sale of the primary product or service, providing convenience and immediate coverage without requiring a separate transaction – a one-stop-shop experience for the end customer. Hence, from the perspective of the insurer, embedded insurance is more than an alternate distribution channel; it is a commitment to change how insurance products are produced and experienced. A more traditional insurance offering with an insurance-centric and line-of-business oriented paradigm gets transformed into an embedded solution with customer-centric and lifestyle-oriented focus.

The following key features define embedded insurance:

- Native component of the primary product: The insurance coverage is seamlessly embedded into the customer’s purchase journey of non-insurance products, goods and services as:

- An inherent feature of the primary product or

- An opt-in/opt out feature or

- An add-on feature or

- A feature of a membership model

- Proximity to the primary product’s core value proposition: Embedded insurance enhances the core offering of the primary product, good or service by providing added value through insurance coverage.

- White labelling: The insurance proposition is sold under the brand of the primary product.

- Customer interaction owned by primary product partner: The customer journey and the interaction with the end customer also for the insurance coverage is no longer owned by insurance but by the primary product partner.

- Distributed by non-insurance primary product partners: The insurance coverage is distributed by a primary product partner, such as OEMs, telcos, retailers, mobility providers, digital marketplaces. Thus, insurers can leverage the primary product partners’ large customer base and data.

- Leverage product partner’s customer data: The insurer utilises extensive customer data available through the primary product partner to design and tailor personalised insurance solutions.

- Use of appropriate technology solutions: The technology solution used to bridge the spatial and temporal gap between the insurer and the point of sale enables a one-stop-shop experience.

For embedded insurance, the end customer relationship is not owned by the insurer but by the primary product partner. The insurer, however, can take advantage of this customer relationship with an embedded proposition. The primary product partners are keen to retain full control of their customer relationship and therefore co-operative solutions need to be found to embed the insurance solution into that customer relationship at the right place and at the right time, without impacting the existing primary product customer journey.

Martin Frick, former CTO Companjon

Figure 1: Insurance business models

Figure 1 depicts the evolution of embedded insurance along two dimensions: product evolution and distribution channel. From traditional insurance all the way to a seamlessly embedded insurance proposition enabled by the digital transformation of the industry, which facilitates embedding of insurance products into primary product customer journeys. This proposition requires a simplified insurance product structure, a close integration of the core insurance value chain into one of the primary products, and a suitable open, modular, and omni-speed technical architecture on the insurer’s side. The latter is necessary to integrate the insurance coverage part of the customer journey into the original look and feel of the end-customers’ experience at the point of sale. Only then is the insurance product a truly native component of the primary product.

At first sight the above categorisation of the different insurance models might be straightforward but let us go beyond the two dimensions product evolution and distribution channel. Table 1 maps the key features of embedded insurance to the different distribution models facilitating a clear definition of a true product offering.

Table 1: Insurance business models and key characteristics

The characterisation of the insurance models from Table 1 is illustrated with examples in Figure 2 (except traditional insurance which is not the focus of this article).

Figure 2: Typical samples for each insurance model

Key success factors of an embedded insurance proposition

Having defined what a true embedded insurance offering looks like, you might ask yourself if there are actionable items to plan and execute such a proposition as an insurer or as new entrant in the insurance domain. We at Synpulse have developed a NEOINSURANCE® model that sheds light on how we believe the future state-of-the-art insurer will look like. It is built upon 7 core beliefs, each of which will help insurers to understand and navigate towards a future-proof proposition. In essence, the NEOINSURANCE® model states that the monolithic coverage of the value chain under one roof (traditional insurers) is no longer viable. Rather, segmenting the value chain across to specialised ecosystem players will provide end-customers with a higher value added and improve the customer experience.

The embedded insurance business model is one concrete application of the NEOINSURANCE® model:

Figure 3: The Synpulse NEOINSURANCE® model applied to an embedded insurance business model

The above outlines again that embedded insurance is significantly more than just a new distribution model. Importantly, an embedded insurance proposition needs to be developed holistically, starting with a clear vision and strategy of where and how to operate in the embedded insurance domain. Firstly, insurers must be fully aware which ecosystem role they want to play and hence which capabilities they want to keep in-house vs. source from external partners. The selection of strategic ecosystem partners – especially the primary product partner – is another important decision. One must also be aware that such an embedded insurance proposition bears specific operational and reputational risks, which must be managed properly.

Let’s deep dive into three parts of the partitioned value chain that outline key challenges insurers typically face when engaging on the embedded insurance playground:

Embedded distribution

In the embedded insurance model, the distribution of the insurance product is fully provided by the primary product partner. We have discussed this aspect in previous sections.

Product development

In embedded insurance, the insurance product needs to ultimately follow the primary product. Hence, the primary product will dictate the coverage required and the insurance purchase must have the same look and feel as the primary product. This requires the capability to co-create together with the primary product partner a common end customer proposition, perceived as one mold by the end customer. The insurer needs to upskill/reskill or source such capabilities and establish agile brand-servantship circles that are organised together with the primary product partner across company boundaries. This approach to product development is novel to traditional insurers that follow a predominantly self-contained approach.

IT

The insurance customer journey must seamlessly dock onto the customer journey of the primary product partner to “fuel” the insurance solution at the right time and in the right place at the point of sale as a one-stop shop experience for the end customer. This requires an advanced IT-technology stack based on an open, modular and microservices-driven architecture enabling full API-readiness.

Engaging in embedded insurance has significant consequences for the necessary IT capabilities of the insurer: the technical requirements for the customer interaction are driven by user experience of the product partner and its look and feel, which must be adopted by the insurance purchase experience. Modern cloud-native insurance core systems provide a significant advantage in this context.

Martin Frick, former CTO Companjon

How Synpulse can help to define, setup and operate a holistic TOM for a true embedded insurance proposition

Synpulse is your strategic embedded insurance partner. We offer consulting and technology services to insurance companies worldwide, including the Embedded Insurance Target Operating Model (TOM)®, Embedded Insurance Product, and Pricing Model®, Embedded Insurance Capability Model®, and Embedded Insurance Architecture Blueprints® among other.

Further we maintain non-commercial relationships with key embedded insurance enablers, such as leading insurtechs that provide the technology platform to successfully launch and operate a truly embedded insurance proposition. We maintain a comprehensive Embedded Insurance Market Radar® about suitable embedded insurance platform providers and MGAs that can help you to find the right enabling partners.

Please contact us if you would like to embark on your individual embedded insurance journey with us.

Meet our guest author Martin Frick, former CTO at Companjon! You can reach out to Martin Frick to schedule a conversation.