Loading Insight...

Insights

Insights

Many life and commercial insurers have yet to embrace generative AI, despite its benefits. This topic often elicits tension amongst agents, who may feel uncertain about the impact AI will have on their role, workflow, and relationships with clients. This need not be the case, however. AI can support agents by enhancing customer value, improving advice quality, reducing their administrative workload, and speeding up the sales process.

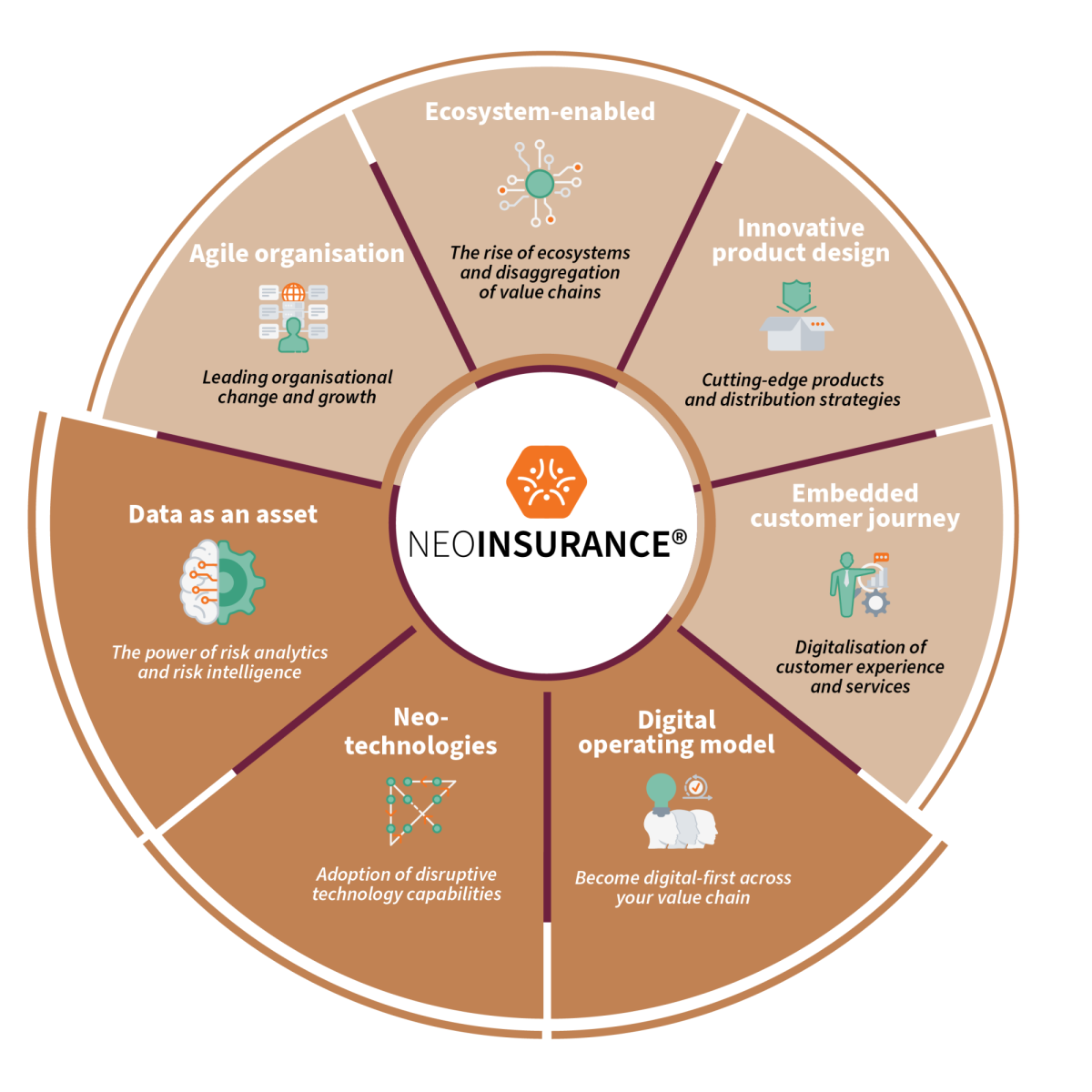

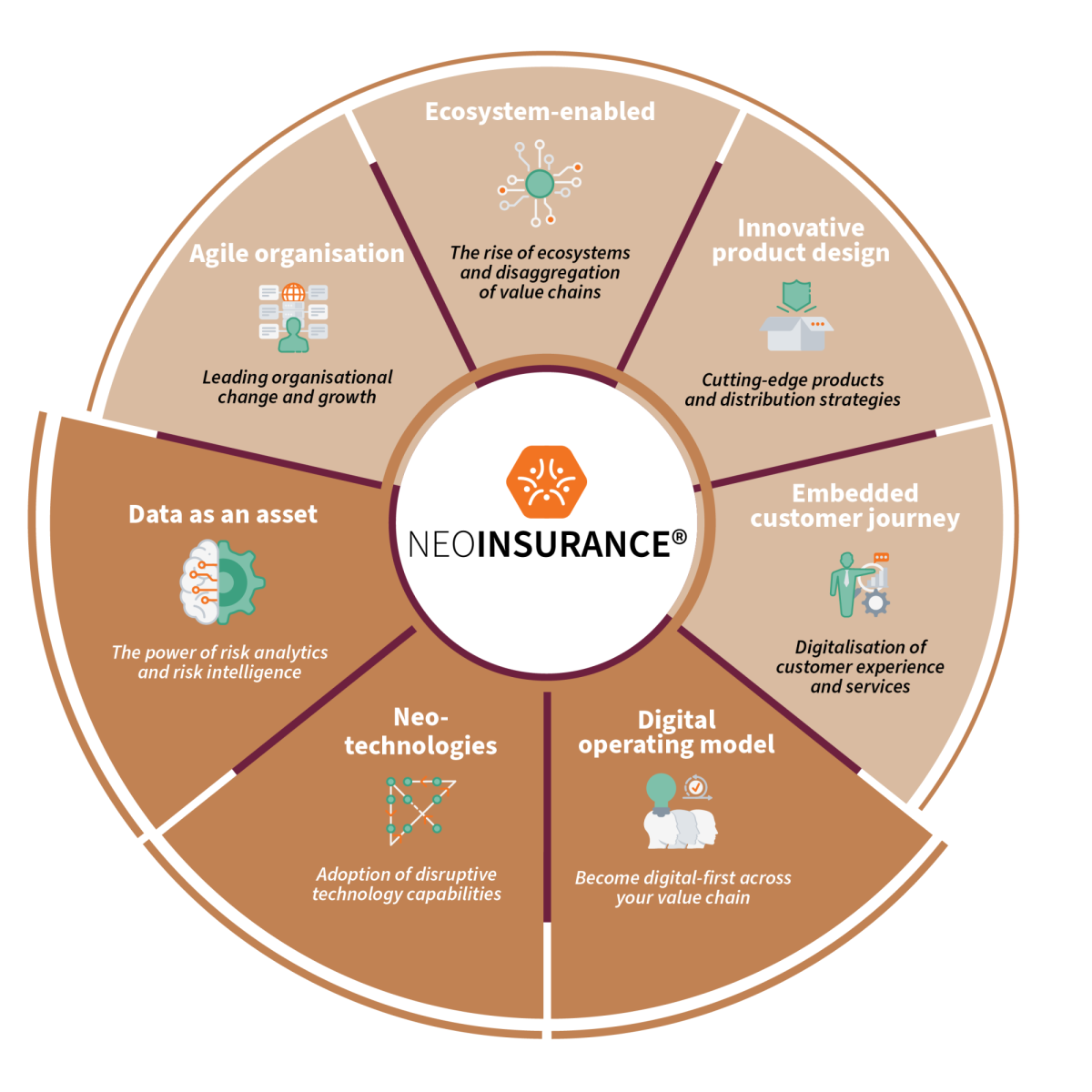

The transformative potential of AI in the life insurance industry, particularly in enhancing the roles of advisors, aligns closely with three of our NEOINSURANCE® Core Beliefs: Digital operating model, Data as an asset, and Neo-technologies, representing a pivotal aspect of our NEOINSURANCEINABOX® service portfolio, driving transformative and sustainable change and growth (refer to Figure 1). You can find out more about our core beliefs in our NEOINSURANCE® Whitepaper 2.0.

Figure 1: NEOINSURANCEINABOX®

Intermediaries and AI must be complementary, not combative

Despite significant technological advancements over the past decade, such as digital transformation initiatives and improved direct sales processes, Synpulse[1] and industry research[2] suggest that the proportion of life insurance sold directly remains relatively low. This holds true regardless of whether the sales channel is analogue or digital.

Customers do not simply wake up in the morning thinking they need life insurance. They must be persuaded or guided into purchasing life insurance by trusted advisors who understand their financial circumstances, risk tolerance, and personal preferences. Advisors play a crucial role in helping customers recognise their need for life insurance, selecting the most suitable policies based on their individual situations. Despite the growing trend of online sales, evidenced by 40% of policies being sold directly online in Singapore in 2022, these online transactions only account for roughly 3% of the total weighted new business premium.[3]

Small-to-medium enterprises (SMEs) are heavily reliant on their broker to understand their potential business liabilities and which insurance products would be most appropriate for their business scenarios. This broad segment of SME insurance is heavily intermediated, with non-tied brokers expected to understand the full product suite for carriers, create cross-selling and up-selling opportunities, and drive revenue.

This provides an opportunity to carriers; if intermediaries’ advice drives the bulk of new business premium, what tools can be provided to advisors to maximise their selling efficiency?

Improving productivity with AI-guided financial advisors

Advisors add the most value when they analyse customer needs in relation to the available products from insurance carriers. AI that enhances the quality of this matching process and supports intermediaries in engaging with clients can enhance the value proposition for customers.

New life advisors are frequently entrusted with understanding client needs, yet they often lack familiarity with the complete range of basic products, let alone experience in regulatory authorisation to match customer needs with investment-linked products.

Likewise, new brokers may possess in-depth knowledge of certain aspects of their insurance products. However, comprehending the varied needs of businesses within the SME category, along with carrier-specific terms and conditions, riders, and exclusions, proves challenging to manage. This complexity is further compounded when considering the multitude of firms offering coverage and the extensive range of available products.

Providing advisors with a tool that aligns customer needs with the carrier's product suite can significantly accelerate sales onboarding and boost productivity for intermediaries. It can also expose advisors to additional products suitable for their clients while maintaining an auditable log of compliant recommendations and talking points for both regulatory verification and customer information.

By integrating AI-driven data analysis and advice into the advisory journey, carriers can expand the range of sales-viable products for intermediaries and enhance customers' exposure to the full suite of available financial solutions. This includes the potential for case sharing between securities-licenced and non-securities-licenced intermediaries. Additionally, this approach allows advisors to focus on nurturing and developing their client relationships, thereby honing their irreplaceable personalised touch.

Empowering insurance intermediaries with an augmented workforce

By leveraging AI to augment their intermediaries, insurers can enhance the strengths of their advisors, enabling them to perform at their peak. This approach accelerates the product advisory learning process for new agents and frees up established advisors from operational or administrative tasks, allowing them to focus on what they do best.

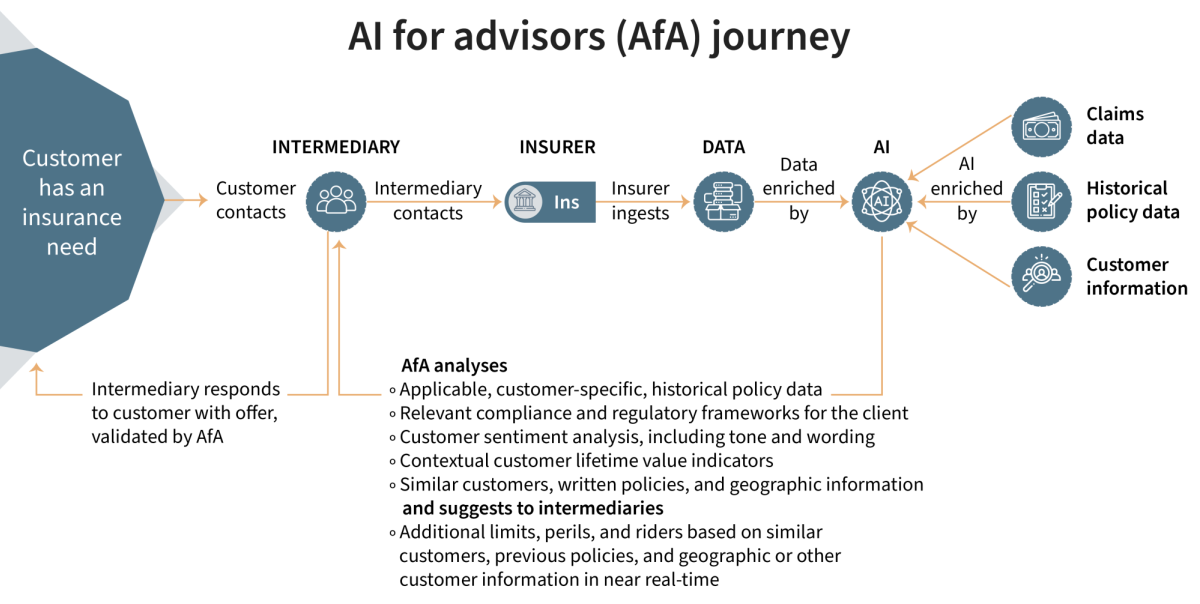

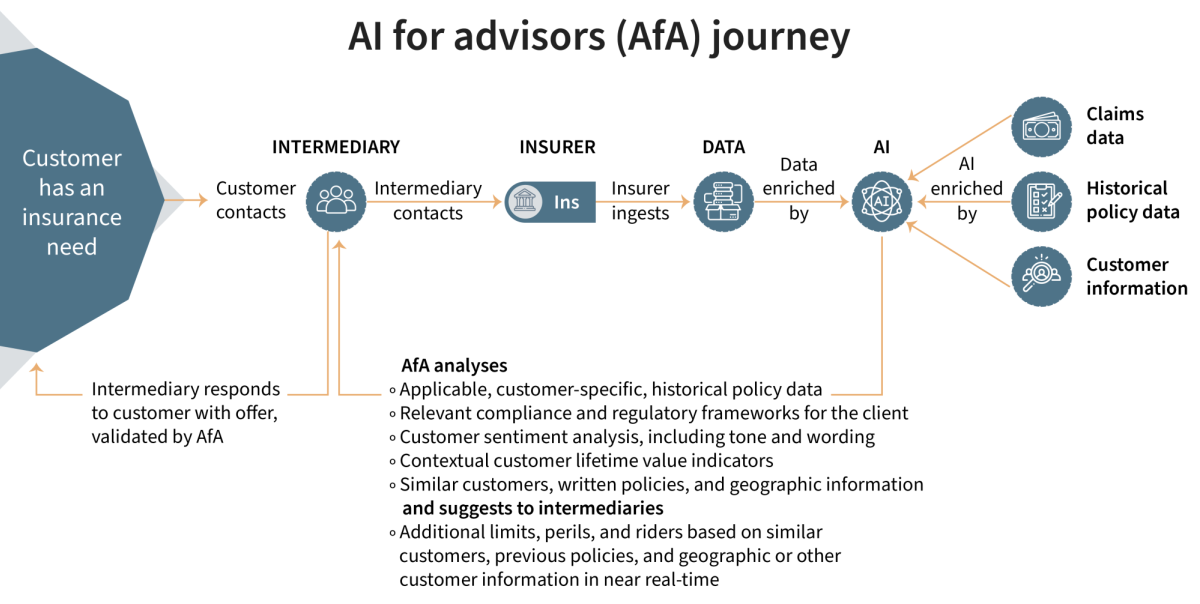

Figure 2: Sample AI for advisors journey in new business context

Consider a new life insurance agent meeting their first client. Despite having regulatory authority to sell a full range of products, the agent is cautious about recommending products they do not fully understand, especially to friends and family. Using the carrier’s AI-powered financial needs analysis (FNA) tool, the agent inputs client information. The AI then suggests suitable, compliant products, provides talking points to explain the recommendations, and offers summaries with citations from product disclosure materials. Initially intending to sell a low-premium term life plan, the agent, guided by the AI tool, recommends a whole life product better suited to the client’s needs and successfully makes the sale.

Alternatively, consider a new broker discussing coverage options with a client opening a new bakery. The client, having experienced industry disruption from COVID, is focused on business interruption coverage. However, the broker is inexperienced and not fully aware of the available products. They request a quote from a carrier with an integrated AI recommendation tool. Based on the carrier’s experience with similar businesses, the AI engine suggests additional coverage options. This enables the broker to provide comprehensive advice, which the client greatly values. As a result, the broker secures additional coverage, receives referrals to other business owners, and the carrier becomes the preferred source for future quotes due to the AI support.

This is supported by the evolving distribution models in insurance. While customers are open to digital purchases, they prefer personal advice, especially in complex scenarios[4] (IVW Trendmonitor). Synpulse’s research reinforces this, showing that it’s not just about multichannel customer engagement but also highlights a dilemma for insurers. As Synpulse Managing Partner and Head of Global Insurance Practice, Silvan Stüssi, noted in response to a question by elipsLife[5] regarding challenges in insurance placement:

Customers want tailored products and personal advice, but they are often unwilling or unable to pay for them.

Silvan Stüssi, Managing Partner and Global Head of Insurance

Synpulse’s network of ecosystem and technology partners enables the implementation of such scenarios today. For instance, Synpulse has previously deployed solutions to process diverse customer data, categorise risk profiles, and provide underwriting recommendations. These solutions, utilising machine learning, adapt and refine over time based on usage and behavioral feedback.

By intelligently designing the user interface, carriers can enhance the capabilities of their sales workforce or channels, fostering stronger relationships with intermediaries and customers. This stimulates demand for additional AI augmentation use cases, freeing business developers to focus on non-automatable elements, shortening sales cycles, and ultimately driving additional revenue.

Transforming distribution strategies and unlocking potential

Synpulse specialises in enhancing distribution strategies through AI, with extensive experience in all insurance lines spread across both our management consulting and technology capabilities – including a dedicated, global Data and Artificial Intelligence practice. Our expertise enables carriers to amplify their sales teams' capabilities effectively, offering concrete assets, capabilities, and partnerships to deliver multiple business benefits, including specialized technology support from our technology powerhouse, Synpulse8. Our market radar accelerates partner selection, while our assessment frameworks and target architecture blueprints help carriers define their desired end-state and necessary technological infrastructure. With a global footprint, Synpulse implements solutions with local resources, leveraging deep expertise in life, health, property and casualty, and reinsurance across various geographies.

This extensive experience allows us to guide organisations in ideation, evaluation, and AI implementation to enhance intermediary and sales channel efficiency. AI, when properly integrated, can improve efficiency and drive premium growth by automating tasks better suited for systems, freeing human developers to focus on sales. Synpulse has a proven track record of operationalizing AI to achieve these goals. As practical partners focused on the financial services industry, we deliver real business value.

If you're looking to harness AI to augment your advisors’ capabilities, we'd love to discuss your needs and goals. Please reach out to Matthias Blum or Jason Amayun to schedule a conversation.

- Life Insurance Online Studie (Synpulse, 2024)

- Facts + Statistics: Distribution channels (Insurance Information Institute)

- More buying life insurance online, but agents still preferred: LIA (The Business Times, 2022)

- Versicherungsvertrieb (Universität St. Gallen, 2023)

- The future of insurance is hybrid (elipsLife, 2024)

Many life and commercial insurers have yet to embrace generative AI, despite its benefits. This topic often elicits tension amongst agents, who may feel uncertain about the impact AI will have on their role, workflow, and relationships with clients. This need not be the case, however. AI can support agents by enhancing customer value, improving advice quality, reducing their administrative workload, and speeding up the sales process.

The transformative potential of AI in the life insurance industry, particularly in enhancing the roles of advisors, aligns closely with three of our NEOINSURANCE® Core Beliefs: Digital operating model, Data as an asset, and Neo-technologies, representing a pivotal aspect of our NEOINSURANCEINABOX® service portfolio, driving transformative and sustainable change and growth (refer to Figure 1). You can find out more about our core beliefs in our NEOINSURANCE® Whitepaper 2.0.

Figure 1: NEOINSURANCEINABOX®

Intermediaries and AI must be complementary, not combative

Despite significant technological advancements over the past decade, such as digital transformation initiatives and improved direct sales processes, Synpulse[1] and industry research[2] suggest that the proportion of life insurance sold directly remains relatively low. This holds true regardless of whether the sales channel is analogue or digital.

Customers do not simply wake up in the morning thinking they need life insurance. They must be persuaded or guided into purchasing life insurance by trusted advisors who understand their financial circumstances, risk tolerance, and personal preferences. Advisors play a crucial role in helping customers recognise their need for life insurance, selecting the most suitable policies based on their individual situations. Despite the growing trend of online sales, evidenced by 40% of policies being sold directly online in Singapore in 2022, these online transactions only account for roughly 3% of the total weighted new business premium.[3]

Small-to-medium enterprises (SMEs) are heavily reliant on their broker to understand their potential business liabilities and which insurance products would be most appropriate for their business scenarios. This broad segment of SME insurance is heavily intermediated, with non-tied brokers expected to understand the full product suite for carriers, create cross-selling and up-selling opportunities, and drive revenue.

This provides an opportunity to carriers; if intermediaries’ advice drives the bulk of new business premium, what tools can be provided to advisors to maximise their selling efficiency?

Improving productivity with AI-guided financial advisors

Advisors add the most value when they analyse customer needs in relation to the available products from insurance carriers. AI that enhances the quality of this matching process and supports intermediaries in engaging with clients can enhance the value proposition for customers.

New life advisors are frequently entrusted with understanding client needs, yet they often lack familiarity with the complete range of basic products, let alone experience in regulatory authorisation to match customer needs with investment-linked products.

Likewise, new brokers may possess in-depth knowledge of certain aspects of their insurance products. However, comprehending the varied needs of businesses within the SME category, along with carrier-specific terms and conditions, riders, and exclusions, proves challenging to manage. This complexity is further compounded when considering the multitude of firms offering coverage and the extensive range of available products.

Providing advisors with a tool that aligns customer needs with the carrier's product suite can significantly accelerate sales onboarding and boost productivity for intermediaries. It can also expose advisors to additional products suitable for their clients while maintaining an auditable log of compliant recommendations and talking points for both regulatory verification and customer information.

By integrating AI-driven data analysis and advice into the advisory journey, carriers can expand the range of sales-viable products for intermediaries and enhance customers' exposure to the full suite of available financial solutions. This includes the potential for case sharing between securities-licenced and non-securities-licenced intermediaries. Additionally, this approach allows advisors to focus on nurturing and developing their client relationships, thereby honing their irreplaceable personalised touch.

Empowering insurance intermediaries with an augmented workforce

By leveraging AI to augment their intermediaries, insurers can enhance the strengths of their advisors, enabling them to perform at their peak. This approach accelerates the product advisory learning process for new agents and frees up established advisors from operational or administrative tasks, allowing them to focus on what they do best.

Figure 2: Sample AI for advisors journey in new business context

Consider a new life insurance agent meeting their first client. Despite having regulatory authority to sell a full range of products, the agent is cautious about recommending products they do not fully understand, especially to friends and family. Using the carrier’s AI-powered financial needs analysis (FNA) tool, the agent inputs client information. The AI then suggests suitable, compliant products, provides talking points to explain the recommendations, and offers summaries with citations from product disclosure materials. Initially intending to sell a low-premium term life plan, the agent, guided by the AI tool, recommends a whole life product better suited to the client’s needs and successfully makes the sale.

Alternatively, consider a new broker discussing coverage options with a client opening a new bakery. The client, having experienced industry disruption from COVID, is focused on business interruption coverage. However, the broker is inexperienced and not fully aware of the available products. They request a quote from a carrier with an integrated AI recommendation tool. Based on the carrier’s experience with similar businesses, the AI engine suggests additional coverage options. This enables the broker to provide comprehensive advice, which the client greatly values. As a result, the broker secures additional coverage, receives referrals to other business owners, and the carrier becomes the preferred source for future quotes due to the AI support.

This is supported by the evolving distribution models in insurance. While customers are open to digital purchases, they prefer personal advice, especially in complex scenarios[4] (IVW Trendmonitor). Synpulse’s research reinforces this, showing that it’s not just about multichannel customer engagement but also highlights a dilemma for insurers. As Synpulse Managing Partner and Head of Global Insurance Practice, Silvan Stüssi, noted in response to a question by elipsLife[5] regarding challenges in insurance placement:

Customers want tailored products and personal advice, but they are often unwilling or unable to pay for them.

Silvan Stüssi, Managing Partner and Global Head of Insurance

Synpulse’s network of ecosystem and technology partners enables the implementation of such scenarios today. For instance, Synpulse has previously deployed solutions to process diverse customer data, categorise risk profiles, and provide underwriting recommendations. These solutions, utilising machine learning, adapt and refine over time based on usage and behavioral feedback.

By intelligently designing the user interface, carriers can enhance the capabilities of their sales workforce or channels, fostering stronger relationships with intermediaries and customers. This stimulates demand for additional AI augmentation use cases, freeing business developers to focus on non-automatable elements, shortening sales cycles, and ultimately driving additional revenue.

Transforming distribution strategies and unlocking potential

Synpulse specialises in enhancing distribution strategies through AI, with extensive experience in all insurance lines spread across both our management consulting and technology capabilities – including a dedicated, global Data and Artificial Intelligence practice. Our expertise enables carriers to amplify their sales teams' capabilities effectively, offering concrete assets, capabilities, and partnerships to deliver multiple business benefits, including specialized technology support from our technology powerhouse, Synpulse8. Our market radar accelerates partner selection, while our assessment frameworks and target architecture blueprints help carriers define their desired end-state and necessary technological infrastructure. With a global footprint, Synpulse implements solutions with local resources, leveraging deep expertise in life, health, property and casualty, and reinsurance across various geographies.

This extensive experience allows us to guide organisations in ideation, evaluation, and AI implementation to enhance intermediary and sales channel efficiency. AI, when properly integrated, can improve efficiency and drive premium growth by automating tasks better suited for systems, freeing human developers to focus on sales. Synpulse has a proven track record of operationalizing AI to achieve these goals. As practical partners focused on the financial services industry, we deliver real business value.

If you're looking to harness AI to augment your advisors’ capabilities, we'd love to discuss your needs and goals. Please reach out to Matthias Blum or Jason Amayun to schedule a conversation.

- Life Insurance Online Studie (Synpulse, 2024)

- Facts + Statistics: Distribution channels (Insurance Information Institute)

- More buying life insurance online, but agents still preferred: LIA (The Business Times, 2022)

- Versicherungsvertrieb (Universität St. Gallen, 2023)

- The future of insurance is hybrid (elipsLife, 2024)