Loading Insight...

Insights

Insights

Staking is becoming a prominent focus in the ever-changing landscape of digital assets. It involves asset holders locking up their tokens as collateral to earn rewards through the validation of blockchain transactions, akin to earning interest through deposits. This process not only enables the generation of additional passive income but also enhances client engagement. It represents an ideal progression in offering access to crypto assets through the facilitation of “buy, sell and custody”, aligning with Synpulse's digital asset banking roadmap for banks.

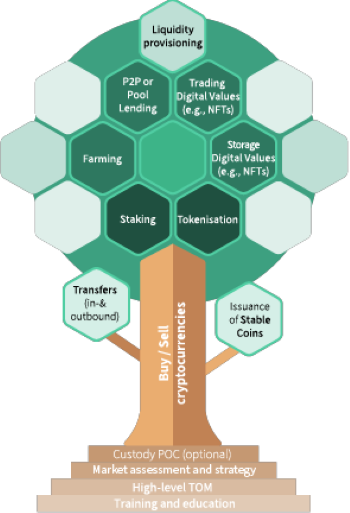

Our mission is to advise banks on how to enter and profit from the digital asset space. In order to do so, Synpulse has created a crypto roadmap for banks (fig. 1) to help educate and navigate them. With this series of articles, we will go step by step into the individual areas of the roadmap by looking into five different use cases following our strategic approach for banks:

- Strategical approach for banks (Introduction)

- Buy / Sell and custody of crypto assets

- Staking

- Lending

- Tokenization of non-bankable assets

- Digital values and NFTs

In this third article we are focusing on staking.

Fig 1: Synpulse use case tree

Staking offers up to 20% return and contributes to a more diversified investment strategy

Many investors already hold crypto assets and seek returns from them, much like they do with traditional interest-bearing or dividend-paying instruments. Staking offers a potential return of up to 20% on assets, surpassing what traditional investments typically provide. It's characterised by its absence of fixed maturity and offers short- to mid-term access to the underlying asset. Incorporating staked assets into an existing portfolio allows for a more diversified investment strategy, empowering banks to stand out and enabling clients to increase their portfolio performance.

Demand from investors for reliable intermediaries that can facilitate staking rises

The lack of staking services from trusted financial institutions forces investors to deal with a complex and uncertain landscape. Furthermore, potential participants are often deterred by concerns about the security of staking providers and protocols. Banks, as trusted financial intermediaries and custodians, are strategically positioned to address this entry barrier, enabling their clients and democratising the staking process.

We at Synpulse help you to establish an operating model enabling booking, settling, monitoring, and reporting of digital assets in a safe and efficient way right from the beginning. To learn more about our appoach click on the link below.

Staking leverages the bank's revenue streams and boosts client retention

By integrating staking into their service offering, banks can capture a significant slice—approximately 20-40%—of the revenue generated by client activities. Staking also offers the opportunity to enhance yields within a bank’s treasury management operations. As a result, this new service opens up new revenue streams and serves as a potent tool for customer retention. In fact, by offering staking services, banks simply follow the traditional logic of paying interest on deposits or assets entrusted to them.

As an additional benefit, financial institutions can bolster the appeal of their offerings through custody services and professional management, which affords clients an added layer of security and control. Options such as delegated staking or airdrops can serve as unique selling points, too.

Integrating staking leverages the existing custody infrastructure and is a logical next step in a bank’s digital asset offering

Banks that have already ventured into the digital asset space are well ahead of the curve. Many of the essential business and technical requirements for implementing staking services are already in place. This includes a comprehensive target operating model (TOM), certain approvals from regulatory bodies, definition of internal policies and the necessary technical infrastructure like wallet management systems and compatibility with primary blockchains and smart contracts.

A successful implementation opens the door to adopting additional digital asset use cases

Integrating staking allows a bank to add more advanced capabilities in the future. For example, business requirements like regular payouts of funds to clients and pooling capabilities can be efficiently integrated, along with addressing soft factors like tax reporting. On the technical front, advances like object modelling for interest-bearing digital assets and strategies for segregating client funds can be incorporated into existing systems. This opens the door for integrating use cases such as the tokenisation of assets traditionally inaccessible through banks, storage of digital values like NFTs, and digital asset lending.

Take the next step in your digital asset journey

Ready to unlock staking's full potential? Contact us today to integrate this powerful use case into your digital asset offering and create a more comprehensive, profitable, and secure experience for your customers.

This is the third part of our article series. Stay tuned and don't miss the upcoming ones or contact us directly to discuss your digital assets roadmap. The next article will focus on lending.

Staking is becoming a prominent focus in the ever-changing landscape of digital assets. It involves asset holders locking up their tokens as collateral to earn rewards through the validation of blockchain transactions, akin to earning interest through deposits. This process not only enables the generation of additional passive income but also enhances client engagement. It represents an ideal progression in offering access to crypto assets through the facilitation of “buy, sell and custody”, aligning with Synpulse's digital asset banking roadmap for banks.

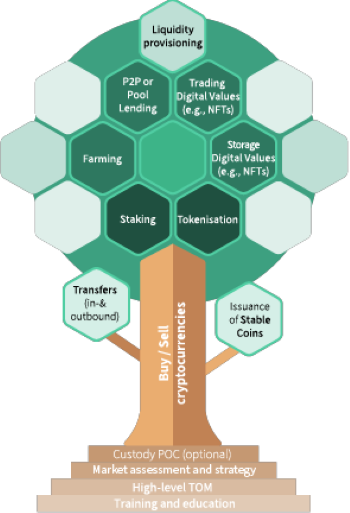

Our mission is to advise banks on how to enter and profit from the digital asset space. In order to do so, Synpulse has created a crypto roadmap for banks (fig. 1) to help educate and navigate them. With this series of articles, we will go step by step into the individual areas of the roadmap by looking into five different use cases following our strategic approach for banks:

- Strategical approach for banks (Introduction)

- Buy / Sell and custody of crypto assets

- Staking

- Lending

- Tokenization of non-bankable assets

- Digital values and NFTs

In this third article we are focusing on staking.

Fig 1: Synpulse use case tree

Staking offers up to 20% return and contributes to a more diversified investment strategy

Many investors already hold crypto assets and seek returns from them, much like they do with traditional interest-bearing or dividend-paying instruments. Staking offers a potential return of up to 20% on assets, surpassing what traditional investments typically provide. It's characterised by its absence of fixed maturity and offers short- to mid-term access to the underlying asset. Incorporating staked assets into an existing portfolio allows for a more diversified investment strategy, empowering banks to stand out and enabling clients to increase their portfolio performance.

Demand from investors for reliable intermediaries that can facilitate staking rises

The lack of staking services from trusted financial institutions forces investors to deal with a complex and uncertain landscape. Furthermore, potential participants are often deterred by concerns about the security of staking providers and protocols. Banks, as trusted financial intermediaries and custodians, are strategically positioned to address this entry barrier, enabling their clients and democratising the staking process.

We at Synpulse help you to establish an operating model enabling booking, settling, monitoring, and reporting of digital assets in a safe and efficient way right from the beginning. To learn more about our appoach click on the link below.

Staking leverages the bank's revenue streams and boosts client retention

By integrating staking into their service offering, banks can capture a significant slice—approximately 20-40%—of the revenue generated by client activities. Staking also offers the opportunity to enhance yields within a bank’s treasury management operations. As a result, this new service opens up new revenue streams and serves as a potent tool for customer retention. In fact, by offering staking services, banks simply follow the traditional logic of paying interest on deposits or assets entrusted to them.

As an additional benefit, financial institutions can bolster the appeal of their offerings through custody services and professional management, which affords clients an added layer of security and control. Options such as delegated staking or airdrops can serve as unique selling points, too.

Integrating staking leverages the existing custody infrastructure and is a logical next step in a bank’s digital asset offering

Banks that have already ventured into the digital asset space are well ahead of the curve. Many of the essential business and technical requirements for implementing staking services are already in place. This includes a comprehensive target operating model (TOM), certain approvals from regulatory bodies, definition of internal policies and the necessary technical infrastructure like wallet management systems and compatibility with primary blockchains and smart contracts.

A successful implementation opens the door to adopting additional digital asset use cases

Integrating staking allows a bank to add more advanced capabilities in the future. For example, business requirements like regular payouts of funds to clients and pooling capabilities can be efficiently integrated, along with addressing soft factors like tax reporting. On the technical front, advances like object modelling for interest-bearing digital assets and strategies for segregating client funds can be incorporated into existing systems. This opens the door for integrating use cases such as the tokenisation of assets traditionally inaccessible through banks, storage of digital values like NFTs, and digital asset lending.

Take the next step in your digital asset journey

Ready to unlock staking's full potential? Contact us today to integrate this powerful use case into your digital asset offering and create a more comprehensive, profitable, and secure experience for your customers.

This is the third part of our article series. Stay tuned and don't miss the upcoming ones or contact us directly to discuss your digital assets roadmap. The next article will focus on lending.