Loading Insight...

Insights

Insights

In recent years, the adoption of digital assets, including cryptocurrencies, has risen substantially, despite periodic price declines. There has been a notable increase in the portion of cryptocurrencies within investors' overall portfolios. This shift signifies a growing inclination towards utilising these digital currencies for investment.

Governments around the world are increasingly acknowledging digital assets, as evidenced by their progressively stricter regulatory initiatives across various jurisdictions. This trajectory towards establishing legal frameworks brings about a sense of assurance for both financial institutions and investors.

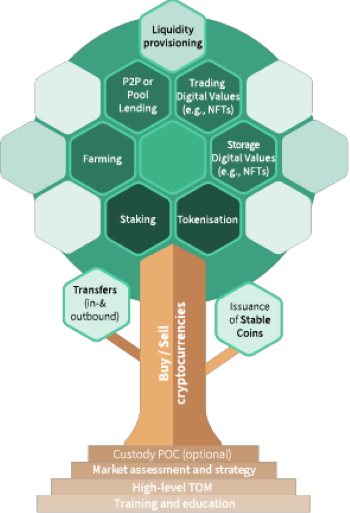

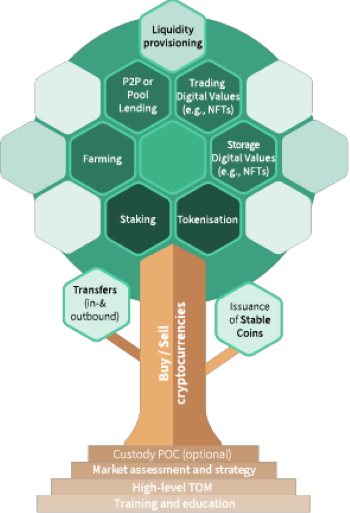

There are initial challenges that must be overcome to provide the full range of crypto use cases to bank customers. Our mission is to advise banks on how to enter and profit from the digital asset space. In order to do so, Synpulse has created a crypto roadmap for banks (fig. 1) to help educate and navigate them. With this series of articles, we will go step by step into the individual areas of the roadmap by looking into the following five different use cases:

- Buy / Sell and custody of crypto assets

- Staking

- Lending

- Tokenization of non-bankable assets

- Digital values and NFTs

20% of all Swiss banks meet investor demand by providing access to the new asset class of crypto assets

In Switzerland alone, more than 40 banks have either implemented or are in the process of implementing crypto-related products to address investor demand.

How do you approach such a product from a strategic standpoint? To learn more about this topic click on the link below.

Synpulse provides a market-validated roadmap for Swiss Banks that balances client value, return on investment as well as technical and regulatory dependencies

At Synpulse, our mission is to empower financial services companies to navigate the digital asset revolution and thrive in a decentralized financial ecosystem. We know from experience that an effective digital asset strategy and roadmap are essential to maximise customer value and return on investment while navigating technical and regulatory dependencies and considering a bank’s strategic direction.

We have evaluated digital asset use cases primarily focusing on business and technical requirements relevant to execution. In conjunction with banking clients’ needs and market demand, we have crafted a dedicated use case roadmap for banks designed to guide financial institutions on their journey into the world of digital assets.

Fig 1: Synpulse use case tree

Buying, selling, and storing crypto assets is the foundation of every digital asset product

The buy, sell, and custody use case provides clients access to the crypto asset class and sets the stage for the introduction of any subsequent offering due to high client demand, the low infrastructural and regulatory requirements, and the dependencies on other use cases based on it. Our insights show that around 25 Swiss banks have already implemented a related product offering by Q2 2023.

In addition, deposits and withdrawals of crypto assets are frequently implemented complementary to the buy, sell, and custody use case, especially to attract new funds already invested in crypto assets. This significantly improves the business case by attracting net new money in crypto assets or investing in traditional asset classes but requires consideration of additional AML regulations.

Further use cases can be implemented with relatively low effort, unlocking additional revenue potential

Upon successful implementation of the buy, sell, and custody use case, most of the prerequisites to expand a digital asset product offering with additional services are already met. Key challenges, such as the setup of custody and the supporting operating model have been addressed successfully. Moreover, the bank already gained initial experience that can be leveraged to create a more comprehensive offering. As a result, banks can smoothly incorporate additional use cases, presenting further extension options for their product offering:

- Staking: Allows clients and banks to generate income on crypto assets under custody.

- Lending: Provides clients with an opportunity to collateralize their crypto assets while the bank can hedge its risk exposure.

- Digital values / NFTs: Enables banks to leverage their traditional business expertise in safekeeping, valuing, and advising on luxury goods such as art, thereby providing added value to their clients.

- Tokenization of non-bankable assets: Unlocking additional opportunities for clients and banks alike by making non-bankable assets tradable as tokens, issuing them, or holding them in custody.

This is the first part of our new article series. Stay tuned and don't miss the upcoming ones or contact us directly to discuss your digital assets roadmap. The next article will focus on staking.

In recent years, the adoption of digital assets, including cryptocurrencies, has risen substantially, despite periodic price declines. There has been a notable increase in the portion of cryptocurrencies within investors' overall portfolios. This shift signifies a growing inclination towards utilising these digital currencies for investment.

Governments around the world are increasingly acknowledging digital assets, as evidenced by their progressively stricter regulatory initiatives across various jurisdictions. This trajectory towards establishing legal frameworks brings about a sense of assurance for both financial institutions and investors.

There are initial challenges that must be overcome to provide the full range of crypto use cases to bank customers. Our mission is to advise banks on how to enter and profit from the digital asset space. In order to do so, Synpulse has created a crypto roadmap for banks (fig. 1) to help educate and navigate them. With this series of articles, we will go step by step into the individual areas of the roadmap by looking into the following five different use cases:

- Buy / Sell and custody of crypto assets

- Staking

- Lending

- Tokenization of non-bankable assets

- Digital values and NFTs

20% of all Swiss banks meet investor demand by providing access to the new asset class of crypto assets

In Switzerland alone, more than 40 banks have either implemented or are in the process of implementing crypto-related products to address investor demand.

How do you approach such a product from a strategic standpoint? To learn more about this topic click on the link below.

Synpulse provides a market-validated roadmap for Swiss Banks that balances client value, return on investment as well as technical and regulatory dependencies

At Synpulse, our mission is to empower financial services companies to navigate the digital asset revolution and thrive in a decentralized financial ecosystem. We know from experience that an effective digital asset strategy and roadmap are essential to maximise customer value and return on investment while navigating technical and regulatory dependencies and considering a bank’s strategic direction.

We have evaluated digital asset use cases primarily focusing on business and technical requirements relevant to execution. In conjunction with banking clients’ needs and market demand, we have crafted a dedicated use case roadmap for banks designed to guide financial institutions on their journey into the world of digital assets.

Fig 1: Synpulse use case tree

Buying, selling, and storing crypto assets is the foundation of every digital asset product

The buy, sell, and custody use case provides clients access to the crypto asset class and sets the stage for the introduction of any subsequent offering due to high client demand, the low infrastructural and regulatory requirements, and the dependencies on other use cases based on it. Our insights show that around 25 Swiss banks have already implemented a related product offering by Q2 2023.

In addition, deposits and withdrawals of crypto assets are frequently implemented complementary to the buy, sell, and custody use case, especially to attract new funds already invested in crypto assets. This significantly improves the business case by attracting net new money in crypto assets or investing in traditional asset classes but requires consideration of additional AML regulations.

Further use cases can be implemented with relatively low effort, unlocking additional revenue potential

Upon successful implementation of the buy, sell, and custody use case, most of the prerequisites to expand a digital asset product offering with additional services are already met. Key challenges, such as the setup of custody and the supporting operating model have been addressed successfully. Moreover, the bank already gained initial experience that can be leveraged to create a more comprehensive offering. As a result, banks can smoothly incorporate additional use cases, presenting further extension options for their product offering:

- Staking: Allows clients and banks to generate income on crypto assets under custody.

- Lending: Provides clients with an opportunity to collateralize their crypto assets while the bank can hedge its risk exposure.

- Digital values / NFTs: Enables banks to leverage their traditional business expertise in safekeeping, valuing, and advising on luxury goods such as art, thereby providing added value to their clients.

- Tokenization of non-bankable assets: Unlocking additional opportunities for clients and banks alike by making non-bankable assets tradable as tokens, issuing them, or holding them in custody.

This is the first part of our new article series. Stay tuned and don't miss the upcoming ones or contact us directly to discuss your digital assets roadmap. The next article will focus on staking.