Loading Insight...

Insights

Insights

As the global economy becomes increasingly digitized, a solid data foundation for incumbent insurers is crucial to compete against insurtechs and new entrants.

The ecosystem imperative, as outlined in our recent NEOINSURANCE® whitepaper, has urged insurers to shift from a product-centric to a lifestyle-oriented approach. This means processing big data from IoT- and telematics-enabled devices, social media, and third parties and drawing out the right actionable decisions to become a truly data-driven organization – a key characteristic of a NEOINSURER®.

However, insurers often face challenges to make full use of and monetize this data, both within their own organization as well as across their ecosystem partners. This is due to inconsistent data structures and standards, cumbersome data access, and different regulatory requirements, as we have stated in the benchmark report of Synpulse in Actuarial Data Science.

Evolving data standards in the open insurance domain

Historically seen, insurers tend to develop their legacy systems inwardly with a closed IT application landscape to seal off against intruders, mergers, and acquisitions (M&A), and unfriendly takeovers. There was no need for data sharing, given that a big portion of the value chain was covered in-house. By contrast, nowadays, each NEOINSURER® performs a more specific role in a harmonized insurance value chain that is partitioned among a wide range of ecosystem players and reaches far beyond the insurance industry.

Traditional insurers run the risk of missing the ecosystem imperative. They must adapt to get connected to API marketplaces, acquire new data-driven business model opportunities, unleash their innovation potential, attract ecosystem partners, and make full use of their data. NEOINSURERS® should closely follow the ecosystem imperative and maximize their data monetization to drive greater success and better fulfill their roles in the open insurance domain.

As a starting point to solve data-related problems that stand in the way of fully exploiting opportunities of ecosystem-driven business models, Synpulse believes that true Open Insurance Data Standards (OPIS) will ensure that data will be readily available, reusable, interoperable, and generates monetizable data value.

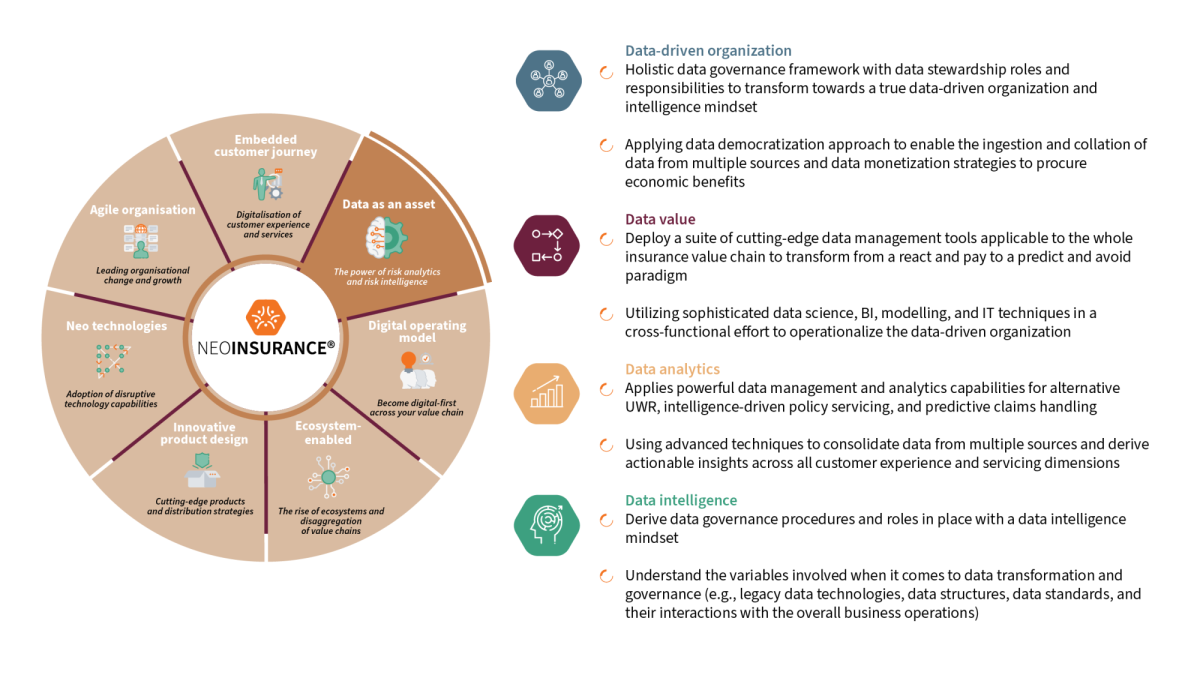

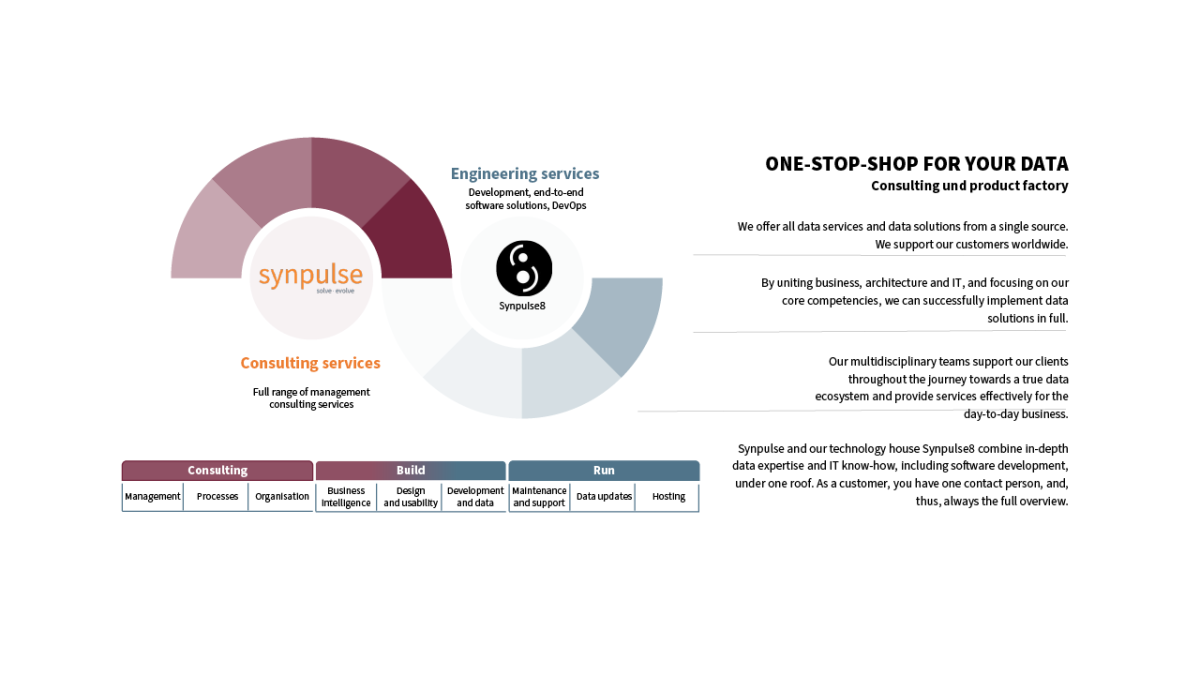

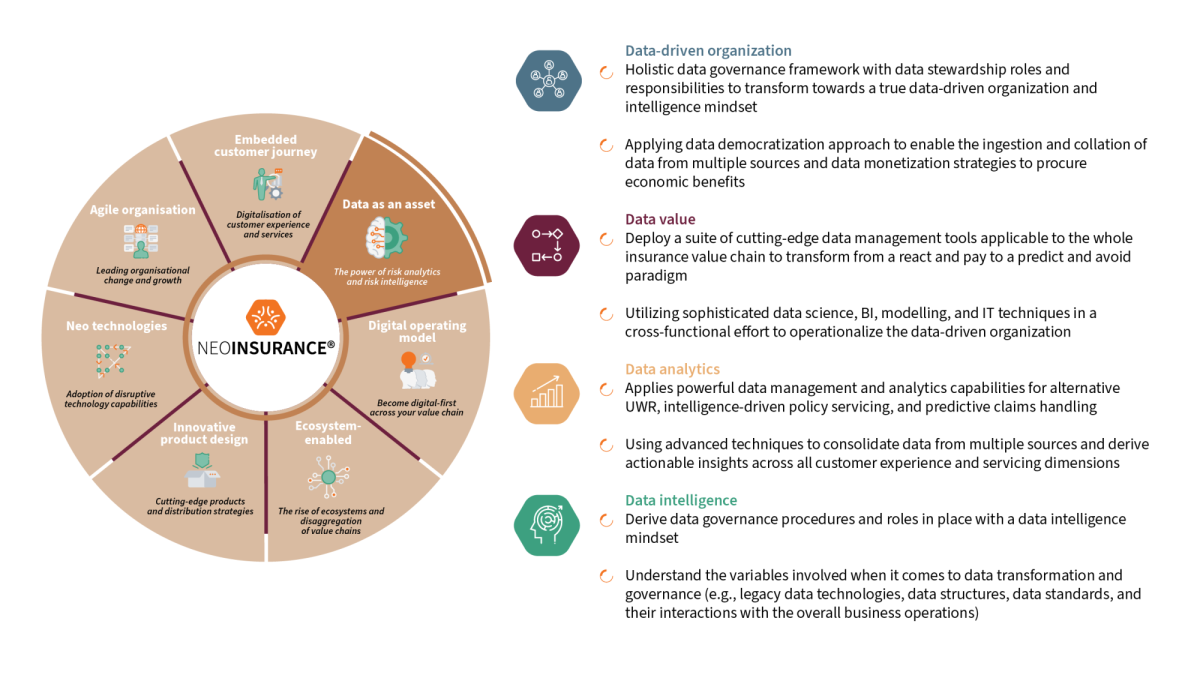

This article is part of the Data as an Asset core belief, one of the key elements within our NEOINSURANCEINABOX® solution (see Figure 1). We will introduce more components in the coming months, so stay tuned.

Figure 1: NEOINSURANCEINABOX® and Data management capabilities of a NEOINSURER®

What are Open Insurance Data Standards?

OPIS are documented, reusable agreements that help insurers publish, access, share, and use more standardized and advanced data quality. Each entity of insurance data, such as customer and business partners, products, policies, and claims, has corresponding OPIS guidelines, formats, and definitions that can be classified into three main standard components:

- Content. The meaning, interpretation, and of insurance data fields to ensure the data is well interpreted and used, including definitions (the definition of a gross premium rate), classifications (mapping claims to insurance products, such as motor and travel insurance), and properties (fields that are belonging to motor insurance and its descriptions).

- Structure. The specified schema and of data tables to ensure reusability, including the defined relations between tables, identifiers, and data types of the properties (e.g., date, integer, text).

- Interface. The required communication of data to ensure the safe exchange of data, including file formats (e.g., JSON, YAML, XML, CSV) and procedures on the data transfer (e.g., exchange with HTTP via web servers, FTP directly between computers, and SMTP via email), where standards are often directed at sharing data via an API, in which data with a JSON or YAML file format are exchanged using HTTP.

In all components, there is the regulatory impact that involves data governance, data principles, and data protection (e.g., GDPR regulation on data protection and privacy in the EU). This affects the content of data that can be shared, structuring the anonymised data and setting up the right interface to safely transfer the data.

How OPIS benefits insurers?

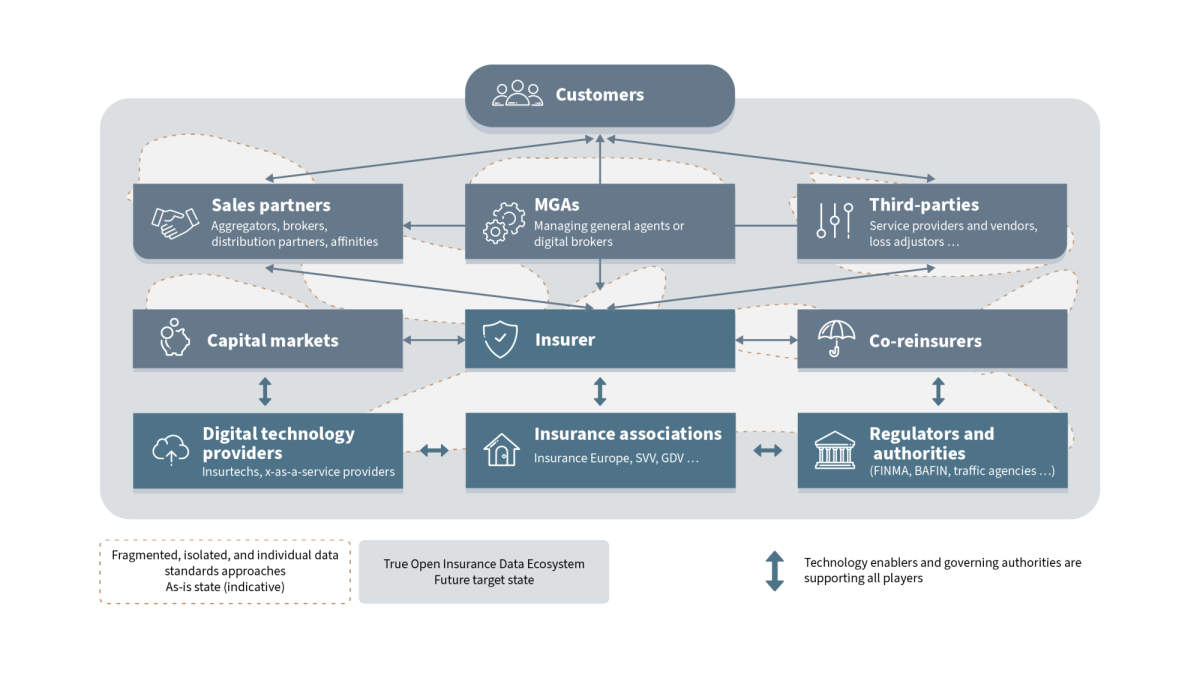

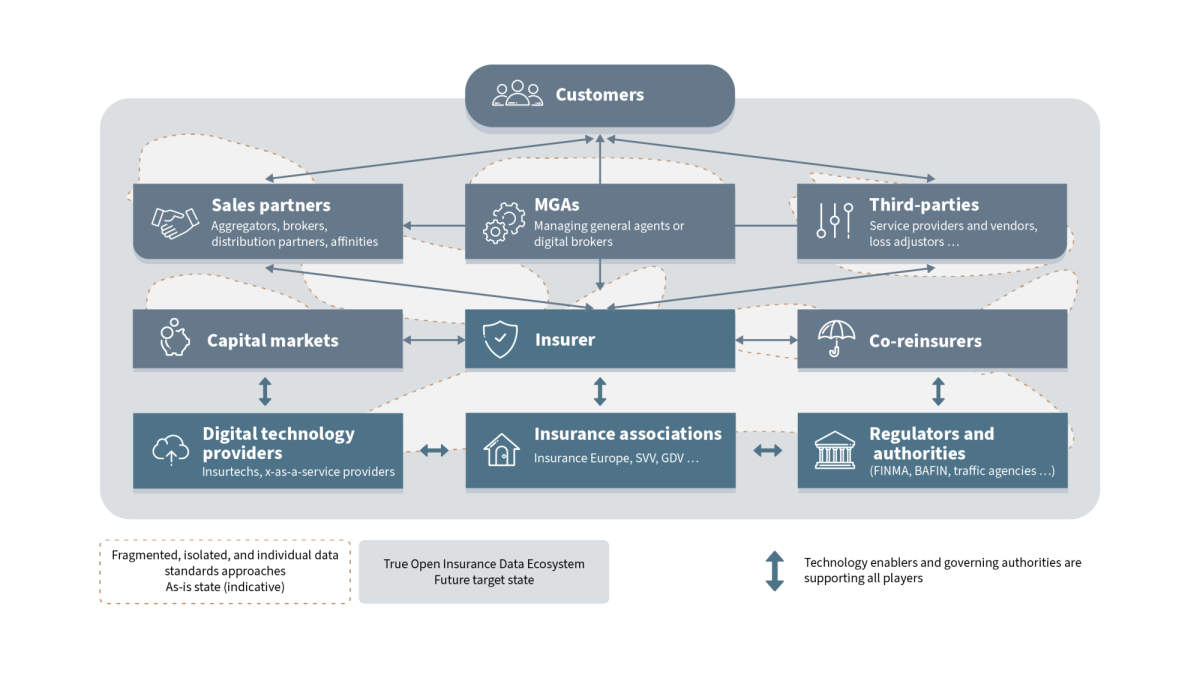

OPIS will address all standard components, leading to significant benefits for all players. At its core, insurers exchange information across the entire value chain through different interconnected and their customers (see Figure 2). It is vital that these insurance transactions are accomplished with timely and accurate data exchange.

There are existing initiatives on data standards that enhance the communications between (e.g., ISO policy standards and ACORD data standards for insurers and reinsurers), boost electronic data exchange between insurers and brokers (e.g., IG B2B) and enforce compliance of insurers by authority standards (e.g., the statutory requirement on third-party liability for motor vehicles). Still, many insurers face fragmented, isolated, and individual data standards. OPIS will enable flawless and efficient information flow between the insurers and all other players relevant to the insurance ecosystem.

As a result, OPIS will improve the efficiency of data exchange and enable process automation, reducing cost and time efforts and enhancing the offerings with faster and more innovative services. Customer experience will also be improved, as they can access better quality data and enjoy more consistent offerings.

Figure 2: Stakeholders of insurance-related data information exchange

OPIS enables progressive, data-driven business models, such as embedded insurance, which prerequisites the unhampered data exchange across multiple ecosystem partners. It also mutually complements their own offerings, as mentioned in our recent social media article Embedded Insurance: What Could Be Use Cases for Your Business?.

Insurers can further unlock the door to a wider range of new data-driven businesses in a true ecosystem and plug and play their value streams to the universal API economy, unleashing unprecedented data revenue potentials. They can also directly benefit from machine learning, analytical and dashboarding tools, and API marketplaces that are sharing the same standards. Moreover, these can generate immediate business revenue by implementing data-driven use cases, such as dynamic pricing, alternative underwriting, cross-selling or up-selling, and claims handling.

OPIS success criteria

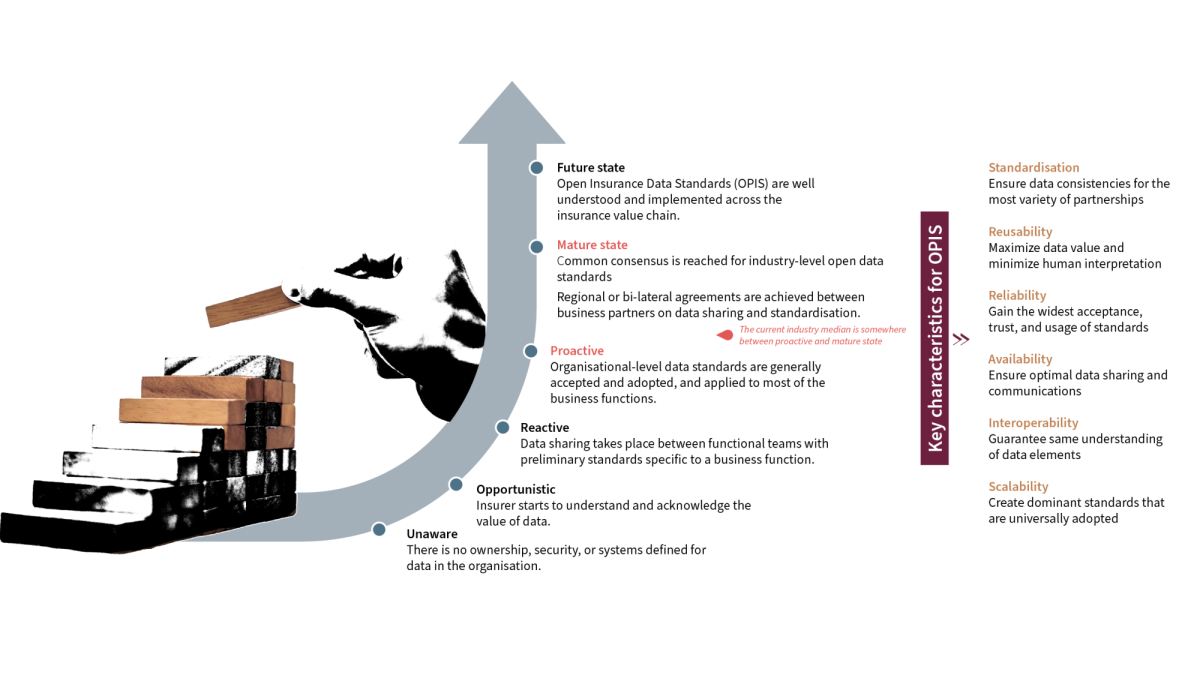

The major success criteria of OPIS include for a sufficient depth and breadth of datasets, reusability to ensure data consistency & compatibility and reduce the need for human interpretation, reliability to ensure data integrity, availability for optimal data sharing and communication between parties, interoperability of multiple partners to enhance collaboration with the widest array of partners, and scalability to enable a network effect with more partners.

But most importantly, it is crucial to start with use cases that have the biggest business impact to make it attractive. The more use cases are moved onto the new standard, the wider its breadth and relevance for others to join. When more partners follow, the more dominant the standards will become, which in turn will attract even more players. A successful example on this network effect is the OpenWealth Association orchestrated by Synpulse, an association that sets the Open API standard for a global wealth management community. It has an increasing member count, starting from six in its foundation in 2021 to 60 members at the end of 2022.

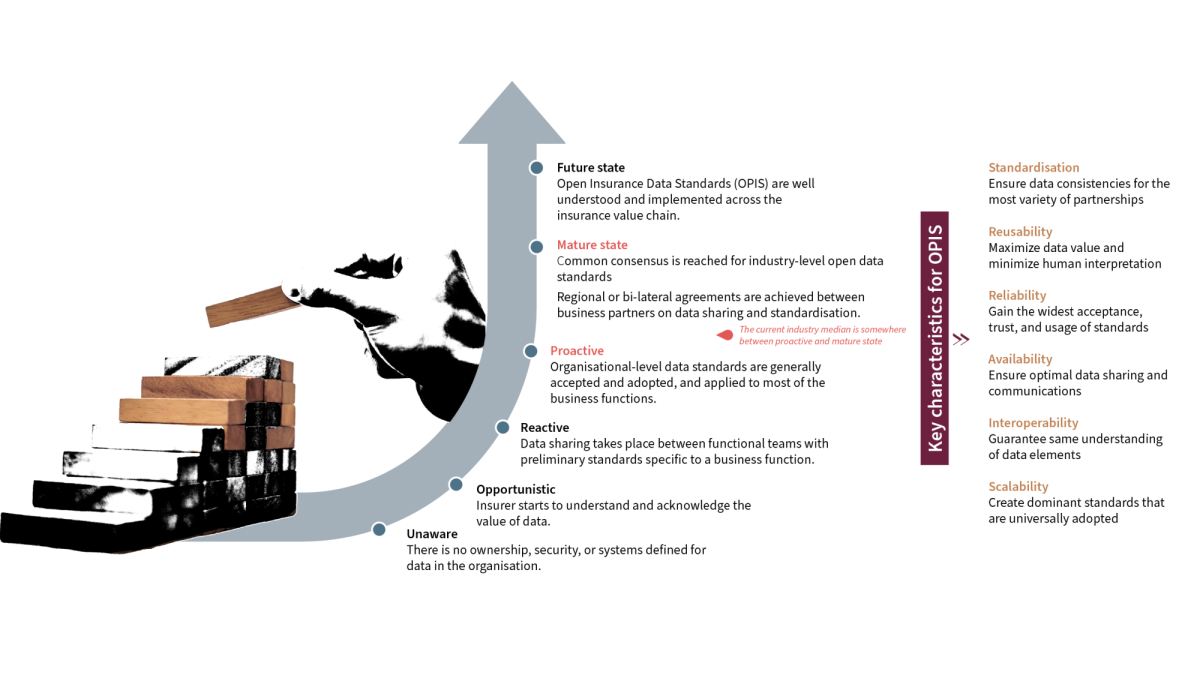

Evolution of OPIS

Some positive movements have been made in recent decades (see Figure 3). It is well accepted that data sharing between separate organizations boost operational efficiency, accuracy, and transparency within the insurance value chain. It enables a much more effective, coordinated response to external changes in areas like the shift in demand, new product designs, and regulatory refinements in the marketplace. Insurers are also increasingly inclined to enter OPIS agreements with close business partners. However, there is still a lack of industry-level coordination and collaboration.

Figure 3. Evolution of data standards

Think about each insurer as a country that comes with its own railway track width, where trains could not commute across borders. That’s the situation facing insurers today with OPIS. There exist significant barriers against wide insurance data sharing. This is due to the protection of intellectual property (IP) and competitive advantage, contractual limitations, and legal concerns on data protection, or simply the excessive cost of data preparation, technical standards, and system integration.

The major players across the insurance value chain need to start aligning the ‘railway width’ of mostly accepted open data standards. They must take the lead to initiate, develop, and manage new data standards, and form an alliance with coordinated contributions and responses to include as many members as possible with proper authentication and authorization. There must also be a common consensus on the goal to produce a robust and reusable agreement that can be implemented between themselves, and then passed across the industry, and ultimately build an open data ecosystem around it for insurers, reinsurers, sales partners, intermediaries, technology provider, regulators, and all other affected parties.

How to move towards the target state

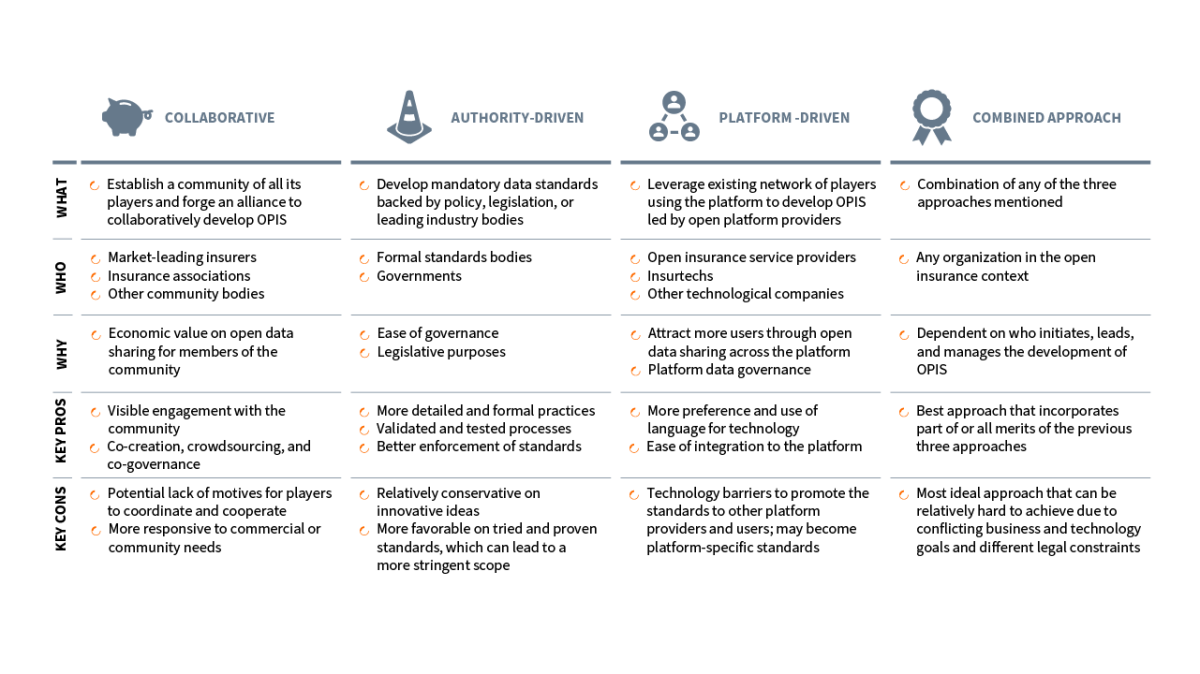

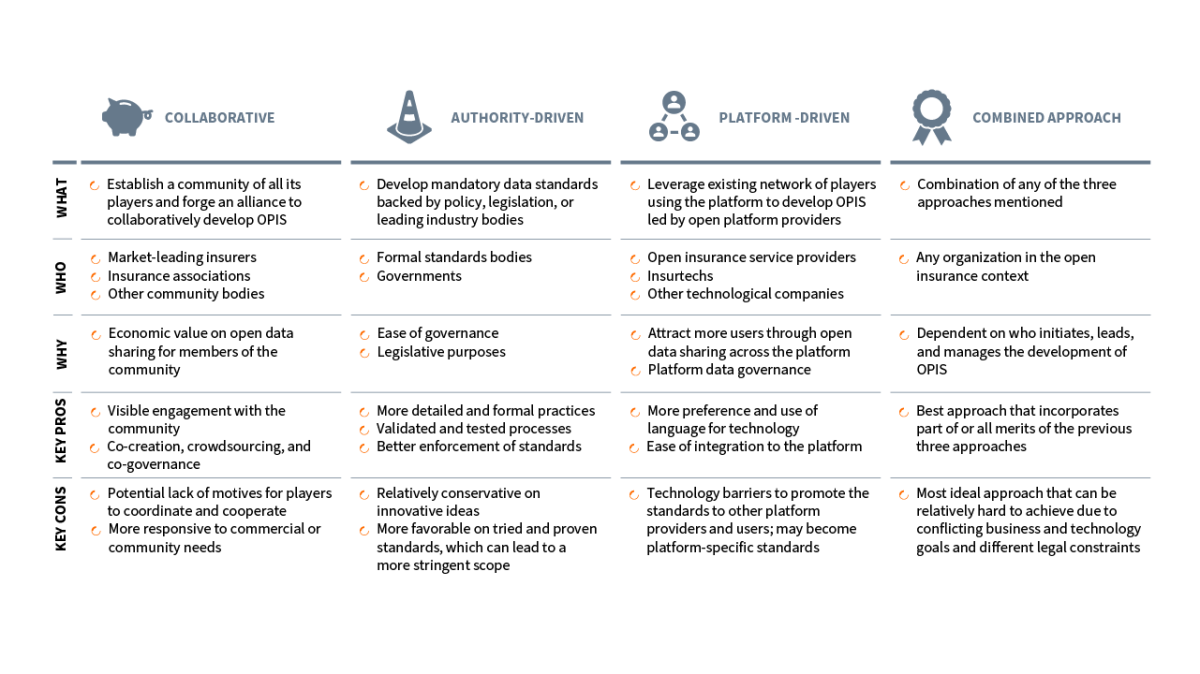

The development of OPIS can be initiated and led by a variety of organizations within the insurance context, from governments and nationally or internationally recognized formal standards bodies (authorities) to market-leading insurers or open insurance service providers, insurance associations, and other community bodies. When developing an open data standard, the processes or approaches can vary (see Figure 4) based on the sector, the aims of the standard, and the needs of the corresponding parties and organizations.

Figure 4. Standard approaches

However, all standard approaches follow similar stages. Most data standards development processes involve:

- Origination. Conduct research, identify, collect, and analyze needs along cross-cutting use cases. Identify the right stakeholders and initiate the standards development, as well as scope, plan, and approve the development towards OPIS target state.

- Development and validation. Identify gaps of current data standards, as well as develop implementation roadmap, allocate resources, create, test, and refine new data standards in the open insurance context.

- Launch and adoption. Pilot and run the new data standards in data-related operations and support its adoption under an open license.

- Monitoring, maintaining, and scaling. Observe, assess, and control the impact and landscape of the new data standards to decide the next steps, as well as refine the standards if necessary to maintain robustness and relevancy and promote them with more adopters across the ecosystem.

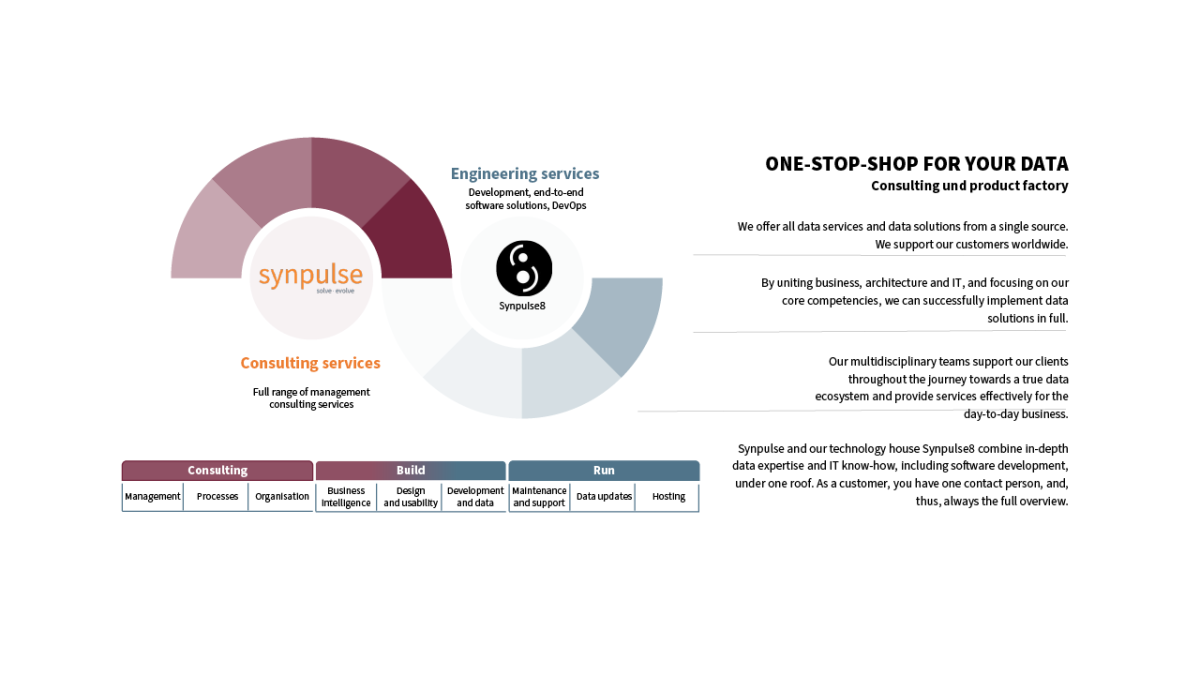

Synpulse, along with Synpulse8, has a strong insurance and technical expertise to support a variety of business and technology initiatives (see Figure 5). Our suite of proprietary assets, such as the NEOINSURANCEINABOX® Model, NEOINSURANCE® Market Radar, NEOINSURANCE® Open Insurance Platform Assessment, and DATAMANAGEMENTINABOX ® are only some of our best practices to accelerate and master your transition towards OPIS in the NEOINSURANCE® game level. We also have long-term partnerships and insights from a broad range of successful data-related projects and initiatives, where all stakeholders are relevant for OPIS.

We utilize our proprietary assets, tech partnerships, and profound experience in data-related digitalization along with our own data and IT professionals such as data architects, API developers and SW engineers, database administrators, data modellers and engineers, data scientists, data and BI analysts and data quality managers Synpulse and Synpulse8 are both equipped with adequate data science and API development and implementation capabilities. These support end-to-end OPIS development with any given approach, helping to raise the individual insurers data management maturity and ability to plug and play into open API ecosystems, as well as support the inauguration and development of a true data ecosystem for open insurance.

Figure 5. Our service offerings for OPIS

If you would like to discuss more insights from this article or take the next step in your NEOINSURANCE® journey, contact us to schedule a follow-up discussion, evaluate your needs in detail, and share more on our offerings.

As the global economy becomes increasingly digitized, a solid data foundation for incumbent insurers is crucial to compete against insurtechs and new entrants.

The ecosystem imperative, as outlined in our recent NEOINSURANCE® whitepaper, has urged insurers to shift from a product-centric to a lifestyle-oriented approach. This means processing big data from IoT- and telematics-enabled devices, social media, and third parties and drawing out the right actionable decisions to become a truly data-driven organization – a key characteristic of a NEOINSURER®.

However, insurers often face challenges to make full use of and monetize this data, both within their own organization as well as across their ecosystem partners. This is due to inconsistent data structures and standards, cumbersome data access, and different regulatory requirements, as we have stated in the benchmark report of Synpulse in Actuarial Data Science.

Evolving data standards in the open insurance domain

Historically seen, insurers tend to develop their legacy systems inwardly with a closed IT application landscape to seal off against intruders, mergers, and acquisitions (M&A), and unfriendly takeovers. There was no need for data sharing, given that a big portion of the value chain was covered in-house. By contrast, nowadays, each NEOINSURER® performs a more specific role in a harmonized insurance value chain that is partitioned among a wide range of ecosystem players and reaches far beyond the insurance industry.

Traditional insurers run the risk of missing the ecosystem imperative. They must adapt to get connected to API marketplaces, acquire new data-driven business model opportunities, unleash their innovation potential, attract ecosystem partners, and make full use of their data. NEOINSURERS® should closely follow the ecosystem imperative and maximize their data monetization to drive greater success and better fulfill their roles in the open insurance domain.

As a starting point to solve data-related problems that stand in the way of fully exploiting opportunities of ecosystem-driven business models, Synpulse believes that true Open Insurance Data Standards (OPIS) will ensure that data will be readily available, reusable, interoperable, and generates monetizable data value.

This article is part of the Data as an Asset core belief, one of the key elements within our NEOINSURANCEINABOX® solution (see Figure 1). We will introduce more components in the coming months, so stay tuned.

Figure 1: NEOINSURANCEINABOX® and Data management capabilities of a NEOINSURER®

What are Open Insurance Data Standards?

OPIS are documented, reusable agreements that help insurers publish, access, share, and use more standardized and advanced data quality. Each entity of insurance data, such as customer and business partners, products, policies, and claims, has corresponding OPIS guidelines, formats, and definitions that can be classified into three main standard components:

- Content. The meaning, interpretation, and of insurance data fields to ensure the data is well interpreted and used, including definitions (the definition of a gross premium rate), classifications (mapping claims to insurance products, such as motor and travel insurance), and properties (fields that are belonging to motor insurance and its descriptions).

- Structure. The specified schema and of data tables to ensure reusability, including the defined relations between tables, identifiers, and data types of the properties (e.g., date, integer, text).

- Interface. The required communication of data to ensure the safe exchange of data, including file formats (e.g., JSON, YAML, XML, CSV) and procedures on the data transfer (e.g., exchange with HTTP via web servers, FTP directly between computers, and SMTP via email), where standards are often directed at sharing data via an API, in which data with a JSON or YAML file format are exchanged using HTTP.

In all components, there is the regulatory impact that involves data governance, data principles, and data protection (e.g., GDPR regulation on data protection and privacy in the EU). This affects the content of data that can be shared, structuring the anonymised data and setting up the right interface to safely transfer the data.

How OPIS benefits insurers?

OPIS will address all standard components, leading to significant benefits for all players. At its core, insurers exchange information across the entire value chain through different interconnected and their customers (see Figure 2). It is vital that these insurance transactions are accomplished with timely and accurate data exchange.

There are existing initiatives on data standards that enhance the communications between (e.g., ISO policy standards and ACORD data standards for insurers and reinsurers), boost electronic data exchange between insurers and brokers (e.g., IG B2B) and enforce compliance of insurers by authority standards (e.g., the statutory requirement on third-party liability for motor vehicles). Still, many insurers face fragmented, isolated, and individual data standards. OPIS will enable flawless and efficient information flow between the insurers and all other players relevant to the insurance ecosystem.

As a result, OPIS will improve the efficiency of data exchange and enable process automation, reducing cost and time efforts and enhancing the offerings with faster and more innovative services. Customer experience will also be improved, as they can access better quality data and enjoy more consistent offerings.

Figure 2: Stakeholders of insurance-related data information exchange

OPIS enables progressive, data-driven business models, such as embedded insurance, which prerequisites the unhampered data exchange across multiple ecosystem partners. It also mutually complements their own offerings, as mentioned in our recent social media article Embedded Insurance: What Could Be Use Cases for Your Business?.

Insurers can further unlock the door to a wider range of new data-driven businesses in a true ecosystem and plug and play their value streams to the universal API economy, unleashing unprecedented data revenue potentials. They can also directly benefit from machine learning, analytical and dashboarding tools, and API marketplaces that are sharing the same standards. Moreover, these can generate immediate business revenue by implementing data-driven use cases, such as dynamic pricing, alternative underwriting, cross-selling or up-selling, and claims handling.

OPIS success criteria

The major success criteria of OPIS include for a sufficient depth and breadth of datasets, reusability to ensure data consistency & compatibility and reduce the need for human interpretation, reliability to ensure data integrity, availability for optimal data sharing and communication between parties, interoperability of multiple partners to enhance collaboration with the widest array of partners, and scalability to enable a network effect with more partners.

But most importantly, it is crucial to start with use cases that have the biggest business impact to make it attractive. The more use cases are moved onto the new standard, the wider its breadth and relevance for others to join. When more partners follow, the more dominant the standards will become, which in turn will attract even more players. A successful example on this network effect is the OpenWealth Association orchestrated by Synpulse, an association that sets the Open API standard for a global wealth management community. It has an increasing member count, starting from six in its foundation in 2021 to 60 members at the end of 2022.

Evolution of OPIS

Some positive movements have been made in recent decades (see Figure 3). It is well accepted that data sharing between separate organizations boost operational efficiency, accuracy, and transparency within the insurance value chain. It enables a much more effective, coordinated response to external changes in areas like the shift in demand, new product designs, and regulatory refinements in the marketplace. Insurers are also increasingly inclined to enter OPIS agreements with close business partners. However, there is still a lack of industry-level coordination and collaboration.

Figure 3. Evolution of data standards

Think about each insurer as a country that comes with its own railway track width, where trains could not commute across borders. That’s the situation facing insurers today with OPIS. There exist significant barriers against wide insurance data sharing. This is due to the protection of intellectual property (IP) and competitive advantage, contractual limitations, and legal concerns on data protection, or simply the excessive cost of data preparation, technical standards, and system integration.

The major players across the insurance value chain need to start aligning the ‘railway width’ of mostly accepted open data standards. They must take the lead to initiate, develop, and manage new data standards, and form an alliance with coordinated contributions and responses to include as many members as possible with proper authentication and authorization. There must also be a common consensus on the goal to produce a robust and reusable agreement that can be implemented between themselves, and then passed across the industry, and ultimately build an open data ecosystem around it for insurers, reinsurers, sales partners, intermediaries, technology provider, regulators, and all other affected parties.

How to move towards the target state

The development of OPIS can be initiated and led by a variety of organizations within the insurance context, from governments and nationally or internationally recognized formal standards bodies (authorities) to market-leading insurers or open insurance service providers, insurance associations, and other community bodies. When developing an open data standard, the processes or approaches can vary (see Figure 4) based on the sector, the aims of the standard, and the needs of the corresponding parties and organizations.

Figure 4. Standard approaches

However, all standard approaches follow similar stages. Most data standards development processes involve:

- Origination. Conduct research, identify, collect, and analyze needs along cross-cutting use cases. Identify the right stakeholders and initiate the standards development, as well as scope, plan, and approve the development towards OPIS target state.

- Development and validation. Identify gaps of current data standards, as well as develop implementation roadmap, allocate resources, create, test, and refine new data standards in the open insurance context.

- Launch and adoption. Pilot and run the new data standards in data-related operations and support its adoption under an open license.

- Monitoring, maintaining, and scaling. Observe, assess, and control the impact and landscape of the new data standards to decide the next steps, as well as refine the standards if necessary to maintain robustness and relevancy and promote them with more adopters across the ecosystem.

Synpulse, along with Synpulse8, has a strong insurance and technical expertise to support a variety of business and technology initiatives (see Figure 5). Our suite of proprietary assets, such as the NEOINSURANCEINABOX® Model, NEOINSURANCE® Market Radar, NEOINSURANCE® Open Insurance Platform Assessment, and DATAMANAGEMENTINABOX ® are only some of our best practices to accelerate and master your transition towards OPIS in the NEOINSURANCE® game level. We also have long-term partnerships and insights from a broad range of successful data-related projects and initiatives, where all stakeholders are relevant for OPIS.

We utilize our proprietary assets, tech partnerships, and profound experience in data-related digitalization along with our own data and IT professionals such as data architects, API developers and SW engineers, database administrators, data modellers and engineers, data scientists, data and BI analysts and data quality managers Synpulse and Synpulse8 are both equipped with adequate data science and API development and implementation capabilities. These support end-to-end OPIS development with any given approach, helping to raise the individual insurers data management maturity and ability to plug and play into open API ecosystems, as well as support the inauguration and development of a true data ecosystem for open insurance.

Figure 5. Our service offerings for OPIS

If you would like to discuss more insights from this article or take the next step in your NEOINSURANCE® journey, contact us to schedule a follow-up discussion, evaluate your needs in detail, and share more on our offerings.