Loading Insight...

Insights

Insights

Tokenisation of non-bankable assets allows both virtual and real-world assets (RWAs), such as real estate, commodities, art, intellectual property, and others, to be converted into digital tokens. These tokens can then be used for various financial services, including trading and lending. While the total market capitalisation of all crypto assets is just below USD 2.5 trillion in mid-2024, the World Economic Forum has estimated that by 2030, tokenised assets could represent up to 10% of the global GDP translating to a market value of around USD 24 trillion. For banks already integrated into the digital asset ecosystem, tokenisation is the logical next step to evolve their service offerings and foster client satisfaction, retention and future readiness.

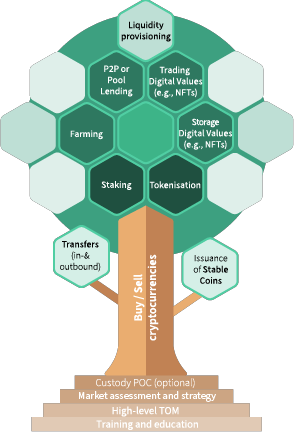

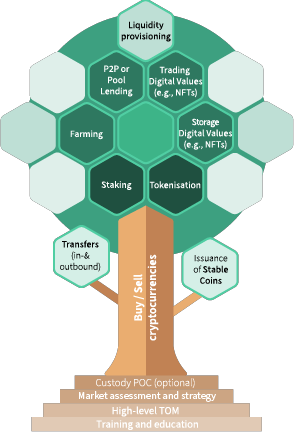

Our mission is to advise banks on how to enter and profit from the digital asset space. In order to do so, Synpulse has created a crypto roadmap for banks (fig. 1) to help educate and navigate them. With this series of articles, we will go step by step into the individual areas of the roadmap by looking into five different use cases following our strategic approach for banks:

- Strategical approach for banks (Introduction)

- Buy / Sell and custody of crypto assets

- Staking

- Lending

- Tokenisation of non-bankable assets

- Digital values and NFTs

In this fifth article we are focusing on tokenisation.

Fig 1: Synpulse use case tree

Tokenisation addresses the needs of private and retail clients

Tokenisation benefits both private banking clients and retail investors by expanding the investment universe and providing access to financing solutions and portfolio diversification.

For private banking clients, tokenising high-value, non-bankable assets turn traditionally illiquid assets into liquid ones, offering new ways to leverage wealth. This is particularly beneficial for high-net-worth individuals (HNWIs) looking to utilize their wealth more effectively.

Retail investors gain access to high-value assets through fractional ownership facilitated by tokenisation, allowing them to diversify portfolios beyond conventional investments like stocks and bonds. This democratises investment opportunities into alternative assets and shifts "retail investors' efficient frontier" upwards. Finally, all market participants benefit from liquidity and more efficient pricing.

Additionally, tokenisation can streamline processes along financial services value chains, with tokens providing transparent and immutable records of ownership and transaction history. This level of transparency and security is appealing to both private and retail clients, as it reduces the risk of fraud and ensures regulatory compliance.

Tokenisation aligns with familiar and traditional banking practises and frameworks

Securitisation is already a well-established process in the traditional finance industry. It involves converting assets like loans into marketable securities, which can be bought and sold by investors. However, this process often involves multiple intermediaries, can be complex, time-consuming, and costly.

Tokenisation allows financial institutions to leverage existing frameworks and processes established for securitisation as it follows a similar principle to create digital representations of various virtual or real-world assets. By using public blockchain networks such as Ethereum for secure and efficient transactions, tokenised assets are composable instantly, which enhances liquidity, transparency, and accessibility of assets.

Banks can leverage their digital asset infrastructure for efficient, cost-effective tokenisation

With around 25% of all Swiss banks supporting digital assets today, they already meet fundamental prerequisites such as custody or smart contract capabilities to unlock the tokenisation use case. On the other hand, they have an established reputation and unique capabilities as custodians to safekeep assets also in real life, providing an edge over non-licenced web3.0 players already engaging in tokenisation.

Indeed, many banks even house these underlying tangible, non-bankable assets in their vaults already which simplifies logistics, reduces cost and streamlines internal processes. In consequence, banks are well-suited to integrating tokenisation services into both their operations, business, and technical infrastructure.

Tokenising non-bankable assets creates new revenue streams and boosts a bank's competitive edge

Once an asset is represented as a digital identity, it can be used to unlock a whole new set of use cases which all come with additional revenue streams beyond transaction and custody fees. Access to liquidity is a primary benefit especially for the original owners of the underlying, as tokenised assets can be traded instantaneously, provide immediate liquidity, and enable short-term financing solutions. In addition, liquid assets often carry a significant liquidity premium of up to 25%, which is of particular interest for HNWIs.

In addition, tokens may be seamlessly used as collateral for Lombard loans and by fractionalising high-value RWA, banks can provide a broader range of alternative investment products, appealing to retail and affluent clients. This can enhance client engagement and attract new client segments at the same time.

Client engagement can be retained while ensuring compliance simultaneously

Tokenising assets has many benefits not only in terms of revenue. Built based on Smart Contracts on public blockchains also facilitates AML-compliance through features like whitelisting, that can be used for onboarding and trading. This ensures that all participants in the ecosystem of a tokenised asset are verified and approved, maintaining regulatory compliance and enhancing security.

In a closed environment, where trading may not be enabled or aspired, the capability to fractionalise family-owned assets still provides a unique solution for succession planning, and administration, locking in clients and ensuring smooth transitions of wealth across generations.

Take the next step in your digital asset journey with Synpulse today

At Synpulse, we have already walked the talk with the tokenisation of our own employee participation programme in form of our Synpulse token. Interested or ready to unlock the world of tokenised assets?

This is the fifth part of our new article series. Stay tuned and don't miss the upcoming ones or contact us directly to discuss your digital assets roadmap. The next article will focus on Digital values and NFTs.

Tokenisation of non-bankable assets allows both virtual and real-world assets (RWAs), such as real estate, commodities, art, intellectual property, and others, to be converted into digital tokens. These tokens can then be used for various financial services, including trading and lending. While the total market capitalisation of all crypto assets is just below USD 2.5 trillion in mid-2024, the World Economic Forum has estimated that by 2030, tokenised assets could represent up to 10% of the global GDP translating to a market value of around USD 24 trillion. For banks already integrated into the digital asset ecosystem, tokenisation is the logical next step to evolve their service offerings and foster client satisfaction, retention and future readiness.

Our mission is to advise banks on how to enter and profit from the digital asset space. In order to do so, Synpulse has created a crypto roadmap for banks (fig. 1) to help educate and navigate them. With this series of articles, we will go step by step into the individual areas of the roadmap by looking into five different use cases following our strategic approach for banks:

- Strategical approach for banks (Introduction)

- Buy / Sell and custody of crypto assets

- Staking

- Lending

- Tokenisation of non-bankable assets

- Digital values and NFTs

In this fifth article we are focusing on tokenisation.

Fig 1: Synpulse use case tree

Tokenisation addresses the needs of private and retail clients

Tokenisation benefits both private banking clients and retail investors by expanding the investment universe and providing access to financing solutions and portfolio diversification.

For private banking clients, tokenising high-value, non-bankable assets turn traditionally illiquid assets into liquid ones, offering new ways to leverage wealth. This is particularly beneficial for high-net-worth individuals (HNWIs) looking to utilize their wealth more effectively.

Retail investors gain access to high-value assets through fractional ownership facilitated by tokenisation, allowing them to diversify portfolios beyond conventional investments like stocks and bonds. This democratises investment opportunities into alternative assets and shifts "retail investors' efficient frontier" upwards. Finally, all market participants benefit from liquidity and more efficient pricing.

Additionally, tokenisation can streamline processes along financial services value chains, with tokens providing transparent and immutable records of ownership and transaction history. This level of transparency and security is appealing to both private and retail clients, as it reduces the risk of fraud and ensures regulatory compliance.

Tokenisation aligns with familiar and traditional banking practises and frameworks

Securitisation is already a well-established process in the traditional finance industry. It involves converting assets like loans into marketable securities, which can be bought and sold by investors. However, this process often involves multiple intermediaries, can be complex, time-consuming, and costly.

Tokenisation allows financial institutions to leverage existing frameworks and processes established for securitisation as it follows a similar principle to create digital representations of various virtual or real-world assets. By using public blockchain networks such as Ethereum for secure and efficient transactions, tokenised assets are composable instantly, which enhances liquidity, transparency, and accessibility of assets.

Banks can leverage their digital asset infrastructure for efficient, cost-effective tokenisation

With around 25% of all Swiss banks supporting digital assets today, they already meet fundamental prerequisites such as custody or smart contract capabilities to unlock the tokenisation use case. On the other hand, they have an established reputation and unique capabilities as custodians to safekeep assets also in real life, providing an edge over non-licenced web3.0 players already engaging in tokenisation.

Indeed, many banks even house these underlying tangible, non-bankable assets in their vaults already which simplifies logistics, reduces cost and streamlines internal processes. In consequence, banks are well-suited to integrating tokenisation services into both their operations, business, and technical infrastructure.

Tokenising non-bankable assets creates new revenue streams and boosts a bank's competitive edge

Once an asset is represented as a digital identity, it can be used to unlock a whole new set of use cases which all come with additional revenue streams beyond transaction and custody fees. Access to liquidity is a primary benefit especially for the original owners of the underlying, as tokenised assets can be traded instantaneously, provide immediate liquidity, and enable short-term financing solutions. In addition, liquid assets often carry a significant liquidity premium of up to 25%, which is of particular interest for HNWIs.

In addition, tokens may be seamlessly used as collateral for Lombard loans and by fractionalising high-value RWA, banks can provide a broader range of alternative investment products, appealing to retail and affluent clients. This can enhance client engagement and attract new client segments at the same time.

Client engagement can be retained while ensuring compliance simultaneously

Tokenising assets has many benefits not only in terms of revenue. Built based on Smart Contracts on public blockchains also facilitates AML-compliance through features like whitelisting, that can be used for onboarding and trading. This ensures that all participants in the ecosystem of a tokenised asset are verified and approved, maintaining regulatory compliance and enhancing security.

In a closed environment, where trading may not be enabled or aspired, the capability to fractionalise family-owned assets still provides a unique solution for succession planning, and administration, locking in clients and ensuring smooth transitions of wealth across generations.

Take the next step in your digital asset journey with Synpulse today

At Synpulse, we have already walked the talk with the tokenisation of our own employee participation programme in form of our Synpulse token. Interested or ready to unlock the world of tokenised assets?

This is the fifth part of our new article series. Stay tuned and don't miss the upcoming ones or contact us directly to discuss your digital assets roadmap. The next article will focus on Digital values and NFTs.