Loading Insight...

Insights

Insights

In the fast-changing world of financial technology, traditional methods are being transformed by new consumer expectations, regulatory changes, and technological advancements. Fintech companies and neobanks lead this transformation but struggle with outdated core banking systems. These systems cannot meet the demands of a digital-first era, making a distributed value chain and ecosystem collaboration essential for success.

Legacy systems lack the agility to integrate with modern technologies, causing inefficiencies and high maintenance costs. There is a clear need for scalable, cost-efficient banking solutions that comply with regulations, support seamless third-party integration through open architectures, and deliver exceptional customer experiences.

Reducing overhead by adopting cloud technology

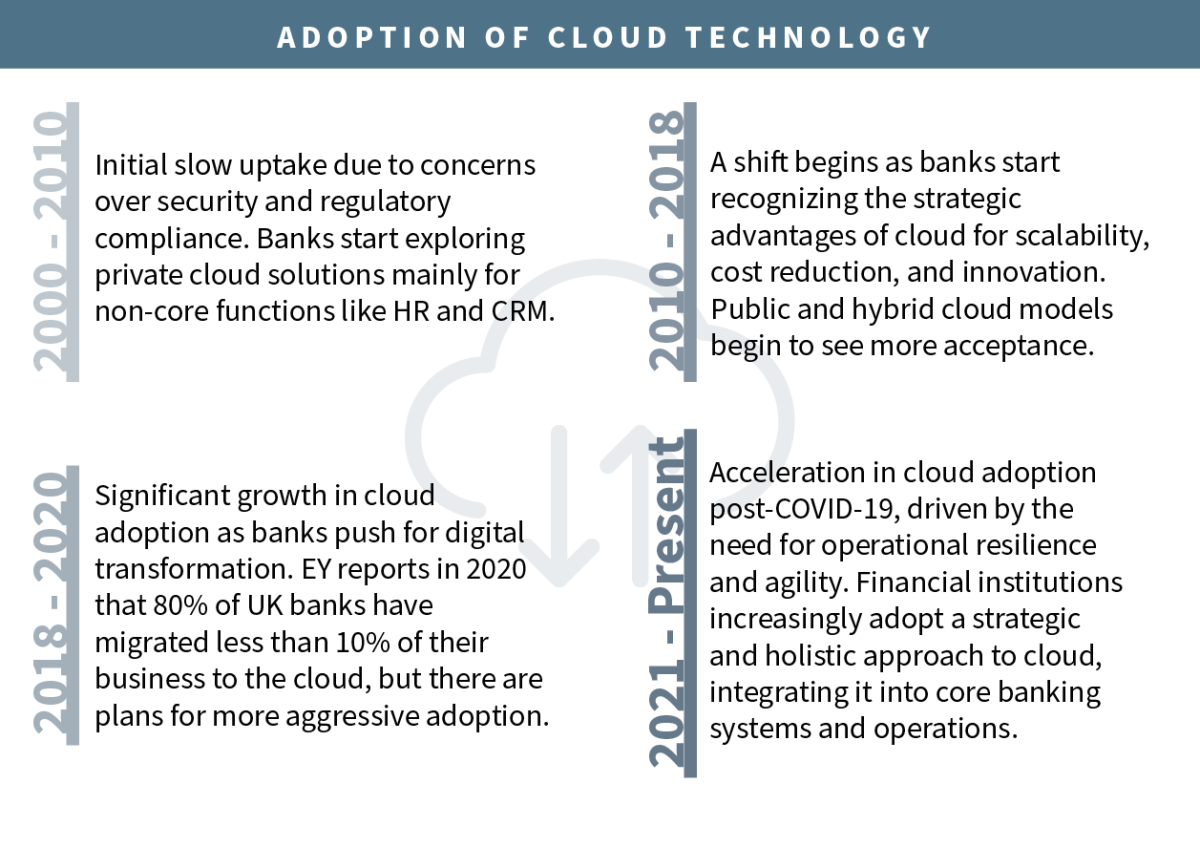

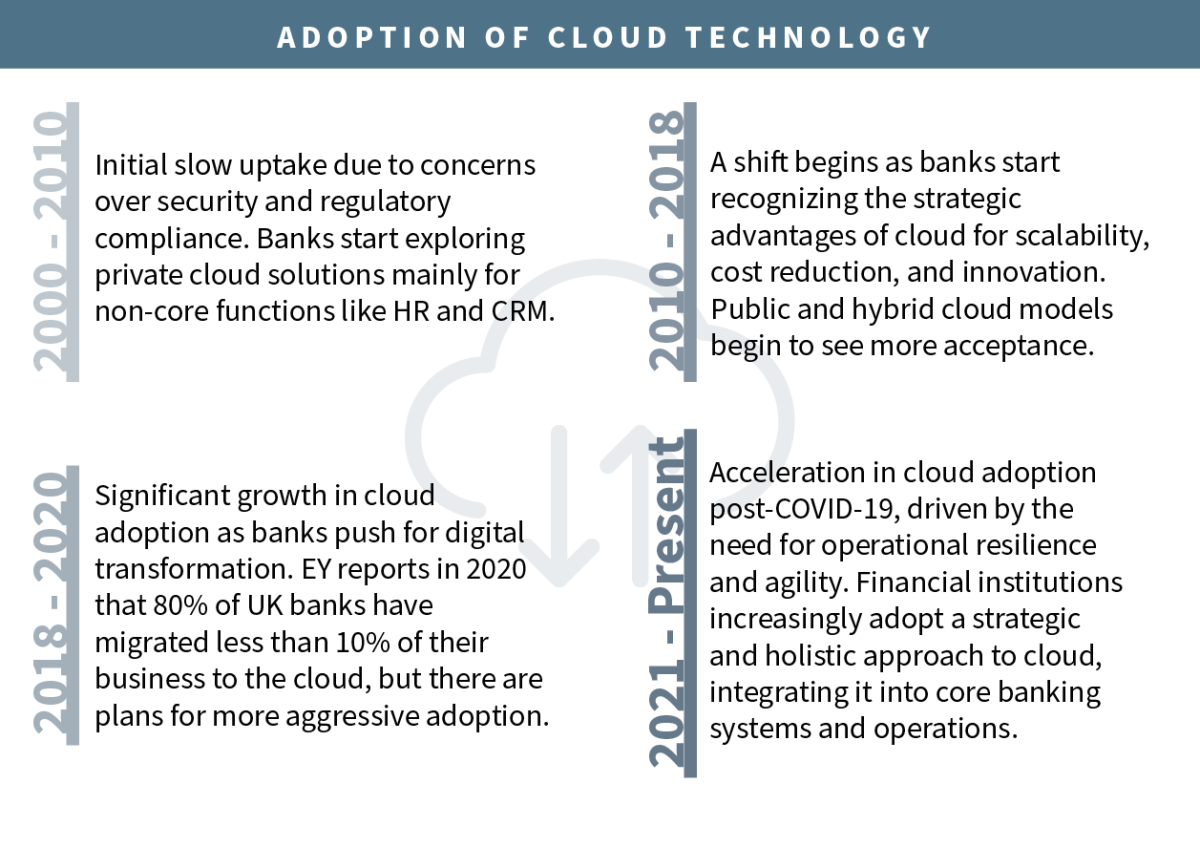

The banking sector is undergoing a significant transformation with the adoption of cloud technology, particularly among fintechs and neobanks. This shift is driven by the need for scalability, efficiency, and enhanced security.

Cloud technology enables fintechs and neobanks to scale their operations cost-effectively, allowing them to adapt swiftly to market changes without the burden of heavy infrastructure investments. Moreover, cloud platforms offer robust security measures and compliance controls, ensuring adherence to strict regulations and providing customers with peace of mind regarding the safety of their data.

By moving to the cloud, financial institutions (FIs) can reduce overhead costs associated with physical data centers, opting instead for a pay-as-you-go model that lowers operating expenses. Cloud-based operations also boast high resilience, minimising downtime and ensuring a reliable customer experience even during unforeseen disruptions.

Furthermore, the cloud accelerates the development and deployment of new banking services, empowering fintechs to innovate and maintain a competitive edge in the rapidly evolving financial landscape. Overall, the shift to the cloud represents a pivotal step forward for fintechs and neobanks, enabling them to achieve scalability, efficiency, and security while driving innovation in the banking sector.

Figure 1: Adoption of cloud technology

Next-generation core banking systems: a must for designing superior user experiences

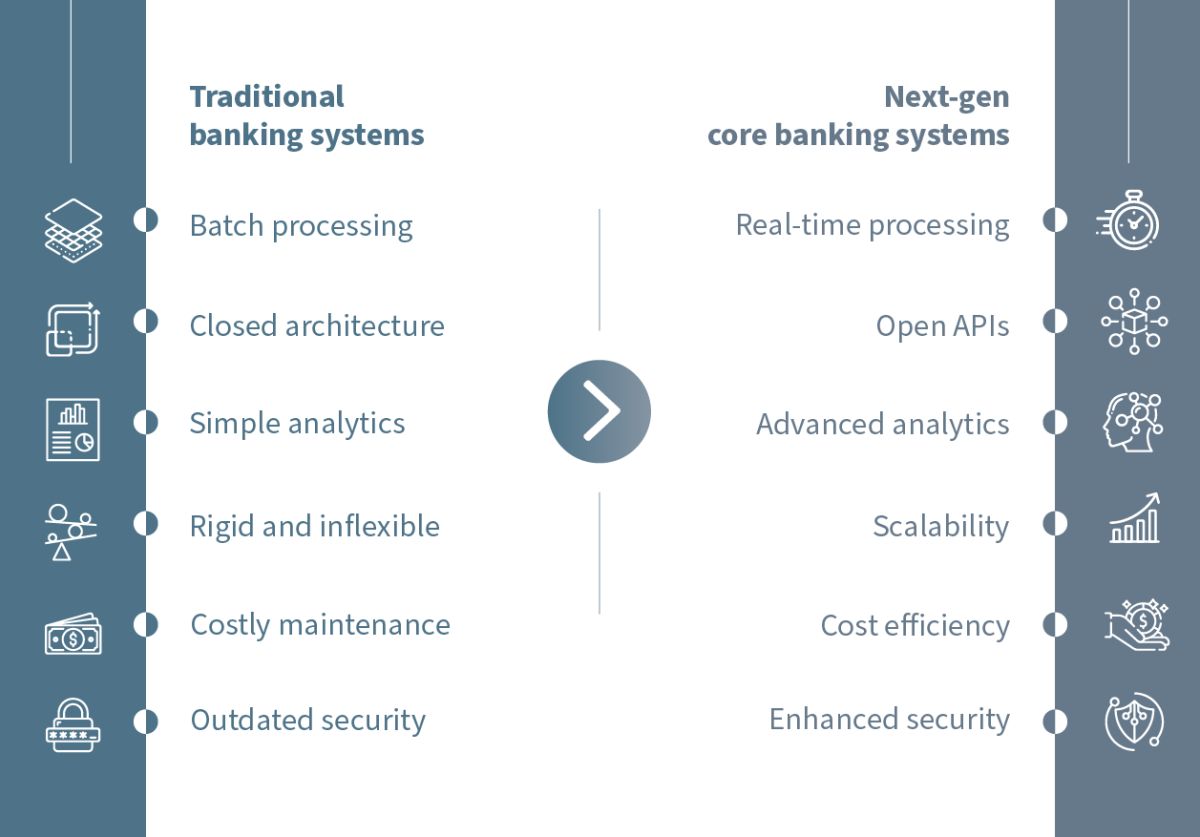

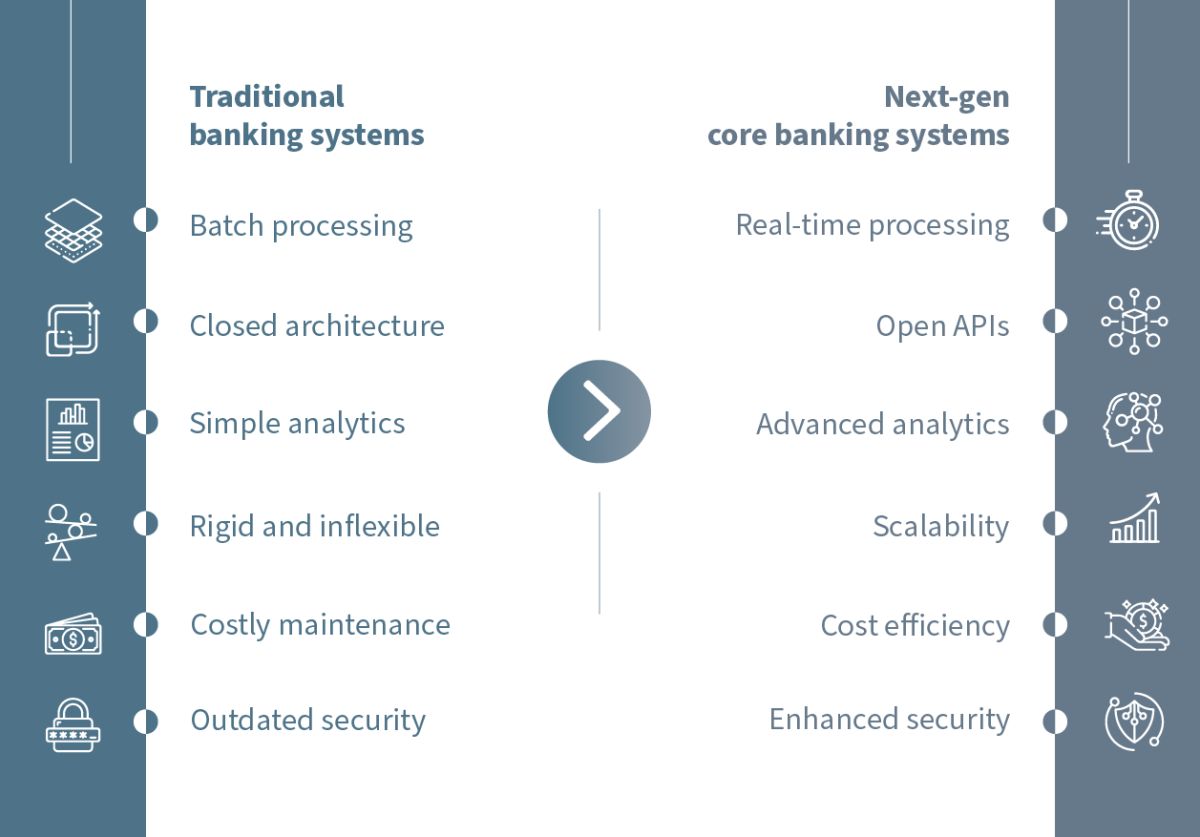

Next-generation core banking systems are revolutionising the fintech landscape by addressing the limitations of traditional, rigid systems. Designed to be agile, flexible, and digital-first, these systems offer essential features such as real-time processing for immediate transaction updates, open APIs enabling seamless integration with other financial services and third-party apps, and advanced analytics to personalise services based on customer behaviors. These capabilities are crucial for fintechs and neobanks striving to deliver superior customer experiences and innovate with new products in today's dynamic market.

Figure 2: Evolution of core banking systems

Regulatory considerations in cloud-based banking systems

Transitioning to cloud-based and next-generation banking systems presents a myriad of regulatory considerations and compliance obligations for fintechs and neobanks. Regulations such as DORA, GDPR and various financial standards impose stringent requirements concerning data security, privacy protection, and transaction integrity. It is imperative for FIs to ensure that their technology platforms adhere to these standards to avoid regulatory penalties and uphold customer trust.

With data security and privacy as paramount concerns, cloud-based systems must implement robust measures such as encryption, access controls, and regular audits to mitigate cyber threats effectively. Compliance with data privacy regulations is essential not only for regulatory adherence but also for maintaining customer confidence and loyalty.

Despite the complexity of regulatory compliance, fintechs and neobanks can leverage cloud technology to streamline their efforts. Cloud platforms often offer built-in compliance tools that automate reporting and monitoring tasks, facilitating adherence to regulatory requirements. By partnering with compliant cloud providers, FIs can focus on delivering innovative services while ensuring regulatory compliance, thereby solidifying their position in the competitive financial landscape.

Integration of Plug& BaaS with next-gen banking systems

The integration of Plug& BaaS with next-generation banking systems represents a strategic alignment with the evolving needs of digital-first FIs. With its cloud-native core, Plug& BaaS seamlessly integrates with cutting-edge banking technologies, empowering fintechs and neobanks to harness the full potential of modern financial solutions.

Central to this integration is Plug& BaaS's architecture, which leverages open APIs to enable smooth connectivity with a diverse array of financial services, data analytics tools, and third-party applications. This flexibility fosters a holistic banking approach that caters to both current operational requirements and future innovations.

Furthermore, modern core banking platforms like Plug& BaaS come equipped with built-in tools to automate and manage compliance tasks, such as reporting and data security. By embedding these compliance functionalities within the system, Plug& BaaS not only mitigates the risk of regulatory breaches but also reduces the overall cost and complexity associated with regulatory adherence.

Plug& BaaS facilitates rapid deployment and scalable expansion

Plug& BaaS excels in operational efficiency with features that enable rapid deployment and scalable expansion. At its core, the platform is constructed on a modular framework, empowering FIs to adopt and scale services in alignment with their evolving needs. This modular approach, complemented by cloud-based infrastructure, enables neobanks and fintechs to commence operations on a modest scale and seamlessly ramp up resources as demand grows, all without substantial upfront investments.

Key operational features include real-time processing capabilities, ensuring swift and efficient execution of all banking operations. Moreover, the cloud infrastructure guarantees scalability and security, robustly supporting operations even amidst fluctuating demand. With Plug& BaaS's comprehensive suite of operational tools, FIs can confidently navigate the path to rapid launch and scalable growth, all while maintaining operational excellence and customer satisfaction.

Accelerating digital transformation with an SaaS model

Synpulse has achieved its fastest-ever implementation of the Avaloq Core Platform for a bank, deploying it on the cloud using a software-as-a-service (SaaS) model. This accomplishment is a significant milestone in the client's digital transformation journey, benefiting from Synpulse's unique integration layer and utilisation of open-source components. With Synpulse's Plug& BaaS, the bank gains the flexibility to expand into various business areas as a licensed online bank.

Utilising the Avaloq Core Platform enables the bank to function as a digital bank while ensuring full compliance with regulatory bodies, such as Austria's Financial Market Authority (FMA) and Germany's Federal Financial Supervisory Authority (BaFin). This empowers the bank to continue driving innovation within Europe's financial sector. The core banking system provided by Avaloq automates and streamlines essential processes across the bank's front, middle, and back offices, encompassing client onboarding, payments, and settlement. This results in high straight-through processing (STP) and service accuracy rates, thereby enhancing the overall efficiency of the bank's operations.

Synchronising with the pulse of innovation

In the ever-evolving banking industry, platforms like Plug& BaaS are positioned to be key drivers of future innovation. The shift towards digital-only banking solutions is expected to gain momentum, prompting more FIs to embrace cloud-based platforms in order to meet the rising expectations of customers for seamless experiences and personalised services.

Plug& BaaS is committed to staying at the forefront of fintech advancements, with a strong emphasis on AI-driven solutions and the ability to swiftly adapt to emerging industry trends. By prioritising innovation, the platform ensures that fintechs and neobanks can deliver tailored, efficient services that cater to the evolving needs of customers.

Furthermore, as Plug& BaaS continues to forge new partnerships and expand its ecosystem, it will further redefine the financial landscape, making it more accessible, secure, and user-centric. By synchronising with the pulse of innovation, Plug& BaaS is well-positioned to shape the future of banking, driving positive change and enabling FIs to thrive in a rapidly evolving digital environment.

For more information on Plug& BaaS, get in touch with our experts today.

In the fast-changing world of financial technology, traditional methods are being transformed by new consumer expectations, regulatory changes, and technological advancements. Fintech companies and neobanks lead this transformation but struggle with outdated core banking systems. These systems cannot meet the demands of a digital-first era, making a distributed value chain and ecosystem collaboration essential for success.

Legacy systems lack the agility to integrate with modern technologies, causing inefficiencies and high maintenance costs. There is a clear need for scalable, cost-efficient banking solutions that comply with regulations, support seamless third-party integration through open architectures, and deliver exceptional customer experiences.

Reducing overhead by adopting cloud technology

The banking sector is undergoing a significant transformation with the adoption of cloud technology, particularly among fintechs and neobanks. This shift is driven by the need for scalability, efficiency, and enhanced security.

Cloud technology enables fintechs and neobanks to scale their operations cost-effectively, allowing them to adapt swiftly to market changes without the burden of heavy infrastructure investments. Moreover, cloud platforms offer robust security measures and compliance controls, ensuring adherence to strict regulations and providing customers with peace of mind regarding the safety of their data.

By moving to the cloud, financial institutions (FIs) can reduce overhead costs associated with physical data centers, opting instead for a pay-as-you-go model that lowers operating expenses. Cloud-based operations also boast high resilience, minimising downtime and ensuring a reliable customer experience even during unforeseen disruptions.

Furthermore, the cloud accelerates the development and deployment of new banking services, empowering fintechs to innovate and maintain a competitive edge in the rapidly evolving financial landscape. Overall, the shift to the cloud represents a pivotal step forward for fintechs and neobanks, enabling them to achieve scalability, efficiency, and security while driving innovation in the banking sector.

Figure 1: Adoption of cloud technology

Next-generation core banking systems: a must for designing superior user experiences

Next-generation core banking systems are revolutionising the fintech landscape by addressing the limitations of traditional, rigid systems. Designed to be agile, flexible, and digital-first, these systems offer essential features such as real-time processing for immediate transaction updates, open APIs enabling seamless integration with other financial services and third-party apps, and advanced analytics to personalise services based on customer behaviors. These capabilities are crucial for fintechs and neobanks striving to deliver superior customer experiences and innovate with new products in today's dynamic market.

Figure 2: Evolution of core banking systems

Regulatory considerations in cloud-based banking systems

Transitioning to cloud-based and next-generation banking systems presents a myriad of regulatory considerations and compliance obligations for fintechs and neobanks. Regulations such as DORA, GDPR and various financial standards impose stringent requirements concerning data security, privacy protection, and transaction integrity. It is imperative for FIs to ensure that their technology platforms adhere to these standards to avoid regulatory penalties and uphold customer trust.

With data security and privacy as paramount concerns, cloud-based systems must implement robust measures such as encryption, access controls, and regular audits to mitigate cyber threats effectively. Compliance with data privacy regulations is essential not only for regulatory adherence but also for maintaining customer confidence and loyalty.

Despite the complexity of regulatory compliance, fintechs and neobanks can leverage cloud technology to streamline their efforts. Cloud platforms often offer built-in compliance tools that automate reporting and monitoring tasks, facilitating adherence to regulatory requirements. By partnering with compliant cloud providers, FIs can focus on delivering innovative services while ensuring regulatory compliance, thereby solidifying their position in the competitive financial landscape.

Integration of Plug& BaaS with next-gen banking systems

The integration of Plug& BaaS with next-generation banking systems represents a strategic alignment with the evolving needs of digital-first FIs. With its cloud-native core, Plug& BaaS seamlessly integrates with cutting-edge banking technologies, empowering fintechs and neobanks to harness the full potential of modern financial solutions.

Central to this integration is Plug& BaaS's architecture, which leverages open APIs to enable smooth connectivity with a diverse array of financial services, data analytics tools, and third-party applications. This flexibility fosters a holistic banking approach that caters to both current operational requirements and future innovations.

Furthermore, modern core banking platforms like Plug& BaaS come equipped with built-in tools to automate and manage compliance tasks, such as reporting and data security. By embedding these compliance functionalities within the system, Plug& BaaS not only mitigates the risk of regulatory breaches but also reduces the overall cost and complexity associated with regulatory adherence.

Plug& BaaS facilitates rapid deployment and scalable expansion

Plug& BaaS excels in operational efficiency with features that enable rapid deployment and scalable expansion. At its core, the platform is constructed on a modular framework, empowering FIs to adopt and scale services in alignment with their evolving needs. This modular approach, complemented by cloud-based infrastructure, enables neobanks and fintechs to commence operations on a modest scale and seamlessly ramp up resources as demand grows, all without substantial upfront investments.

Key operational features include real-time processing capabilities, ensuring swift and efficient execution of all banking operations. Moreover, the cloud infrastructure guarantees scalability and security, robustly supporting operations even amidst fluctuating demand. With Plug& BaaS's comprehensive suite of operational tools, FIs can confidently navigate the path to rapid launch and scalable growth, all while maintaining operational excellence and customer satisfaction.

Accelerating digital transformation with an SaaS model

Synpulse has achieved its fastest-ever implementation of the Avaloq Core Platform for a bank, deploying it on the cloud using a software-as-a-service (SaaS) model. This accomplishment is a significant milestone in the client's digital transformation journey, benefiting from Synpulse's unique integration layer and utilisation of open-source components. With Synpulse's Plug& BaaS, the bank gains the flexibility to expand into various business areas as a licensed online bank.

Utilising the Avaloq Core Platform enables the bank to function as a digital bank while ensuring full compliance with regulatory bodies, such as Austria's Financial Market Authority (FMA) and Germany's Federal Financial Supervisory Authority (BaFin). This empowers the bank to continue driving innovation within Europe's financial sector. The core banking system provided by Avaloq automates and streamlines essential processes across the bank's front, middle, and back offices, encompassing client onboarding, payments, and settlement. This results in high straight-through processing (STP) and service accuracy rates, thereby enhancing the overall efficiency of the bank's operations.

Synchronising with the pulse of innovation

In the ever-evolving banking industry, platforms like Plug& BaaS are positioned to be key drivers of future innovation. The shift towards digital-only banking solutions is expected to gain momentum, prompting more FIs to embrace cloud-based platforms in order to meet the rising expectations of customers for seamless experiences and personalised services.

Plug& BaaS is committed to staying at the forefront of fintech advancements, with a strong emphasis on AI-driven solutions and the ability to swiftly adapt to emerging industry trends. By prioritising innovation, the platform ensures that fintechs and neobanks can deliver tailored, efficient services that cater to the evolving needs of customers.

Furthermore, as Plug& BaaS continues to forge new partnerships and expand its ecosystem, it will further redefine the financial landscape, making it more accessible, secure, and user-centric. By synchronising with the pulse of innovation, Plug& BaaS is well-positioned to shape the future of banking, driving positive change and enabling FIs to thrive in a rapidly evolving digital environment.

For more information on Plug& BaaS, get in touch with our experts today.