Loading Insight...

Insights

Insights

This paper illustrates the importance of industrialisation from the point of view of providing a fully digital client advisory service.

Synpulse has created a market radar of the current state of different industry players and made predictions about optimal operating models of banks in the future. The analysis measures the industrialisation degree in the private wealth management sector in Asia and indicates a trend towards a digital client advisory proposition.

We also defined the target operating model in the industry and assigned target states to different market participants, depending on their current positions.

Banks lag behind in industrialisation

The private wealth management industry in Asia is no longer enjoying large profit margins due to the pressure on commission-based pricing and increasing operational costs. The last decade has been a period of a sole focus on growth, and, today, many private banks are finding themselves trapped with inefficient business models and aging infrastructure as a result.

Instead of long-term strategic investments into their back-end processes, banks took short-term tactical measures to launch products and meet regulatory requirements with minimal infrastructure investment. As a result, many front-to-back processes have grown in complexity and size.

Fundamentally, investments into client-facing channels and new products aim to improve client satisfaction. But, however noble the goal, the provision of services this way is unsustainable, and the ever-increasing rate of new products leads to skyrocketing operating costs. It is time for banks to industrialise their infrastructure and regain control of rising operating costs.

According to a study by Gartner,1 only 20% of traditional firms in the whole financial services industry will remain successful amidst intensifying competition. Although the study focused on the broader industry, it is our opinion that key conclusions apply to the private wealth management sector as well. A similar view was previously highlighted in our article “How to Survive the Perfect Storm: A Perspective from an Ailing Private Bank in Asia”.1

The Gartner study classified leading banks into three different types:

- Banking giants. Banking giants have relatively lower operational costs due to existing scale and large, compounded investments into their platforms and infrastructures. Only 5% of banks have the skills, resources, and scale to become banking giants, the third-party providers of banking services in the future.

- Fintechs or specialised service providers. These smaller firms will each specialise in a discrete segment of the traditional financial services value chain. The utilisation of cutting-edge technology and community development will allow them to scale quickly. Less than 15% of traditional banks can transition to this category due to its narrow service offering and the level of innovation and agility required.

- Long-tail firms. These are banks subscribing to third-party banking platforms to save the maintenance costs of individual platforms. Their focus will lie on superior customer service. Around 80% of banks will transform into client relationship-oriented organisation characterised by lean operations.

The three types of banks collectively share a high degree of sourcing and specialisation to achieve industrialisation. To remain competitive, banks must choose their industrialisation strategy carefully to provide the customer journey of tomorrow effectively and cost-efficiently.

The future advisory journey

The private wealth management client journey is undergoing a period of change and will be transformed along with the underlying platform. A banking platform would typically consist of technologies, products, and a regulatory and compliance framework. A strong platform would cater to different functions: order management system (OMS), research, back-end infrastructure, reporting, and communication facilities. By adopting such a platform, the front-office and back-office activities will become leaner to provide better client service and experience.

The ideal client advisory journey is based on a robust platform to cater to a differentiated client experience. Clients would interact through a fully integrated wealth management platform to receive the complete private banking experience. The client advisor layer may encompass either an in-house relationship manager or an external financial advisor. These client advisors are enabled to deliver their services by the platform providers. Platform providers may be fintechs or banks that have the necessary environment to deliver the core services a client needs.

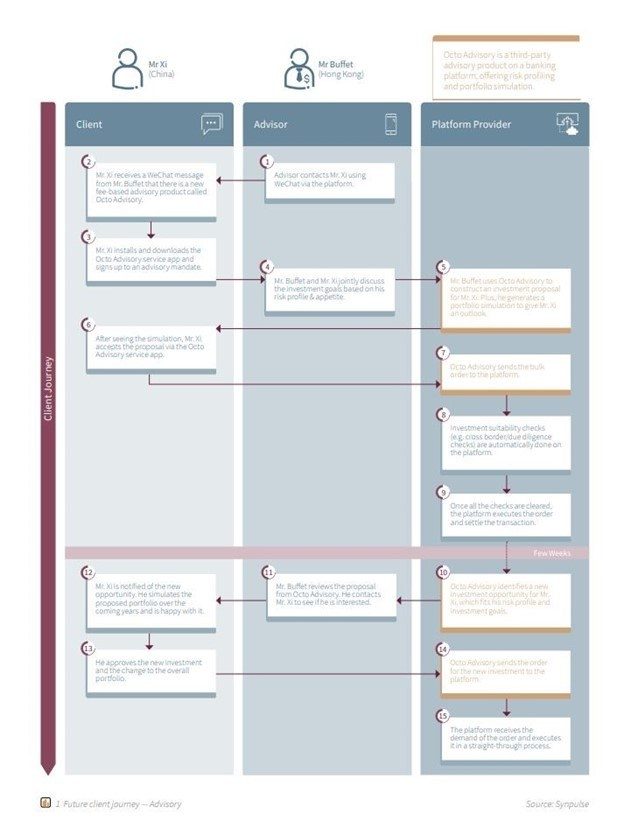

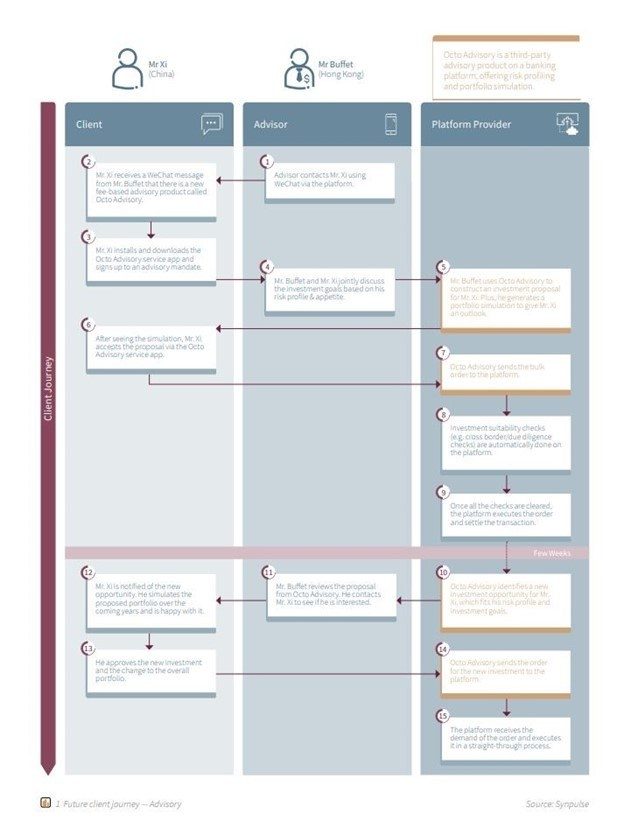

Our view of the advisory journey of tomorrow is described below (see Figure 1). The private banking client (Mr. Xi) is connected with his client advisor (Mr. Buffet) over WeChat. Mr. Buffet unlocks an extremely wide and diverse category of banking services — unlimited by the size of his firm or any restriction on the client segmentation, such as assets under management (AUM) — by subscribing to a private banking platform service. A large, third-party banking provider offers the platform as a service.

In this illustration, Mr. Xi receives an invitation from Mr. Buffet to start using a new service application, Octo Advisory, a bionic-advisory application that comes with portfolio simulation. The Octo Advisory banking platform is fully integrated with WeChat, allowing clients to communicate with their advisors in a compliant yet convenient way. The application allows the parties to discuss and define investment strategy, as well as authorise its execution with an electronic sign-off by Mr. Xi. The information will be passed straight through to the third-party platform provider for processing.

The implementation of the investment proposal, including the execution of transactions, is done through the wealth management platform. The platform provider may either serve as an execution desk themselves or connect to another third-party desk to execute the trades.

Compliance checks, as well as surveillance, are both conducted automatically, with no continuous supervision required. This future state operating model takes advantage of harmonised and standardised processes executed on a fully integrated platform used by multiple parties involved in the investment advisory process.

Automation is everywhere, from retrieving the instructions from Octo Advisory” to suitability assessment and regulatory checks powered by embedded application suites, and to the execution and settlement by the platform provider, the process minimises manual work and requires little monitoring.

Figure 1. Future client journey in advisory

In summary, the ideal client advisory journey describes a scenario, wherein multiple parties from different firms across all three layers, including the client, client advisor, and platform provider, work seamlessly together. The foundation for this is the next-generation operating model.

Current state of the next-generation operating model

Next-generation operating model and its assessment criteria

Financial service providers want to enhance services for clients but do it at a minimal increase of operational costs. They want to be agile, yet compliant. Whilst they are all working towards the same goal, there are many ways to approach the problem. To gain scale and profit from investments made by other players in the market, firms should explore partnership and sourcing options (i.e., rent a system or infrastructure, rather than build or buy).

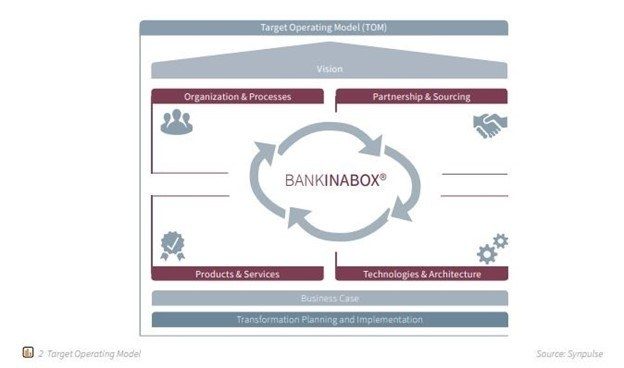

The next-generation operating model introduced by Synpulse offers banks maximum agility, a modular-yet-connected platform, a best-fit sourcing strategy, and process control. The infrastructure investment to reach the target operating model of the future will be considerable, but its necessity cannot be understated in a market flooded by lightning-fast, lean challengers with infrastructure to match.

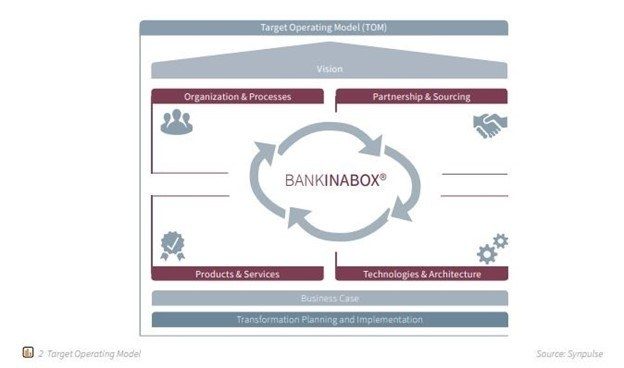

Ultimately, financial service providers that will achieve the target state will gain access to efficient business processes due to an enabling infrastructure and high agility in operation (see Figure 2).

Figure 2. Target operating model

The approach in this paper looks at the four key pillars to achieve the target state, such as:3

- Organisation and processes. This focuses on current processes and measures them against quantitative and qualitative targets to identify bottlenecks and redundant activities. It suggests optimisation options and highlights necessary organisational changes for more open and agile management.

- Products and services. This explores opportunities to extend product and service offerings and to improve time-to-market. It exposes functional gaps in the current IT system landscape and advises on high-level business requirements to support new products and services.

- Technologies and architecture. This revolves around the analysis of the current application landscape and IT infrastructure. A more open and connected infrastructure will help the bank to realise and leverage new technologies at a faster pace.

- Partnership and sourcing. This addresses the search for the right vendor or tool to perform the vendor’s due diligence. In the future, open infrastructure will allow easy and seamless access to different service providers. A proper partnership and sourcing management will become vital when making strategic decisions.

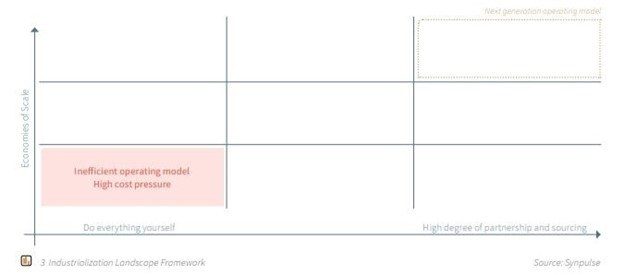

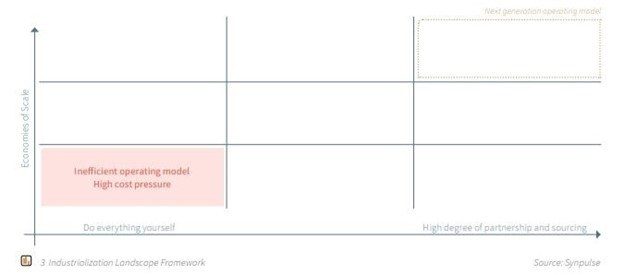

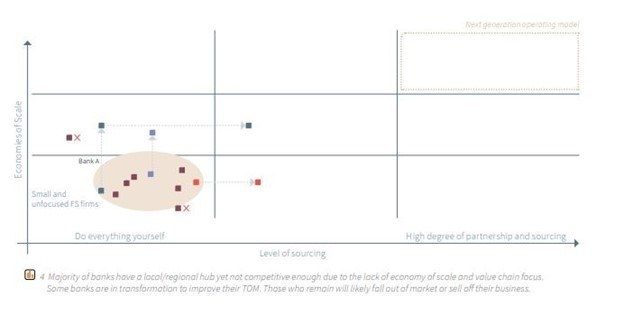

Through examination of the four pillars, Synpulse conducted a survey to assess where the private banks’ operating models stand today. Bank names are anonymised for confidentiality. The findings are presented in the following graph (see Figure 3), with the definition of the axes, as follows:

- Economies of scale (y-axis). This is defined as the reduced cost per unit that arises from the increased total output of a product or service. In the future, established players will be capable to offer product, process, and infrastructure as a service (PaaS, IaaS, etc.) to other businesses, which is also why this “as a service” model will be considered as part of the total output.

- Degree of partnership and sourcing (x-axis). This typically focuses on resource optimisation, value chain decomposition (through sourcing), and products and services enhancement (through partnership). The degree normalises the ratio of product and service of one firm involved in sourcing and partnership activities, with all the product and service offerings in the market. If the offering of a firm is very minimal, it is subjected to fewer partner and sourcing activities. Hence, the total amount of available products and services in the whole industry is factored in.

Figure 3. Industrialisation landscape framework

Banks equipped with the next-generation operating model will achieve economies of scale due to a high degree of partnership and sourcing (top right), whilst the operating model at the lower left will suffer from high-cost pressure. Our previous study found that if private banks do not change their operating model and do not industrialise, they will spend approximately USD 9.4 billion on operational costs by 20204. Non-industrialised banks will struggle and face pressure to either consolidate or sell off their business.

Not all industry players are equal — three clusters to cover the majority of players

In terms of the level of sourcing, many banks are still located at the lower end of the spectrum due to a suboptimal operational model and the high maintenance costs of aging in-house infrastructure. This misalignment has left banks unable to tap into the top-line growth in the private wealth management industry.

Typical banks within this cluster will stagnate at most USD 20 billion of AUM in the Asia-Pacific regions. In this cluster, Bank A, for example, aims to achieve economies of scale through mergers and acquisitions (M&A) with other banks (see Figure 4). Whilst this can lead to better economies of scale, in theory, the level of partnership and sourcing is often limited. This is because the consolidation of companies may take time and cause a time lag in value realisation.

Whilst some banks decide to merge, others may prefer increasing their level of external sourcing via partnerships. Outsourcing allows external expertise and capabilities to be utilised for the non-revenue-producing parts of a bank’s value chain whilst keeping the core competencies in-house. As a result, banks will be able to offload some of their operating costs to external vendors and optimise their revenues by focusing on their key strengths.

Figure 4. A sample of a bank that would want to achieve economies of scale through M&A

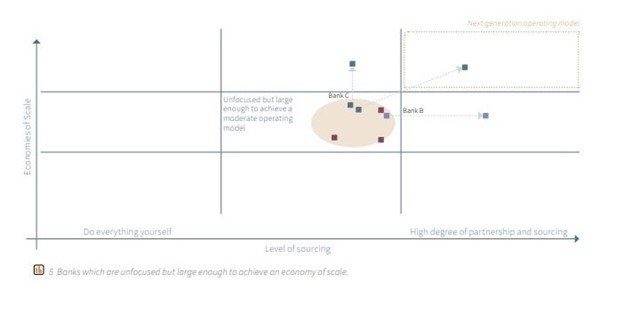

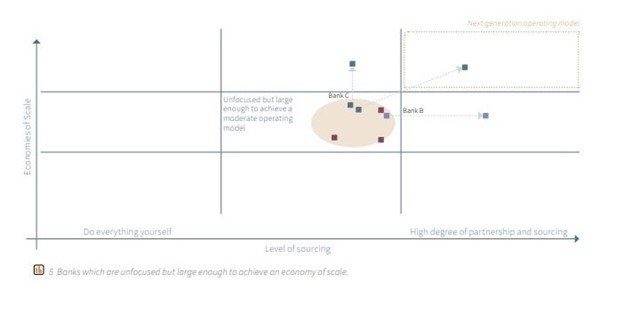

Some banks’ operating models are well-established on a regional level (see Figure 5). Although these banks do not necessarily have a clear business focus, they are large enough to achieve economies of scale. Therefore, the cost pressures they face are manageable today.

Bank B, in this case, decided to grow its business on a regional level. Through business process outsourcing, more resources are allocated to its core strength, brokerage services. On the other hand, some banks, such as Bank C, aim to achieve a superb, global customer experience. With strong IT platforms and well-designed governance and processes, efficient insourcing will help these players to leverage economies of scale. These banks are better positioned for incremental evolution of their operating models towards the next generation.

Figure 5. Banks that are unfocused but large enough to achieve an economy of scale

The last cluster covers mainly the non-traditional banks in the industry (see Figure 6). Players can be external asset or fund managers, family offices, challenger banks, or even tech giants like Alibaba or Tencent. They are becoming a threat to traditional banks, not only because of disruptive technologies but also due to their increasing numbers. Albeit their technologies and niche focus put them at a great advantage, these players are not yet able to offer the full variety of private banking products and services that higher-net-worth clients have come to expect.

Similarly, the regulatory requirements of various financial services licences pose a significant challenge to these players, creating a barrier to entry into the industry.

Figure 6. Industry’s non-traditional banks

Supposing that the traditional private banks demand for disruptive technologies, and the niche challengers long for broader wealth management services expertise, the picture becomes clear that collaboration and joint ventures or mergers will maximise the industry utility for a win-win situation. Once players are connected to an open network, the as-a-service model can be widely used.

“A possible alternative for smaller private banks to ride the tech wave is to rent a [technology] platform from bigger players,” said Kathryn Shih, APAC President of UBS, in an interview.5 In the future, big players can lend their platform, business processes, and infrastructure to smaller players for mutual benefit. The result is precisely the four seamlessly integrated layers mentioned in the client journey, where each layer is an ecosystem by itself.

Conclusion

Industrialisation through a centralised platform can help private banks and other financial service firms, such as independent financial advisors or external asset managers, to prepare for the future where the as-a-service banking model becomes the new norm.

The as-a-service model helps banks meet the changing client expectations, adapt to varying business needs, and adopt new technologies. Properly positioned and implemented, private banks can prioritise their resources on what really drives their businesses. Some specialise in client services and utilise third-party solutions to substitute their costly operational functions, whilst others can benefit from economies of scale by offering their highly efficient services, such as the product and trade life cycle, to other banks or fintech.

Banking will become a service provided on a platform, offering any private banking or wealth management firm any specific service along the value chain. Its core is the collaboration with external partners to deliver the state-of-the-art digital advisory journey with a human touch, which the private banking clients are looking for.

This paper illustrates the importance of industrialisation from the point of view of providing a fully digital client advisory service.

Synpulse has created a market radar of the current state of different industry players and made predictions about optimal operating models of banks in the future. The analysis measures the industrialisation degree in the private wealth management sector in Asia and indicates a trend towards a digital client advisory proposition.

We also defined the target operating model in the industry and assigned target states to different market participants, depending on their current positions.

Banks lag behind in industrialisation

The private wealth management industry in Asia is no longer enjoying large profit margins due to the pressure on commission-based pricing and increasing operational costs. The last decade has been a period of a sole focus on growth, and, today, many private banks are finding themselves trapped with inefficient business models and aging infrastructure as a result.

Instead of long-term strategic investments into their back-end processes, banks took short-term tactical measures to launch products and meet regulatory requirements with minimal infrastructure investment. As a result, many front-to-back processes have grown in complexity and size.

Fundamentally, investments into client-facing channels and new products aim to improve client satisfaction. But, however noble the goal, the provision of services this way is unsustainable, and the ever-increasing rate of new products leads to skyrocketing operating costs. It is time for banks to industrialise their infrastructure and regain control of rising operating costs.

According to a study by Gartner,1 only 20% of traditional firms in the whole financial services industry will remain successful amidst intensifying competition. Although the study focused on the broader industry, it is our opinion that key conclusions apply to the private wealth management sector as well. A similar view was previously highlighted in our article “How to Survive the Perfect Storm: A Perspective from an Ailing Private Bank in Asia”.1

The Gartner study classified leading banks into three different types:

- Banking giants. Banking giants have relatively lower operational costs due to existing scale and large, compounded investments into their platforms and infrastructures. Only 5% of banks have the skills, resources, and scale to become banking giants, the third-party providers of banking services in the future.

- Fintechs or specialised service providers. These smaller firms will each specialise in a discrete segment of the traditional financial services value chain. The utilisation of cutting-edge technology and community development will allow them to scale quickly. Less than 15% of traditional banks can transition to this category due to its narrow service offering and the level of innovation and agility required.

- Long-tail firms. These are banks subscribing to third-party banking platforms to save the maintenance costs of individual platforms. Their focus will lie on superior customer service. Around 80% of banks will transform into client relationship-oriented organisation characterised by lean operations.

The three types of banks collectively share a high degree of sourcing and specialisation to achieve industrialisation. To remain competitive, banks must choose their industrialisation strategy carefully to provide the customer journey of tomorrow effectively and cost-efficiently.

The future advisory journey

The private wealth management client journey is undergoing a period of change and will be transformed along with the underlying platform. A banking platform would typically consist of technologies, products, and a regulatory and compliance framework. A strong platform would cater to different functions: order management system (OMS), research, back-end infrastructure, reporting, and communication facilities. By adopting such a platform, the front-office and back-office activities will become leaner to provide better client service and experience.

The ideal client advisory journey is based on a robust platform to cater to a differentiated client experience. Clients would interact through a fully integrated wealth management platform to receive the complete private banking experience. The client advisor layer may encompass either an in-house relationship manager or an external financial advisor. These client advisors are enabled to deliver their services by the platform providers. Platform providers may be fintechs or banks that have the necessary environment to deliver the core services a client needs.

Our view of the advisory journey of tomorrow is described below (see Figure 1). The private banking client (Mr. Xi) is connected with his client advisor (Mr. Buffet) over WeChat. Mr. Buffet unlocks an extremely wide and diverse category of banking services — unlimited by the size of his firm or any restriction on the client segmentation, such as assets under management (AUM) — by subscribing to a private banking platform service. A large, third-party banking provider offers the platform as a service.

In this illustration, Mr. Xi receives an invitation from Mr. Buffet to start using a new service application, Octo Advisory, a bionic-advisory application that comes with portfolio simulation. The Octo Advisory banking platform is fully integrated with WeChat, allowing clients to communicate with their advisors in a compliant yet convenient way. The application allows the parties to discuss and define investment strategy, as well as authorise its execution with an electronic sign-off by Mr. Xi. The information will be passed straight through to the third-party platform provider for processing.

The implementation of the investment proposal, including the execution of transactions, is done through the wealth management platform. The platform provider may either serve as an execution desk themselves or connect to another third-party desk to execute the trades.

Compliance checks, as well as surveillance, are both conducted automatically, with no continuous supervision required. This future state operating model takes advantage of harmonised and standardised processes executed on a fully integrated platform used by multiple parties involved in the investment advisory process.

Automation is everywhere, from retrieving the instructions from Octo Advisory” to suitability assessment and regulatory checks powered by embedded application suites, and to the execution and settlement by the platform provider, the process minimises manual work and requires little monitoring.

Figure 1. Future client journey in advisory

In summary, the ideal client advisory journey describes a scenario, wherein multiple parties from different firms across all three layers, including the client, client advisor, and platform provider, work seamlessly together. The foundation for this is the next-generation operating model.

Current state of the next-generation operating model

Next-generation operating model and its assessment criteria

Financial service providers want to enhance services for clients but do it at a minimal increase of operational costs. They want to be agile, yet compliant. Whilst they are all working towards the same goal, there are many ways to approach the problem. To gain scale and profit from investments made by other players in the market, firms should explore partnership and sourcing options (i.e., rent a system or infrastructure, rather than build or buy).

The next-generation operating model introduced by Synpulse offers banks maximum agility, a modular-yet-connected platform, a best-fit sourcing strategy, and process control. The infrastructure investment to reach the target operating model of the future will be considerable, but its necessity cannot be understated in a market flooded by lightning-fast, lean challengers with infrastructure to match.

Ultimately, financial service providers that will achieve the target state will gain access to efficient business processes due to an enabling infrastructure and high agility in operation (see Figure 2).

Figure 2. Target operating model

The approach in this paper looks at the four key pillars to achieve the target state, such as:3

- Organisation and processes. This focuses on current processes and measures them against quantitative and qualitative targets to identify bottlenecks and redundant activities. It suggests optimisation options and highlights necessary organisational changes for more open and agile management.

- Products and services. This explores opportunities to extend product and service offerings and to improve time-to-market. It exposes functional gaps in the current IT system landscape and advises on high-level business requirements to support new products and services.

- Technologies and architecture. This revolves around the analysis of the current application landscape and IT infrastructure. A more open and connected infrastructure will help the bank to realise and leverage new technologies at a faster pace.

- Partnership and sourcing. This addresses the search for the right vendor or tool to perform the vendor’s due diligence. In the future, open infrastructure will allow easy and seamless access to different service providers. A proper partnership and sourcing management will become vital when making strategic decisions.

Through examination of the four pillars, Synpulse conducted a survey to assess where the private banks’ operating models stand today. Bank names are anonymised for confidentiality. The findings are presented in the following graph (see Figure 3), with the definition of the axes, as follows:

- Economies of scale (y-axis). This is defined as the reduced cost per unit that arises from the increased total output of a product or service. In the future, established players will be capable to offer product, process, and infrastructure as a service (PaaS, IaaS, etc.) to other businesses, which is also why this “as a service” model will be considered as part of the total output.

- Degree of partnership and sourcing (x-axis). This typically focuses on resource optimisation, value chain decomposition (through sourcing), and products and services enhancement (through partnership). The degree normalises the ratio of product and service of one firm involved in sourcing and partnership activities, with all the product and service offerings in the market. If the offering of a firm is very minimal, it is subjected to fewer partner and sourcing activities. Hence, the total amount of available products and services in the whole industry is factored in.

Figure 3. Industrialisation landscape framework

Banks equipped with the next-generation operating model will achieve economies of scale due to a high degree of partnership and sourcing (top right), whilst the operating model at the lower left will suffer from high-cost pressure. Our previous study found that if private banks do not change their operating model and do not industrialise, they will spend approximately USD 9.4 billion on operational costs by 20204. Non-industrialised banks will struggle and face pressure to either consolidate or sell off their business.

Not all industry players are equal — three clusters to cover the majority of players

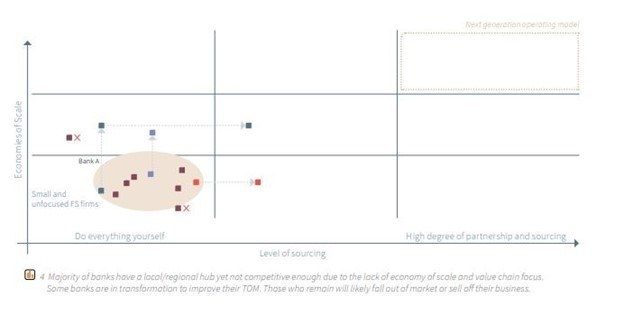

In terms of the level of sourcing, many banks are still located at the lower end of the spectrum due to a suboptimal operational model and the high maintenance costs of aging in-house infrastructure. This misalignment has left banks unable to tap into the top-line growth in the private wealth management industry.

Typical banks within this cluster will stagnate at most USD 20 billion of AUM in the Asia-Pacific regions. In this cluster, Bank A, for example, aims to achieve economies of scale through mergers and acquisitions (M&A) with other banks (see Figure 4). Whilst this can lead to better economies of scale, in theory, the level of partnership and sourcing is often limited. This is because the consolidation of companies may take time and cause a time lag in value realisation.

Whilst some banks decide to merge, others may prefer increasing their level of external sourcing via partnerships. Outsourcing allows external expertise and capabilities to be utilised for the non-revenue-producing parts of a bank’s value chain whilst keeping the core competencies in-house. As a result, banks will be able to offload some of their operating costs to external vendors and optimise their revenues by focusing on their key strengths.

Figure 4. A sample of a bank that would want to achieve economies of scale through M&A

Some banks’ operating models are well-established on a regional level (see Figure 5). Although these banks do not necessarily have a clear business focus, they are large enough to achieve economies of scale. Therefore, the cost pressures they face are manageable today.

Bank B, in this case, decided to grow its business on a regional level. Through business process outsourcing, more resources are allocated to its core strength, brokerage services. On the other hand, some banks, such as Bank C, aim to achieve a superb, global customer experience. With strong IT platforms and well-designed governance and processes, efficient insourcing will help these players to leverage economies of scale. These banks are better positioned for incremental evolution of their operating models towards the next generation.

Figure 5. Banks that are unfocused but large enough to achieve an economy of scale

The last cluster covers mainly the non-traditional banks in the industry (see Figure 6). Players can be external asset or fund managers, family offices, challenger banks, or even tech giants like Alibaba or Tencent. They are becoming a threat to traditional banks, not only because of disruptive technologies but also due to their increasing numbers. Albeit their technologies and niche focus put them at a great advantage, these players are not yet able to offer the full variety of private banking products and services that higher-net-worth clients have come to expect.

Similarly, the regulatory requirements of various financial services licences pose a significant challenge to these players, creating a barrier to entry into the industry.

Figure 6. Industry’s non-traditional banks

Supposing that the traditional private banks demand for disruptive technologies, and the niche challengers long for broader wealth management services expertise, the picture becomes clear that collaboration and joint ventures or mergers will maximise the industry utility for a win-win situation. Once players are connected to an open network, the as-a-service model can be widely used.

“A possible alternative for smaller private banks to ride the tech wave is to rent a [technology] platform from bigger players,” said Kathryn Shih, APAC President of UBS, in an interview.5 In the future, big players can lend their platform, business processes, and infrastructure to smaller players for mutual benefit. The result is precisely the four seamlessly integrated layers mentioned in the client journey, where each layer is an ecosystem by itself.

Conclusion

Industrialisation through a centralised platform can help private banks and other financial service firms, such as independent financial advisors or external asset managers, to prepare for the future where the as-a-service banking model becomes the new norm.

The as-a-service model helps banks meet the changing client expectations, adapt to varying business needs, and adopt new technologies. Properly positioned and implemented, private banks can prioritise their resources on what really drives their businesses. Some specialise in client services and utilise third-party solutions to substitute their costly operational functions, whilst others can benefit from economies of scale by offering their highly efficient services, such as the product and trade life cycle, to other banks or fintech.

Banking will become a service provided on a platform, offering any private banking or wealth management firm any specific service along the value chain. Its core is the collaboration with external partners to deliver the state-of-the-art digital advisory journey with a human touch, which the private banking clients are looking for.