Loading Insight...

Insights

Insights

Open Banking will revolutionize Canada's financial landscape, empowering consumers and reshaping traditional banking models. As the nation looks forward to its full implementation, we will delve into its expected timeline, along with the impact, challenges, and approach to a new financial era.

Open Banking is on track to become a transformational force in the financial services industry. By disrupting the “one institution, one set of data” norm and establishing data sharing between financial institutions (FIs), the paradigm of financial services will shift and empower consumer choice, increase competitive intensity and regulatory standardization.

The Canadian Open Banking journey

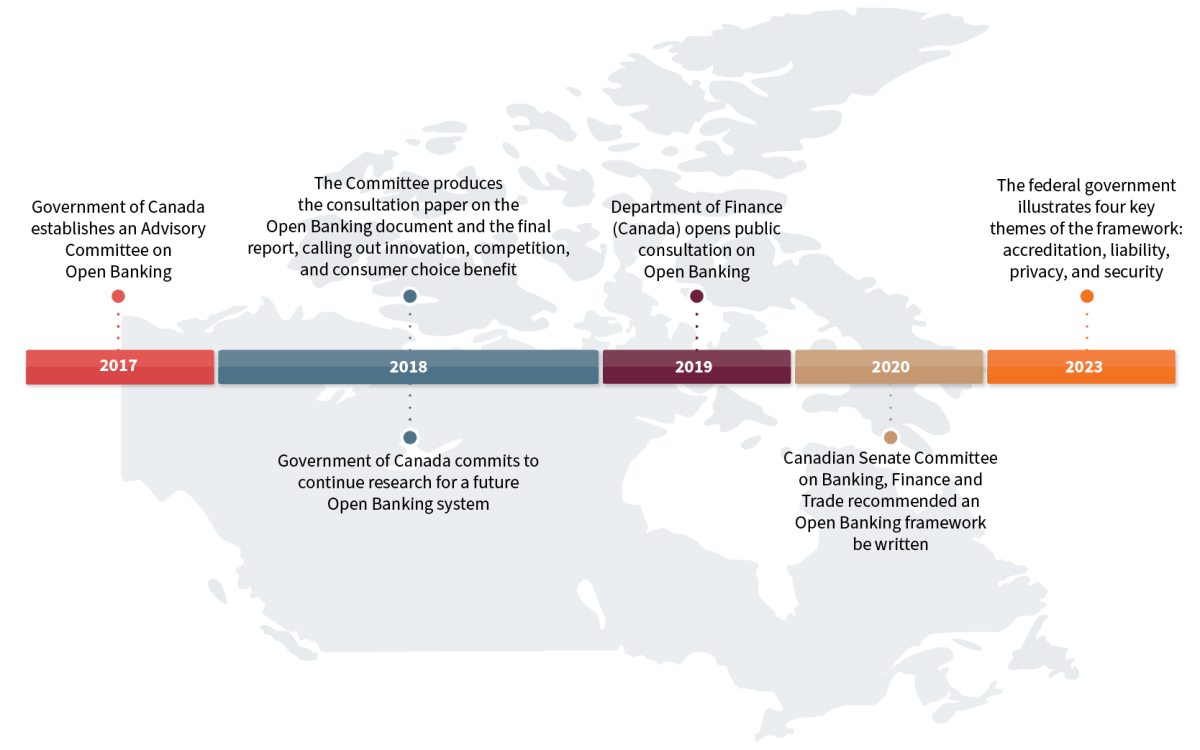

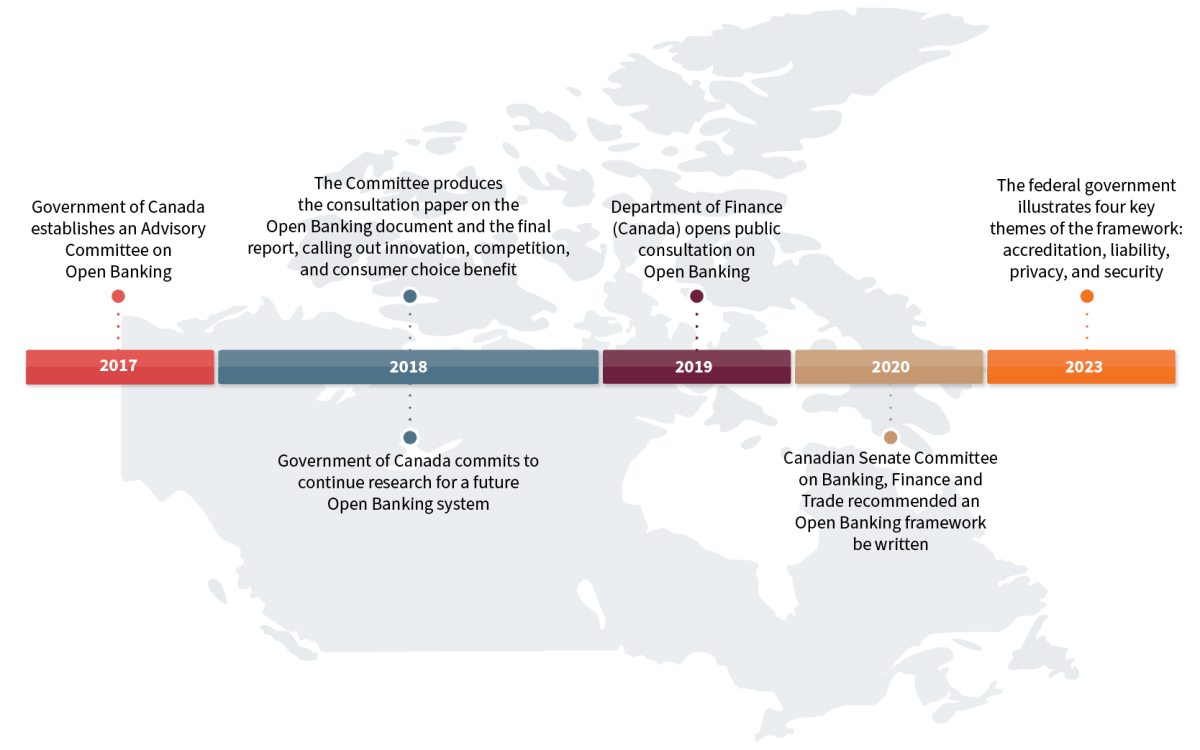

With the establishment of the Federal Advisory Committee, Canadian FIs and consumers have been anticipating a federal approach to Open Banking since 2017. However, the Canadian FIs are not yet ready for the delivery of the national Open Banking framework. This timeline will illustrate the expected timeframe, the public-private approach, and the preliminary architecture of Open Banking in Canada.

Figure 1: The timeline of Open Banking in Canada

While the implementation of Open Banking is still in the early stages, it will significantly impact consumers, FIs, and regulators in Canada. FIs must act swiftly as completing the framework will rapidly revolutionize the sector. To prevent market share loss, they should plan technology updates alongside regulatory changes.

Navigating the opportunities and challenges

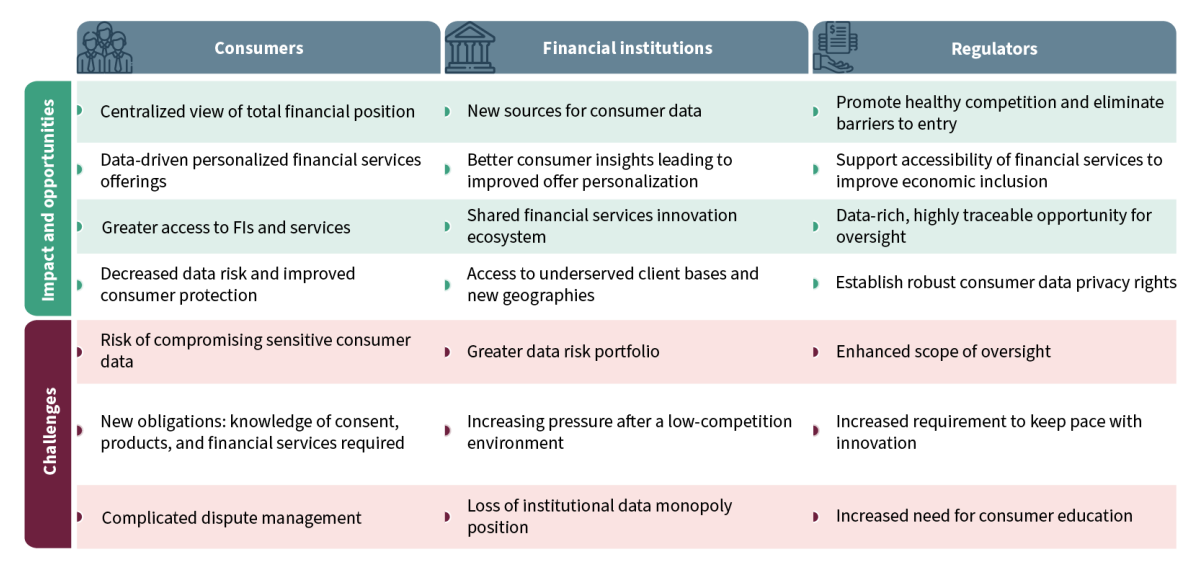

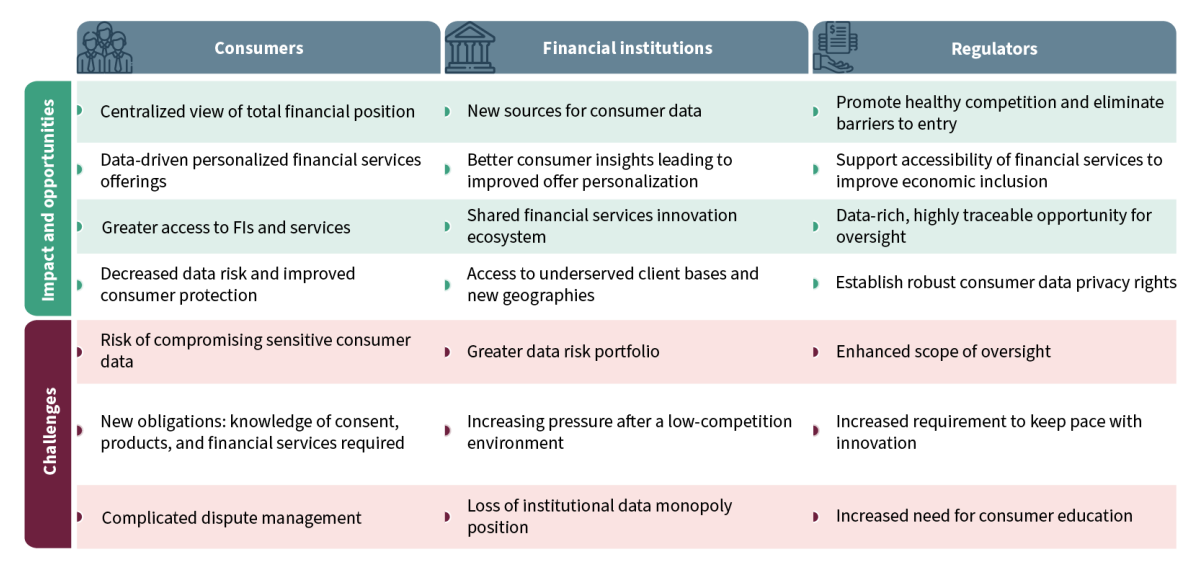

Open Banking presents a multitude of opportunities and advantages by fostering transparency, personalization, competition, accessibility, cybersecurity, and innovation. But despite the evident benefits, there are several challenges associated with Open Banking.

Figure 2: Opportunities vs. challenges in Open Banking

Consumers, FIs, and regulators will face challenges with the implementation of Open Banking. However, FIs can begin to overcome these challenges and leverage them for competitive advantage.

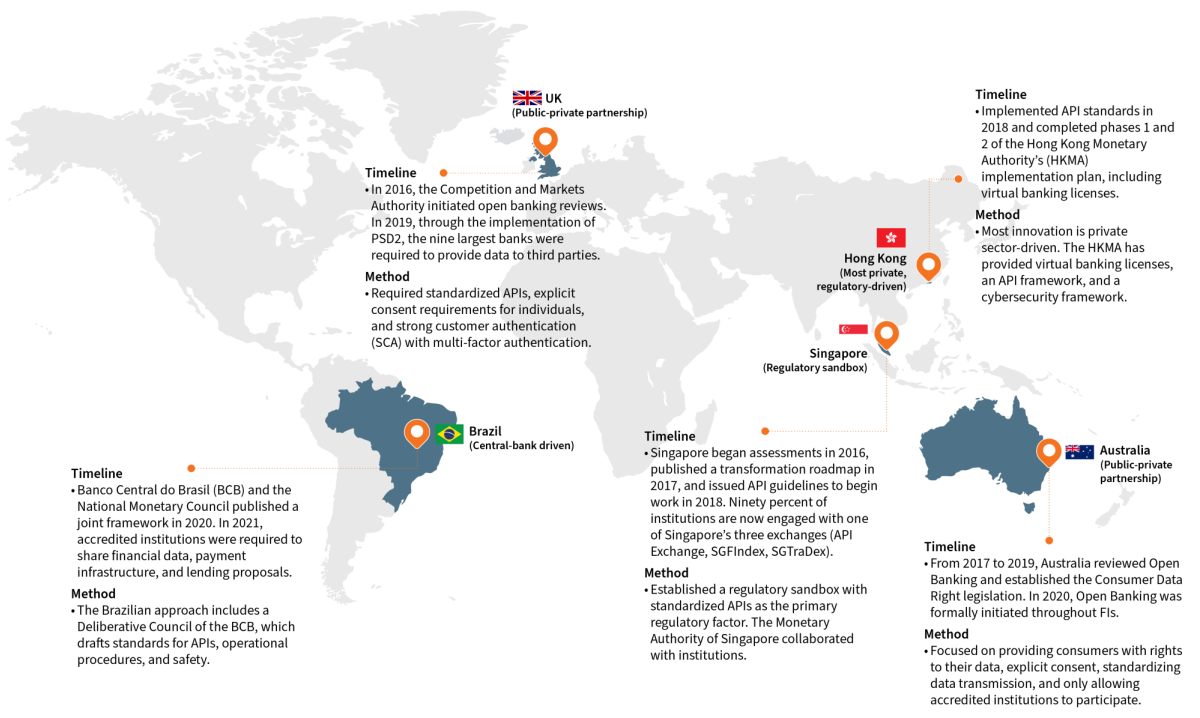

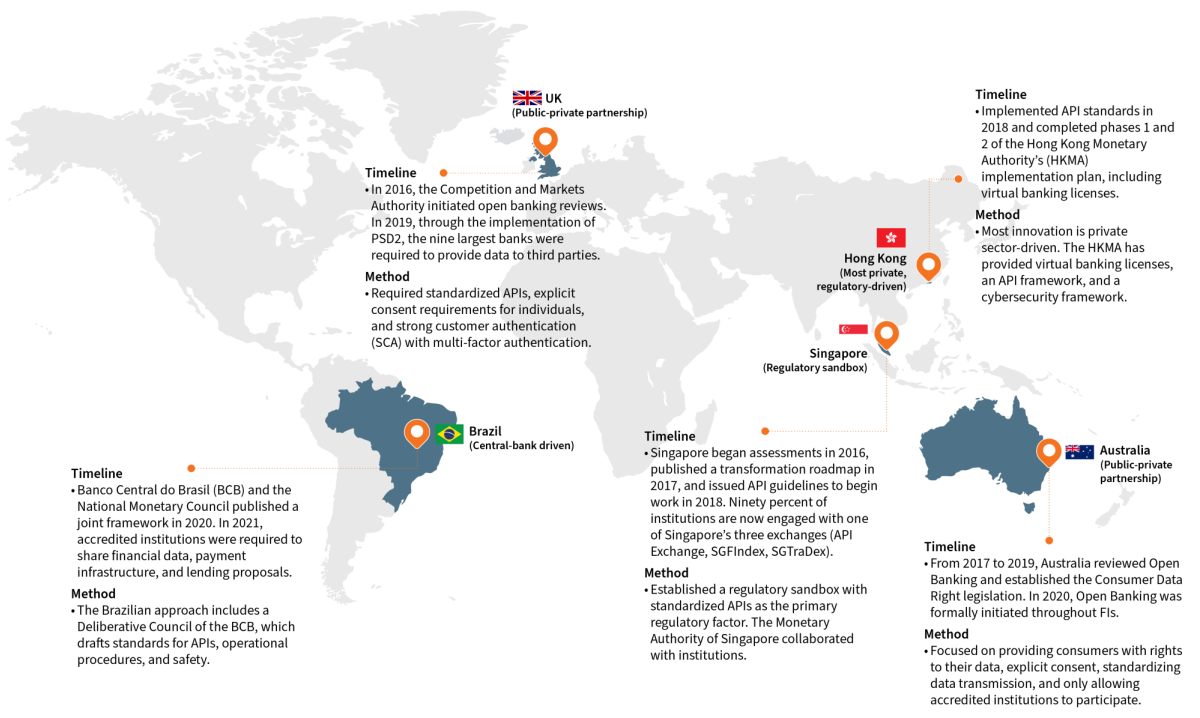

One of the biggest challenges of navigating Open Banking in Canada is the uncertainty faced by an incomplete federal Open Banking strategy. Canadian FIs can prepare for the regulatory structure by applying lessons learned from early adopter nations.

Learning from global pioneers

Figure 3: Early adopter nations in Open Banking

Key shared outcomes:

- Growth of the fintech sector: increased innovation in financial services

- Increased competition with new account offerings: account aggregation, budgeting, and lending

- Rise of empowered consumers: ownership of data, improved consumer choice, new access to credit

These early adoption cases exemplify the transformative potential of Open Banking on a global scale. Canadian FIs can use these cases as a playbook for the development of a domestic Open Banking ecosystem.

Embracing an ecosystem approach

The benefits of established Open Banking ecosystems in global pioneer nations have been rapidly growing fintech sectors, increased competition amongst FIs and empowered consumers. To capture these benefits, FIs should consider the following practical elements from a consumer, FI, and regulatory lens.

Consumers

- Educate consumers regarding data sharing and consent

- Clarify benefits and risks, including data control

- Encourage them to demonstrate demand, including in pilots

- Familiarize consumers with regulatory bodies

Financial Institutions

- Begin planning for secure API construction

- Establish partnerships with innovative fintechs

- Consider the establishment of fintech incubation programmes

- Communicate and collaborate with regulatory bodies

Regulators

- Provide an entrepreneurial environment for FIs to develop the ecosystem

- Support the creation of policies around data security, privacy, and trust

- Complete the Open Banking framework with consideration for API standardization and accreditation platforms

The key to a successful Open Banking implementation is an ecosystem approach. To build that ecosystem, consumers, FIs, and regulators need to take joint initiative to embrace Open Banking.

Navigating the new financial ecosystem

The pathway towards a successful Open Banking ecosystem in Canada is complex and challenging to implement. However, the benefits far outweigh the risks. To provide consumers with unprecedented choice and freedom, institutions need to keep pace with the rapid, regulatory-driven rate of change to maintain their position on the development of cutting-edge financial products and technology.

Open Banking will revolutionize Canada's financial landscape, empowering consumers and reshaping traditional banking models. As the nation looks forward to its full implementation, we will delve into its expected timeline, along with the impact, challenges, and approach to a new financial era.

Open Banking is on track to become a transformational force in the financial services industry. By disrupting the “one institution, one set of data” norm and establishing data sharing between financial institutions (FIs), the paradigm of financial services will shift and empower consumer choice, increase competitive intensity and regulatory standardization.

The Canadian Open Banking journey

With the establishment of the Federal Advisory Committee, Canadian FIs and consumers have been anticipating a federal approach to Open Banking since 2017. However, the Canadian FIs are not yet ready for the delivery of the national Open Banking framework. This timeline will illustrate the expected timeframe, the public-private approach, and the preliminary architecture of Open Banking in Canada.

Figure 1: The timeline of Open Banking in Canada

While the implementation of Open Banking is still in the early stages, it will significantly impact consumers, FIs, and regulators in Canada. FIs must act swiftly as completing the framework will rapidly revolutionize the sector. To prevent market share loss, they should plan technology updates alongside regulatory changes.

Navigating the opportunities and challenges

Open Banking presents a multitude of opportunities and advantages by fostering transparency, personalization, competition, accessibility, cybersecurity, and innovation. But despite the evident benefits, there are several challenges associated with Open Banking.

Figure 2: Opportunities vs. challenges in Open Banking

Consumers, FIs, and regulators will face challenges with the implementation of Open Banking. However, FIs can begin to overcome these challenges and leverage them for competitive advantage.

One of the biggest challenges of navigating Open Banking in Canada is the uncertainty faced by an incomplete federal Open Banking strategy. Canadian FIs can prepare for the regulatory structure by applying lessons learned from early adopter nations.

Learning from global pioneers

Figure 3: Early adopter nations in Open Banking

Key shared outcomes:

- Growth of the fintech sector: increased innovation in financial services

- Increased competition with new account offerings: account aggregation, budgeting, and lending

- Rise of empowered consumers: ownership of data, improved consumer choice, new access to credit

These early adoption cases exemplify the transformative potential of Open Banking on a global scale. Canadian FIs can use these cases as a playbook for the development of a domestic Open Banking ecosystem.

Embracing an ecosystem approach

The benefits of established Open Banking ecosystems in global pioneer nations have been rapidly growing fintech sectors, increased competition amongst FIs and empowered consumers. To capture these benefits, FIs should consider the following practical elements from a consumer, FI, and regulatory lens.

Consumers

- Educate consumers regarding data sharing and consent

- Clarify benefits and risks, including data control

- Encourage them to demonstrate demand, including in pilots

- Familiarize consumers with regulatory bodies

Financial Institutions

- Begin planning for secure API construction

- Establish partnerships with innovative fintechs

- Consider the establishment of fintech incubation programmes

- Communicate and collaborate with regulatory bodies

Regulators

- Provide an entrepreneurial environment for FIs to develop the ecosystem

- Support the creation of policies around data security, privacy, and trust

- Complete the Open Banking framework with consideration for API standardization and accreditation platforms

The key to a successful Open Banking implementation is an ecosystem approach. To build that ecosystem, consumers, FIs, and regulators need to take joint initiative to embrace Open Banking.

Navigating the new financial ecosystem

The pathway towards a successful Open Banking ecosystem in Canada is complex and challenging to implement. However, the benefits far outweigh the risks. To provide consumers with unprecedented choice and freedom, institutions need to keep pace with the rapid, regulatory-driven rate of change to maintain their position on the development of cutting-edge financial products and technology.