Loading Insight...

Insights

Insights

In this article, we'll delve into the significance of transforming risk control using remote inspections, customer self-assessments, and data augmentation.

Risk control services are essential for assessing and mitigating operational risk while providing underwriters with vital risk insights. Traditionally, these services involved time-consuming and costly on-site inspections. This methodology depended on the total insured value (TIV), which ignored many risks that fall outside of the TIV threshold, leaving insurers with significant exposure. However, technological advances are revolutionising risk assessment and enhancing scalability.

Evolution and challenges of risk control

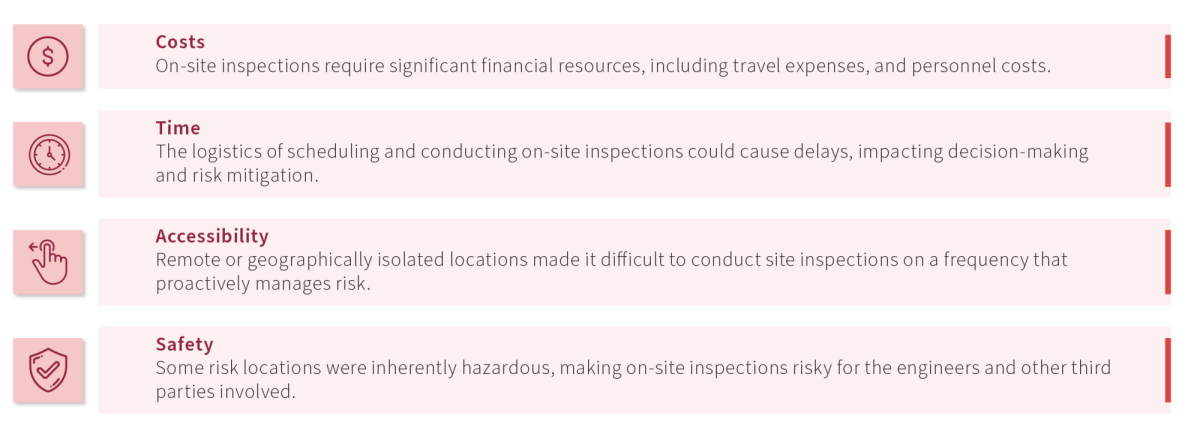

In the past, risk control professionals relied heavily on physical visits to evaluate and assess risk. While these on-site inspections were effective, they often posed several challenges.

Remote inspection and assessment

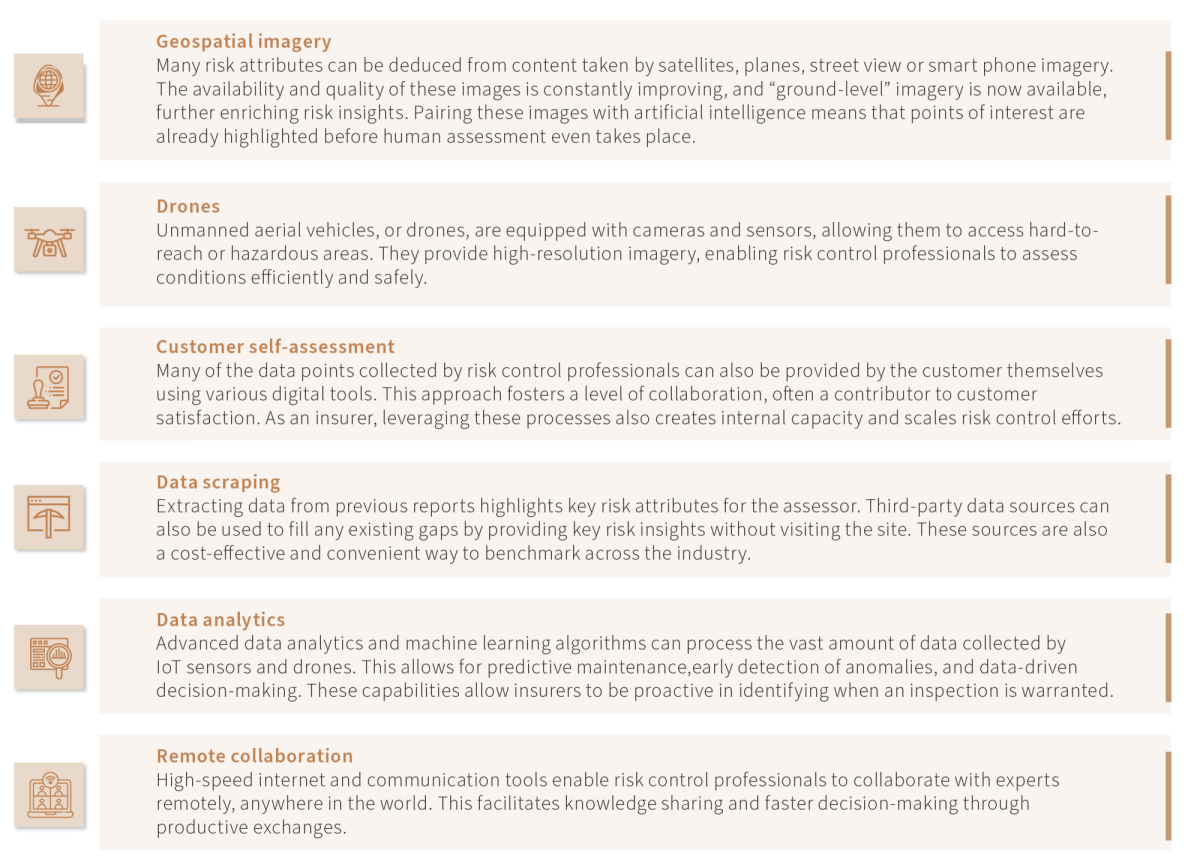

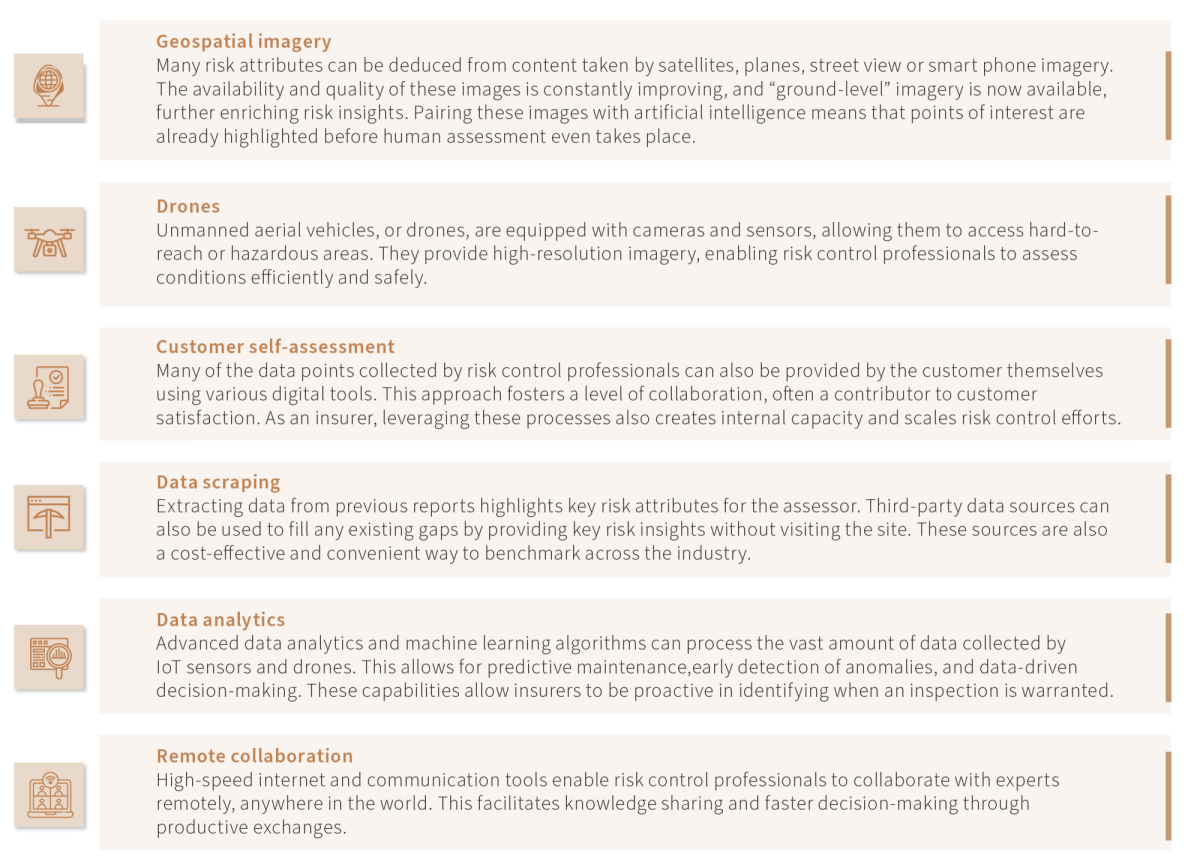

Remote inspection technology and processes have revolutionised the field of risk control by addressing these challenges. This transformation is driven by several key components:

The importance of transforming today

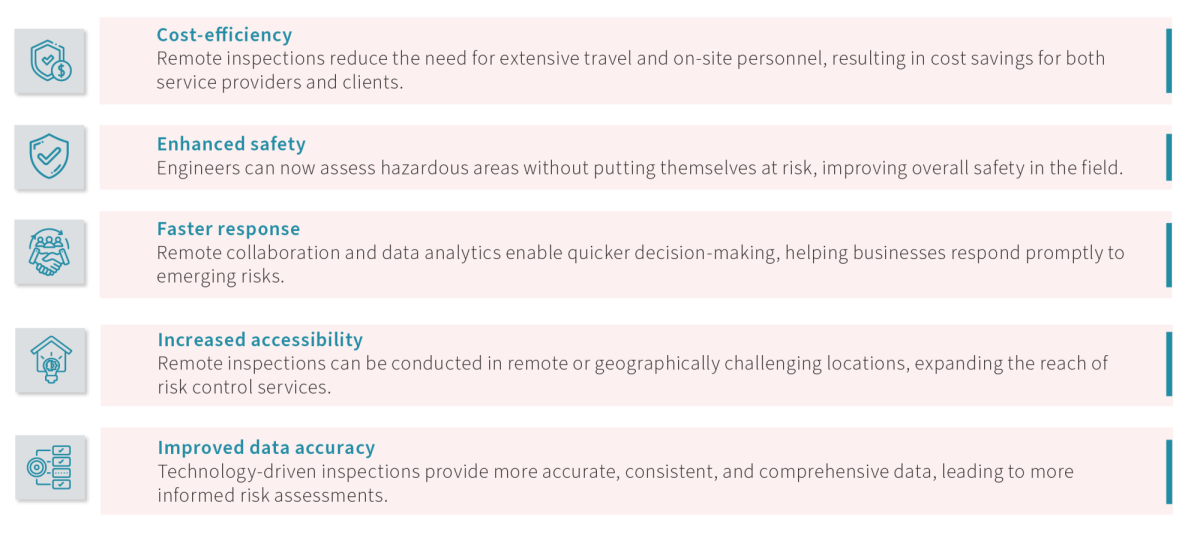

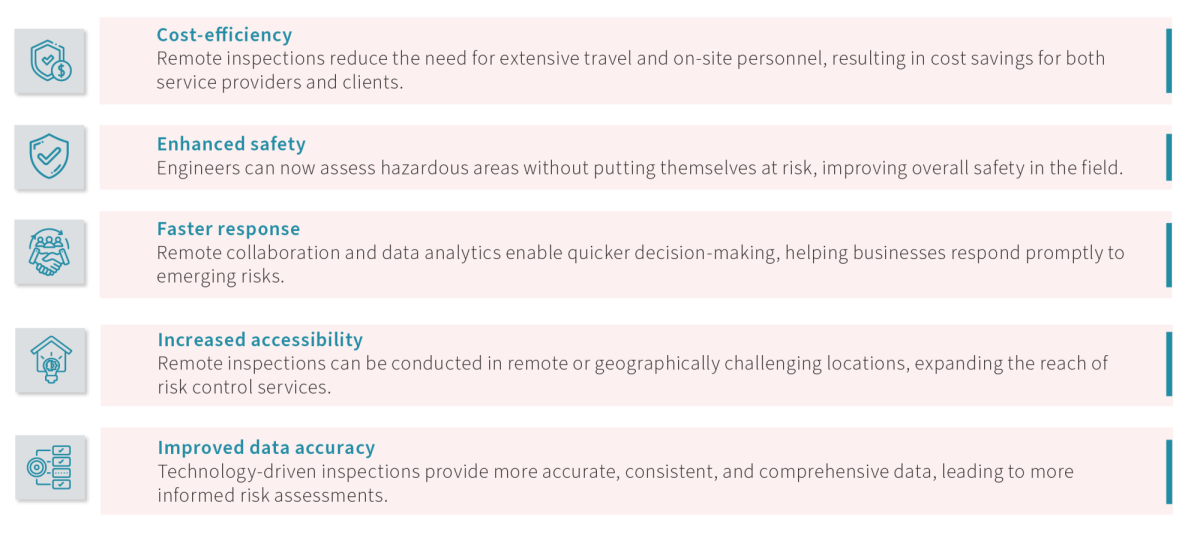

Transforming risk control services through remote inspection technology and processes offers several significant benefits:

Revolutionising risk control

The transformation of risk control services through remote inspections is a significant step forward in the industry. Insurers that adopt these processes are seeing significant improvements in the scalability of their risk control efforts. With this model, insurers are effectively managing risks below the traditional TIV threshold, which is something that was previously not viable. Embracing this revolution is not only a smart move for insurance organisations but also a vital one to keep up with the ever-evolving risks. As technology continues to advance, the importance of these transformative changes in risk engineering cannot be overstated.

What's covered in the series:

- Part 1: Technology's Role in Bringing Risk Control to Your Whole Portfolio

- Part 2: Transforming Risk Control Services Through Remote Assessment

- Part 3: Harnessing Real-Time Insights for Risk Control with IoT

- Part 4: Unlocking Risk Control Insights With the Power of Predictive Analytics

- Part 5: Building Foundations for the Future with a Risk Object Management System

Join us in this exploration of cutting-edge risk control methodologies, technological innovations, and forward-thinking strategies that not only enhance profitability but also position commercial insurance companies at the forefront of proactive and data-centric risk management. Download the entire article series now.

In this article, we'll delve into the significance of transforming risk control using remote inspections, customer self-assessments, and data augmentation.

Risk control services are essential for assessing and mitigating operational risk while providing underwriters with vital risk insights. Traditionally, these services involved time-consuming and costly on-site inspections. This methodology depended on the total insured value (TIV), which ignored many risks that fall outside of the TIV threshold, leaving insurers with significant exposure. However, technological advances are revolutionising risk assessment and enhancing scalability.

Evolution and challenges of risk control

In the past, risk control professionals relied heavily on physical visits to evaluate and assess risk. While these on-site inspections were effective, they often posed several challenges.

Remote inspection and assessment

Remote inspection technology and processes have revolutionised the field of risk control by addressing these challenges. This transformation is driven by several key components:

The importance of transforming today

Transforming risk control services through remote inspection technology and processes offers several significant benefits:

Revolutionising risk control

The transformation of risk control services through remote inspections is a significant step forward in the industry. Insurers that adopt these processes are seeing significant improvements in the scalability of their risk control efforts. With this model, insurers are effectively managing risks below the traditional TIV threshold, which is something that was previously not viable. Embracing this revolution is not only a smart move for insurance organisations but also a vital one to keep up with the ever-evolving risks. As technology continues to advance, the importance of these transformative changes in risk engineering cannot be overstated.

What's covered in the series:

- Part 1: Technology's Role in Bringing Risk Control to Your Whole Portfolio

- Part 2: Transforming Risk Control Services Through Remote Assessment

- Part 3: Harnessing Real-Time Insights for Risk Control with IoT

- Part 4: Unlocking Risk Control Insights With the Power of Predictive Analytics

- Part 5: Building Foundations for the Future with a Risk Object Management System

Join us in this exploration of cutting-edge risk control methodologies, technological innovations, and forward-thinking strategies that not only enhance profitability but also position commercial insurance companies at the forefront of proactive and data-centric risk management. Download the entire article series now.