Loading Insight...

Insights

Insights

Our second core belief in digital banking revolves around the importance of design thinking for product innovation. In this article, we explore how adopting a human-centric ideation approach can lead to transformative solutions and cutting-edge products that deliver enhanced functionality and scalability.

Design thinking is not simply another buzzword that product teams unabashedly repeat to appear trendy or knowledgeable. It is a process that stems from user research and ultimately culminates in a transformative solution. It is also a strategy to navigate through disruptive market forces to adapt to rapid changes.

What is within this core belief?

At the core of design thinking is a people-centric approach that combines human needs, economic viability, and technological feasibility to develop innovative solutions capable of addressing challenges.1

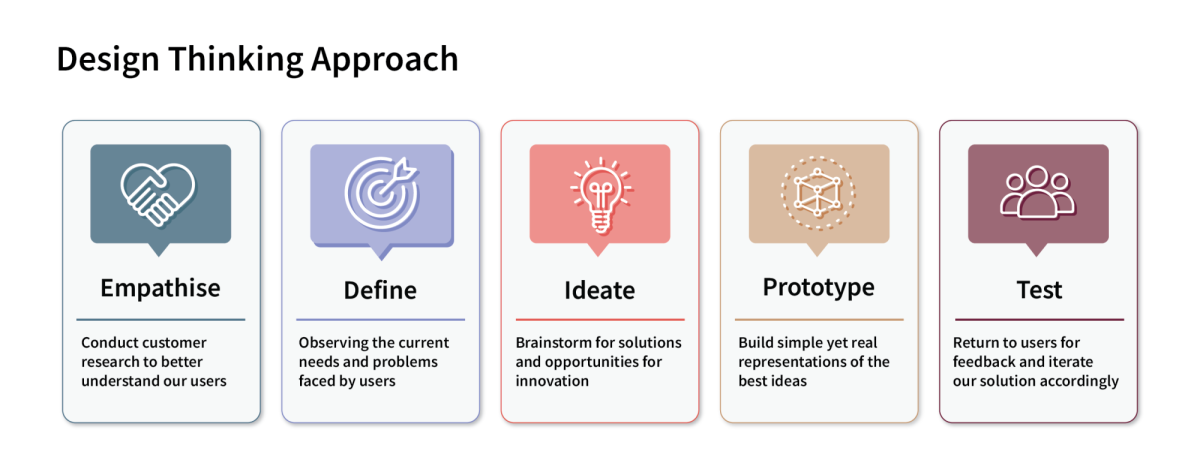

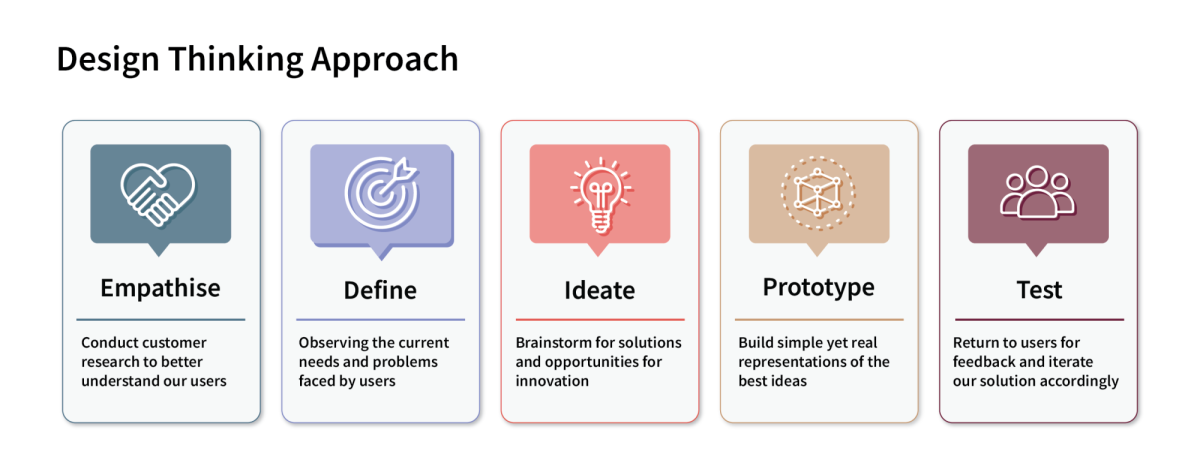

Design thinking reinvents the pitfall of “we do things here this way” and instead opens up opportunities for us to reimagine how we create products for our users, an essential aspect for product innovation. By prioritising human needs, quick prototyping, and user validation, design thinking can be delivered through these five key principles: empathise, define, ideate, prototype, and test (see Figure 1). 2

Figure 1. The five principles of design thinking

Why is it relevant to digital banking?

As new technologies continue to emerge and expand, traditional banks and financial institutions are met with unprecedented market forces. Fintech companies are quickly snapping up market share by building their own digital ecosystems to woo customers.

Consumer behaviours and expectations in this digital age are in a constant state of flux, and for many users, the banking app they use represents the bank itself. What they want now is a consistent digital banking experience – convenient, 24/7 customer support, intuitive, personalised, and interactive – leaving behind physical branches, manual applications, slow responses, and one-size-fits-all products.

Banks need to adapt and evolve their business models, adopting design thinking into their practice to quickly test and refine new ideas. By actively reiterating new ideas, banks can increase their likelihood of developing successful products and services, mitigating the risk of introducing one that doesn’t have a product-market fit.3 This allows them to differentiate themselves in a competitive market.

As such, it is imperative for banks to embark on the journey of design thinking to create greater satisfaction and pleasant customer experiences that could lead to increased loyalty and revenue for the bank.4

How we can support you in your digital journey

Design thinking is already shaping up the market and will continue to do so. At Synpulse, we believe in employing the best industry practices to help our clients navigate through market challenges.

Supported by our tech powerhouse, Synpulse8, we rethink our clients’ business processes with a focus on customer experience through Innov8tion Sprint. Through three main stages – discover, define and envisioning, and test and playback – this four-week process following a design thinking approach will enable us to converge on a design-led solution. Using our PULSE8 framework and deep industry knowledge, we are in a unique position to define these solutions with the client.

The future of banking will be one that offers intelligent experiences with tailor-made solutions at all digital touchpoints. Valuing a user-led design approach, we have developed the Digital Banking Platform, powered by PULSE8, a digital banking turnkey solution that fits in with the customer’s lifestyle and financial well-being.

Contact us to evaluate your needs in detail and take the next step in your digital banking journey.

Our second core belief in digital banking revolves around the importance of design thinking for product innovation. In this article, we explore how adopting a human-centric ideation approach can lead to transformative solutions and cutting-edge products that deliver enhanced functionality and scalability.

Design thinking is not simply another buzzword that product teams unabashedly repeat to appear trendy or knowledgeable. It is a process that stems from user research and ultimately culminates in a transformative solution. It is also a strategy to navigate through disruptive market forces to adapt to rapid changes.

What is within this core belief?

At the core of design thinking is a people-centric approach that combines human needs, economic viability, and technological feasibility to develop innovative solutions capable of addressing challenges.1

Design thinking reinvents the pitfall of “we do things here this way” and instead opens up opportunities for us to reimagine how we create products for our users, an essential aspect for product innovation. By prioritising human needs, quick prototyping, and user validation, design thinking can be delivered through these five key principles: empathise, define, ideate, prototype, and test (see Figure 1). 2

Figure 1. The five principles of design thinking

Why is it relevant to digital banking?

As new technologies continue to emerge and expand, traditional banks and financial institutions are met with unprecedented market forces. Fintech companies are quickly snapping up market share by building their own digital ecosystems to woo customers.

Consumer behaviours and expectations in this digital age are in a constant state of flux, and for many users, the banking app they use represents the bank itself. What they want now is a consistent digital banking experience – convenient, 24/7 customer support, intuitive, personalised, and interactive – leaving behind physical branches, manual applications, slow responses, and one-size-fits-all products.

Banks need to adapt and evolve their business models, adopting design thinking into their practice to quickly test and refine new ideas. By actively reiterating new ideas, banks can increase their likelihood of developing successful products and services, mitigating the risk of introducing one that doesn’t have a product-market fit.3 This allows them to differentiate themselves in a competitive market.

As such, it is imperative for banks to embark on the journey of design thinking to create greater satisfaction and pleasant customer experiences that could lead to increased loyalty and revenue for the bank.4

How we can support you in your digital journey

Design thinking is already shaping up the market and will continue to do so. At Synpulse, we believe in employing the best industry practices to help our clients navigate through market challenges.

Supported by our tech powerhouse, Synpulse8, we rethink our clients’ business processes with a focus on customer experience through Innov8tion Sprint. Through three main stages – discover, define and envisioning, and test and playback – this four-week process following a design thinking approach will enable us to converge on a design-led solution. Using our PULSE8 framework and deep industry knowledge, we are in a unique position to define these solutions with the client.

The future of banking will be one that offers intelligent experiences with tailor-made solutions at all digital touchpoints. Valuing a user-led design approach, we have developed the Digital Banking Platform, powered by PULSE8, a digital banking turnkey solution that fits in with the customer’s lifestyle and financial well-being.

Contact us to evaluate your needs in detail and take the next step in your digital banking journey.