Loading Insight...

Insights

Insights

The market for crypto-backed lending is gaining traction among digital asset investors, allowing them to secure loans against their crypto holdings. This niche has grown significantly, with the market exceeding USD 22 billion by 2023’s end in the DeFi space alone [1]. Banks have extensive lending experience, so they are ideally positioned to seize this substantial opportunity and boost both their interest income and fee-based revenue. The incorporation of Digital Asset Lending aligns with both a bank's value proposition as well as their digital asset strategy, catering to the demand for sophisticated financial solutions in the expanding digital asset market.

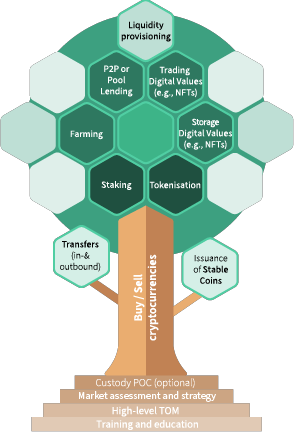

Our mission is to advise banks on how to enter and profit from the digital asset space. In order to do so, Synpulse has created a crypto roadmap for banks (fig. 1) to help educate and navigate them. With this series of articles, we will go step by step into the individual areas of the roadmap by looking into five different use cases following our strategic approach for banks:

- Strategical approach for banks (Introduction)

- Buy / Sell and custody of crypto assets

- Staking

- Lending

- Tokenization of non-bankable assets

- Digital values and NFTs

In this fourth article we are focusing on lending.

Fig 1: Synpulse use case tree

Wealthy crypto investors seek diversification and security but fear missing out on high returns

The surge in client demand for crypto lending is attributed to price increases for major cryptocurrencies and the broader adoption of digital assets. By the end of 2023, there were almost 100’000 crypto millionaires worldwide [2]. The adoption rate of cryptocurrencies in Switzerland is also significant, with more than 20% of the population owning cryptocurrencies [3].

Investors holding large amounts of cryptocurrencies and digital assets increasingly seek lending solutions as they become more wealthy, familiar, and comfortable with digital assets. They believe in the future of this new asset class and its diversification opportunities, eager to capitalise on its advantages without missing out. To do so, they must find reputable partners beyond decentralised finance (DeFi) solutions.

Banks are well-positioned and equipped to serve crypto-invested clients

Banks are uniquely positioned to benefit within the complex realm of digital assets further solidifying their role in this evolving landscape. Unlike many unlicensed institutions, such as centralised finance (CeFi) players, banks can leverage their reputation and strict regulation, assuring investors that their funds will be managed prudently.

Private banks already have a high level of expertise in lending products like lombard lending or single-stock lending, which translates well with lending against cryptocurrencies such as Bitcoin or Ether. Existing risk profiles and current processes can be leveraged.

Banks can simultaneously leverage and profit from their existing digital asset infrastructure

Our market insights reveal that almost 50 Swiss institutions already offer trading and custody services for digital assets or are working on related service offerings. This brings them only one step away from extending their offering to the lending of digital assets, especially since compliance with most of the functional requirements is already met. The extension of their service offering enables banks to generate cross-product synergies like lombard lending.

With the safekeeping of lent digital assets, as well as offering corresponding loans, banks can enhance their competitive edge and capture a larger market share within the traditional financial sector. New client groups can be served, with existing processes utilised to maximise margins and returns.

Decentralised lending opens the door to more complex financial products and services

The technical infrastructure for interacting with smart contracts can be utilised to integrate decentralised lending platforms. This enables banks to hedge their lending operations in the decentralised finance (DeFi) space, where lending and borrowing are already well-established practices with loan-to-value ratios (LTVs) of up to 80%.

The potential to provide access to decentralised lending platforms and combine them with a bank’s digital asset lending proposition is substantial and innovative. While client deposits can be used to back loans and leverage a bank’s margin business, liquidity can also be tapped for any tokenised asset. However, banks must seek legal clarity, adapt risk management practices where necessary and enrich their target operating models (TOMs) to build such a comprehensive decentralisation-based lending service.

Take the next step in your digital asset journey with the power of digital asset lending

Ready to dive into the revolutionary world of decentralised lending? Contact us today to integrate this service and reap benefits for your institution and your clients. This is the fourth part of our new article series. Stay tuned and don't miss the upcoming ones. The next article will focus on Tokenization of non-bankable assets.

This is the fourth part of our article series. Stay tuned and don't miss the upcoming ones or contact us directly to discuss your digital assets roadmap. The next article will focus on Tokenization.

1. Lending TVL Rankings (Defilama, 2024) 2. The Crypto Wealth Report (Hendley & Partners, 2023) 3. Share of respondents who indicated they either owned or used cryptocurrencies in 56 countries and territories worldwide from 2019 to 2024 (Statista, 2024)

The market for crypto-backed lending is gaining traction among digital asset investors, allowing them to secure loans against their crypto holdings. This niche has grown significantly, with the market exceeding USD 22 billion by 2023’s end in the DeFi space alone [1]. Banks have extensive lending experience, so they are ideally positioned to seize this substantial opportunity and boost both their interest income and fee-based revenue. The incorporation of Digital Asset Lending aligns with both a bank's value proposition as well as their digital asset strategy, catering to the demand for sophisticated financial solutions in the expanding digital asset market.

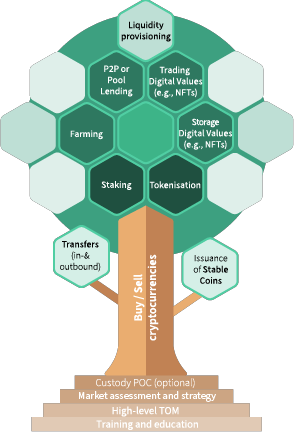

Our mission is to advise banks on how to enter and profit from the digital asset space. In order to do so, Synpulse has created a crypto roadmap for banks (fig. 1) to help educate and navigate them. With this series of articles, we will go step by step into the individual areas of the roadmap by looking into five different use cases following our strategic approach for banks:

- Strategical approach for banks (Introduction)

- Buy / Sell and custody of crypto assets

- Staking

- Lending

- Tokenization of non-bankable assets

- Digital values and NFTs

In this fourth article we are focusing on lending.

Fig 1: Synpulse use case tree

Wealthy crypto investors seek diversification and security but fear missing out on high returns

The surge in client demand for crypto lending is attributed to price increases for major cryptocurrencies and the broader adoption of digital assets. By the end of 2023, there were almost 100’000 crypto millionaires worldwide [2]. The adoption rate of cryptocurrencies in Switzerland is also significant, with more than 20% of the population owning cryptocurrencies [3].

Investors holding large amounts of cryptocurrencies and digital assets increasingly seek lending solutions as they become more wealthy, familiar, and comfortable with digital assets. They believe in the future of this new asset class and its diversification opportunities, eager to capitalise on its advantages without missing out. To do so, they must find reputable partners beyond decentralised finance (DeFi) solutions.

Banks are well-positioned and equipped to serve crypto-invested clients

Banks are uniquely positioned to benefit within the complex realm of digital assets further solidifying their role in this evolving landscape. Unlike many unlicensed institutions, such as centralised finance (CeFi) players, banks can leverage their reputation and strict regulation, assuring investors that their funds will be managed prudently.

Private banks already have a high level of expertise in lending products like lombard lending or single-stock lending, which translates well with lending against cryptocurrencies such as Bitcoin or Ether. Existing risk profiles and current processes can be leveraged.

Banks can simultaneously leverage and profit from their existing digital asset infrastructure

Our market insights reveal that almost 50 Swiss institutions already offer trading and custody services for digital assets or are working on related service offerings. This brings them only one step away from extending their offering to the lending of digital assets, especially since compliance with most of the functional requirements is already met. The extension of their service offering enables banks to generate cross-product synergies like lombard lending.

With the safekeeping of lent digital assets, as well as offering corresponding loans, banks can enhance their competitive edge and capture a larger market share within the traditional financial sector. New client groups can be served, with existing processes utilised to maximise margins and returns.

Decentralised lending opens the door to more complex financial products and services

The technical infrastructure for interacting with smart contracts can be utilised to integrate decentralised lending platforms. This enables banks to hedge their lending operations in the decentralised finance (DeFi) space, where lending and borrowing are already well-established practices with loan-to-value ratios (LTVs) of up to 80%.

The potential to provide access to decentralised lending platforms and combine them with a bank’s digital asset lending proposition is substantial and innovative. While client deposits can be used to back loans and leverage a bank’s margin business, liquidity can also be tapped for any tokenised asset. However, banks must seek legal clarity, adapt risk management practices where necessary and enrich their target operating models (TOMs) to build such a comprehensive decentralisation-based lending service.

Take the next step in your digital asset journey with the power of digital asset lending

Ready to dive into the revolutionary world of decentralised lending? Contact us today to integrate this service and reap benefits for your institution and your clients. This is the fourth part of our new article series. Stay tuned and don't miss the upcoming ones. The next article will focus on Tokenization of non-bankable assets.

This is the fourth part of our article series. Stay tuned and don't miss the upcoming ones or contact us directly to discuss your digital assets roadmap. The next article will focus on Tokenization.

1. Lending TVL Rankings (Defilama, 2024) 2. The Crypto Wealth Report (Hendley & Partners, 2023) 3. Share of respondents who indicated they either owned or used cryptocurrencies in 56 countries and territories worldwide from 2019 to 2024 (Statista, 2024)